Unlike the West, ETFs have failed to garner the attention of investors in India. So the trend this year is thought-provoking, to say the least.

The Association of Mutual Funds, or AMFI, categorises exchange traded funds as Gold ETFs and Other ETFs – the latter referring to the equity index tracking funds. In the first 5 months of this calendar year, the Other ETF category witnessed a net inflow of Rs 2,351 crores, higher than the equity category’s net inflow of Rs 1,626 crore over the same period.

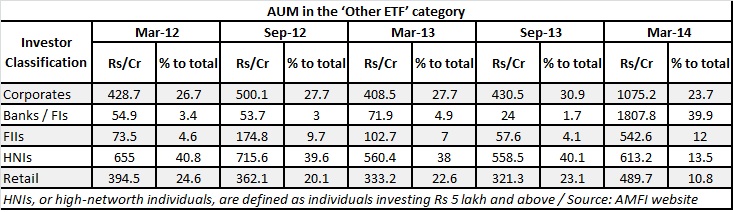

Does that mean investors are inching towards ETFs, as against active traded funds? A deeper analysis of the flow data into the Other ETF category brings some interesting facts to light.

1. The Goldman Sachs CPSE ETF garnered a lot of interest.

The ETF tracks the National Stock Exchange’s CPSE Index – an acronym for Central Public Sector Enterprises. The index has 10 public sector enterprises with ONGC, GAIL and CIL having the highest weightage, while SAIL and BHEL were not included. Goldman Sachs Asset Management launched the Goldman Sachs CPSE ETF which garnered Rs 3,000 crore in assets in March during its launch. That month, the Other ETF category saw net inflows of Rs 3,087 crores.

2. While the total amount invested by retail investors has gone up, its share in actual percentage terms has dipped.

Corporates and HNIs have historically been the major investors in this space and this trend continues. According to newspaper reports, the participation in this NFO from banks and financial institutions was high.

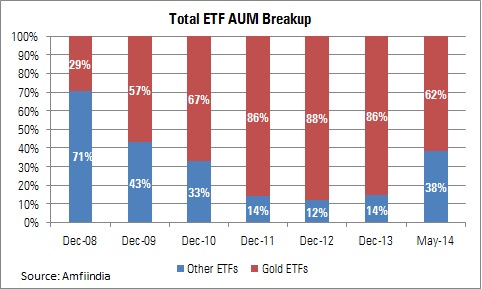

3. The share of Gold ETFs to the overall ETF category has dipped considerably over the past 5 months.

The meteoric rise in the price of gold from 2005 onwards resulted in investors flocking to Gold ETFs. In fact, between 2002 and 2012, the price of gold surged around 400% over that decade. But the bull run in gold lost steam last year prompting investors to redeem their investments in Gold ETFs. Between June 2013 and May 2014, the Gold ETF category witnessed a 27% drop in assets.