Creating the most optimal portfolio for a client is one of the biggest responsibilities that financial advisers have.

Clients may be holding multiple assets in their portfolio, but is that asset allocation optimal?

Does it put their financial goals and needs front and centre, where they belong?

Asset allocation is the process of dividing investments among different kinds of asset categories, such as stocks, bonds, gold, cash, etc. to achieve a feasible combination of risk and reward that is consistent with an investor's specific situation and goals. Empirical studies show that asset allocation policy is one of the most important factors in determining portfolio performance. It puts the principle of diversification to work so that when some asset classes are experiencing a downturn, others may be experiencing stronger performance. However, asset allocation does not eliminate the risk of experiencing investment losses.

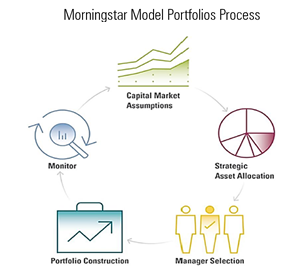

Morningstar Investment Adviser India Private Limited (Morningstar) offers a range of model portfolios which are built for the long term, with a keen eye on risk, and created to help meet your clients’ needs at each stage of their life. Constructing a model portfolio for clients involves a series of steps, starting from estimating asset class risk and returns and ending with monitoring and reviewing of portfolio. Within each step, Morningstar applies various models and concepts that have been extensively researched and tested through practical implementation over a period of time.

Advisers may use various methods in determining the asset allocation mix for a client, of which the popular method is mean-variance analysis. Mean-variance analysis was developed by Harry Markowitz in the 1950’s and provides a mathematical framework for generating portfolios that maximize expected return for a given level of risk and minimize risk for a given level of return (optimal portfolios).

This method requires three statistical estimates for each asset class: expected return (mean), expected risk (standard deviation) and expected relationship between the asset classes (correlation coefficients).

Using historical numbers as estimates

There are various ways to derive these estimates. One such way is a naïve process of taking the average of asset class returns, risk and correlations over some historical period. To illustrate this, let’s consider past 12 years return for equity and fixed income. Sensex has delivered an annualized return of 15.4%, whereas CCIL all sovereign index (proxy for long-term fixed income bonds) has delivered an annualized return of 6.4%. Taking a rear-view mirror approach by simply looking at historical numbers will lead to a higher equity allocation in a portfolio because of high historical return as compared to bonds.

However, this won’t be correct as there are several drawbacks. First, extrapolation of historical return is not indicative of future performance. Second, over allocation to assets with high historical returns, leads to a less diversified portfolio and increased risk. Lastly, with increased risk there will be a low probability of achieving client’s financial goals. Similarly, using historical standard deviation and correlation as estimates lacks robustness as they are sensitive to outliers.

Morningstar’s forward-looking capital market assumptions

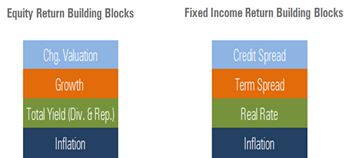

Morningstar is widely acknowledged as one of the leading authorities on the development of capital market assumptions and has written numerous award-winning articles on the subject. Our capital market assumptions are robust and forward-looking in nature. We use supply-side building blocks approach to forecast returns for equity as an asset class. The supply-side model is based on the idea that equity returns can be decomposed into underlying economic and corporate fundamentals. Our approach separates the expected return of equity asset class into four key drivers: 1) Inflation 2) Total Yield 3) Growth 4) Change in Valuation. Similar to our equity asset class assumptions, we use a building blocks approach to forecast returns of fixed income asset classes. The key components of our fixed income model are: 1) Inflation 2) Real Rate 3) Term Spread and 4) Credit Spread.

We produce conditional forecasts for 10-year and 20-year horizons which are specific to a current market environment and Unconditional forecasts which are independent of a given market environment and are used for a longer investment horizon. Morningstar’s capital market assumptions are governed by the firm’s Global Capital Markets Sub-Committee. This committee, which is part of Morningstar, Inc.’s investment management group’s Global Investment Policy Committee structure, is comprised of senior investment professionals across our investment teams in North America, Europe and Asia.

Since risk, return and correlation forms the base of mean-variance analysis, it is important that these estimates are backed by sound research and are not based on historical numbers. Morningstar’s capital market assumptions are used as inputs in mean-variance analysis to create optimal portfolios.

About Morningstar Model Portfolios

Morningstar Model Portfolios are based on more than 30 years of groundbreaking research on long-term strategic asset allocation. Our goal is to provide exposure to a broad range of asset classes that can be weighted according to our expectations of risk and reward.

In investing, the basics matter. That's why we begin with our own research showing that the mix of assets in a portfolio can have a greater impact on investment returns than timing markets. Guided by this research, we use risk and return forecasts across domestic asset classes and international equities to develop a strategic asset allocation for each portfolio. Independent and Institutional advisers can use these portfolios to help clients reach their financial goals.

We’re committed to helping independent and institutional advisors create better outcomes for their clients. You know your clients’ needs and how to build plans to meet them. We combine our investment knowledge with portfolio construction experience to provide investing solutions that put your clients first.

In our next series of communication, we will share some more insights on how you and your clients can benefit from Morningstar’s Model Portfolios. Stay Tuned!

Disclaimer