This post has been written by Larissa Fernand, editor of Morningstar.in, and Himanshu Srivastava, senior fund analyst.

In February, when Morningstar reiterated its Gold analyst rating to HDFC Top 200 and HDFC Equity, a reader wrote in rather perturbed.

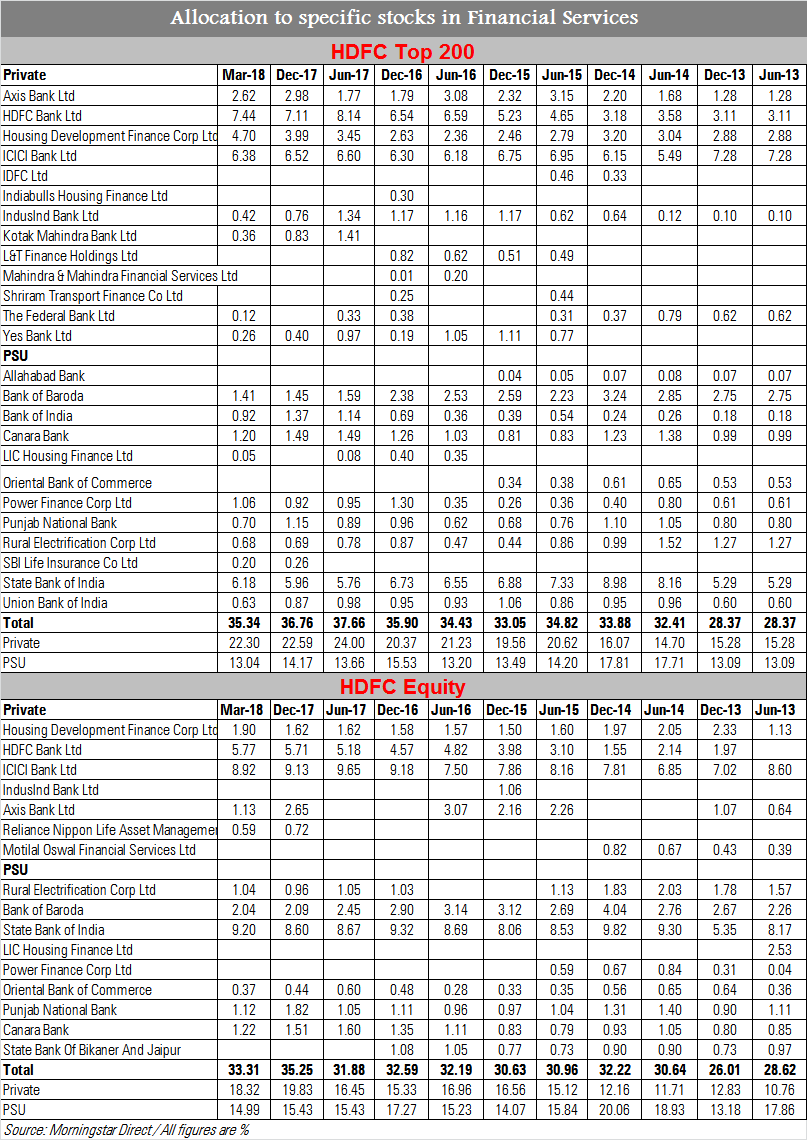

He argued as to why we would “do something like that” when the portfolios sport a substantial allocation to public sector banks which are straddled with non-performing assets, or NPAs. That argument was not without merit. After all, none of us need to be reminded that stressed assets in Indian banks have reached alarming proportions.

Fund manager Prashant Jain is a firm believer that the Indian market operates on the basis of cycles with clear sector leadership. With that frame of reference, he combines a top-down view with a bottom-up approach to finding stocks that have the best appreciation potential given his economic framework.

Over the past decades, Infotech has been the sector leader (1995-2000), followed by Capex, Banking and Commodities (2001-2007), and FMCG, Pharmaceuticals and Automobiles (2008-2015).

So where are we right now?

Last year, when Prashant spoke to us, he had set his sights on Corporate Banking, Metals and Mining, and Industrials. The cycle, as he sees it, is characterized by a recovery in capex, lower inflation, lower interest rates, lower current account deficit, stable currency and peaking NPAs. He was extremely aware that the stressed accounts that have not surfaced till date would keep NPA levels rising for a few years.

That did not deter him because he sees the banking sector as the catalyst for the country’s economy and believes that the growth of the overall economy is intrinsically correlated to the health of the banking industry.

When one tries to understand Prashant’s affinity for banking stocks, they must attempt to look at it from his lens. He prefers to overlook the popular public vs private categorization and filters them through the corporate versus retail framework. For instance, State Bank of India, ICICI Bank and Axis Bank could be classified as corporate lenders, while HDFC Bank, Kotak Bank and IndusInd are predominantly retail banks. Both are good business models and both should do well. Since corporate lending is more cyclical, the peaks and troughs are typically higher and deeper and give rise to asset quality issues.

The success of HDFC Equity and HDFC Top 200 lies in the fact that Prashant sticks to his knitting, so to speak. He develops a sound investment thesis and has the conviction to stick with his research and his positions, and not second guess himself. It takes courage and determination to do so when the stocks invested in move in the opposite direction envisaged or when one’s contemporaries wash their hands off them.

Though the NPA predicament cannot be underestimated, Prashant has analysed this quagmire from every conceivable angle. He believes that corporate banks are good quality businesses, have a stable market share, solid retail franchises, and attractive ROE across market cycles. He also is of the opinion that large public sector banks are sustainable and growing businesses. India is a saver’s economy and citizens parking money in banks will sustain for a long time. Banks will remain the largest credit providers in the foreseeable future.

The government has an acute focus on resolving this issue. Banks will eventually recover in profitability as the stress on asset quality is being resolved by sale of assets since many of the stressed groups are cash-flow poor but asset rich.

What investors should note

The funds managed by Prashant Jain will most probably run into rough weather this year as bank stocks falter.

Also, the funds now infamously court more risk than a typical category peer. Over a 5-year period, the standard deviation of HDFC Equity (18.24%) and HDFC Top 200 (17.37) is significantly higher than the category average (14.24%).

As mentioned above, his investments are made keeping in mind his perception of the next cycle. In various interactions, he has always emphasized that “when the market is moving from one theme to the other, you have to let go of your winning bets and buy something that is promising for the future. Till the time this works out, performance suffers.”

We are not underplaying that, but would like to point out to his affinity for bank stocks. It was his investments in public sector banks which led to significant underperformance in 2013 and 2015.

While we still maintain that he is a steady fund manager when it comes to adhering to his investing style and mandate, and stand behind our Gold rating, in the short run, and this year specifically, his funds could be headed for a bumpy ride.