The National Pension Scheme, or NPS, is a voluntary, defined contribution retirement savings scheme. A large part of its attractiveness is the benefit under Section 80CCD (1b) (which is over and above the Section 80C benefit).

Basavaraj Tonagatti, a Certified Financial Planner, sheds clarity on the investment.

Myth 1: NPS provides pension/annuity.

No.

All it does it help you accumulate a retirement corpus. Using this retirement corpus, you have to buy an annuity product or pension product from life insurance companies; such as like LIC’s Jeevan Akshay VI.

Myth 2: The tax treatment is favourable.

PFRDA, media and many middlemen pitch for tax benefits available while investing in NPS. Many invest only on the basis of this. Let’s look at the NPS taxation when you arrive at the retirement age.

Assume that you attained Rs 1 crore retirement corpus from NPS. You have to now mandatorily employ 40% of it (Rs 40 lakh) to buy an annuity or pension plan.

The annuity or pension which you will receive regularly during your retirement from this Rs 40 lakh investment is taxable, just like salary income. As per your tax slab, you will be taxed.

The balance Rs 60 lakh can be withdrawn. Out of this, only Rs 40 lakh is tax-free; with the balance Rs 20 lakh, you either pay tax (as per the tax slab you fall under) or buy an annuity to defer the tax.

Myth 3: There is no risk.

Investors feel safe about their money invested in Scheme G Fund (government securities) or Scheme C Fund (corporate bonds).

No investment is risk-free.

The credit quality of debt instruments is measured in terms of ratings. Higher ratings offer lower returns but low risk too. It is a misconception that credit risk refers to risk of default by the bond issuing entity.

There is a possibility that the credit rating of a bond or instrument the fund is holding may change at any point of time. The rating is not permanent and can change when the company’s finances change. Do not be under the misconception that credit rating refers to default risk and the rating will never change.

It is the measurement of a bond’s sensitivity to movements in interest rates. It is usually measured in years. For example, a debt mutual fund with the modified duration of 3.1% means if there is a 1% interest rate movement then the fund will undergo the movement of 3.1%. Hence, higher the modified duration means higher the interest rate risk.

A debt fund portfolio usually consists of a number of bonds where each could have a different maturity date. Maturity is the time period remaining before which a bond comes up for repayment by the issuer. Average maturity is simply the weighted average time left up to the maturity of the various bonds in a portfolio. Higher the average maturity greater the interest rate risk of a debt fund.

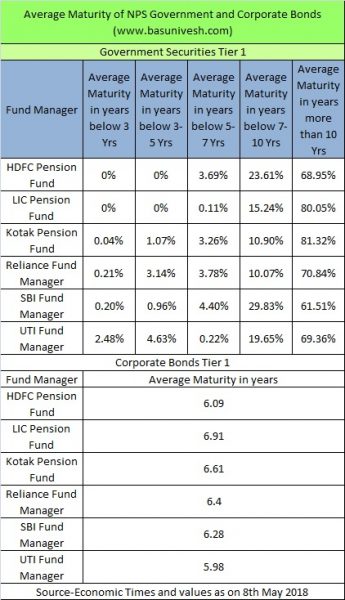

In the case of NPS, let us consider the average maturity of its holdings (government securities and corporate bonds).

All funds managers are holding long-term maturity bonds. Due to the last few quarters of RBI’s policy to hold interest rate due to higher inflation, crude price rise and other factors, there is a lesser return from these two categories since two years.

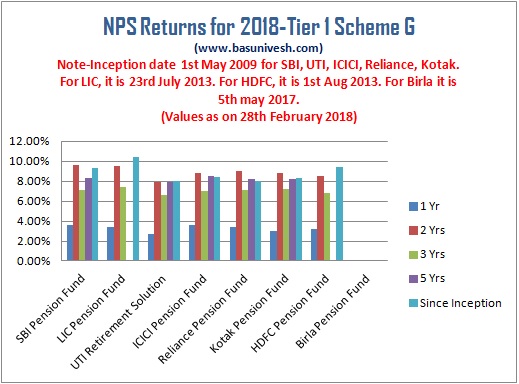

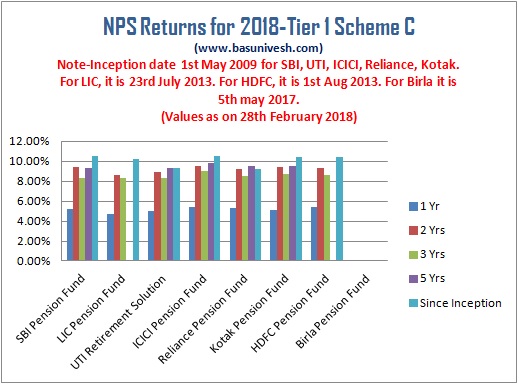

You may notice that by referring below images.

Notice that 1-year returns for all fund managers in the case of government securities is below 4%. However, due to different sets of credit rating and average maturity, the corporate bond scheme performed better.

This proves that due to their long-term bond holdings, your money is riskier due to interest rate volatility. This would impact someone who is about to retire.

Assume that you are 55 years of age and opted for Aggressive Life Cycle Fund. Then your assets will be in government securities (75%), corporate bonds securities (10%) and the rest in equity (15%). At 55, your retirement corpus is still at high risk as the fund manager holds higher maturity government securities. If there is a fall in inflation and the RBI starts to reduce rates, he will end up with 2% to 3% return on his long-term accumulated retirement corpus.

The image below gives a clear picture of how your asset is classified under the auto choice option of NPS depending on your age. They believe they are reducing your risk by moving your money to debt. But in debt, you will see how much volatility is there due to fund managers holdings long-term bonds.

Even if you have not opted for the auto choice option, you have no other options to switch between their default equity, corporate bonds and government securities portfolio. And the debt portfolio of NPS is also risky.

Myth 4: Expense ratio is clear.

It is the lowest, but not clear.

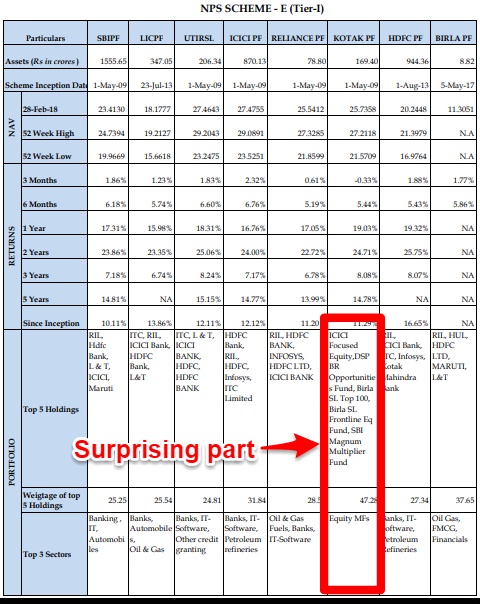

In the above image of PFRDA, concentrate on the marked part of the Kotak fund manager’s equity holding for Tier 1 Scheme of NPS: Large Cap Fund-ICICI Focussed Equity (2.23%), Multi-Cap Fund-DSPBR Opportunities Fund (2.18%), Large Cap Fund-Birla Sunlife Top 100 Fund (2.32%), Large Cap Fund-Birla Sunlife Frontline Equity Fund (2.21%) and Multi-Cap Fund-SBI Magnum Multiplier Fund (2.09%). The values mentioned in the bracket are respective funds expense ratios.

With such expense ratios, how is the Kotak Fund managing the NPS subscribers money at the low cost of 0.1%? Essentially, do NPS subscribers have to pay double the cost (one to the Kotak Fund and another cost to mutual funds)?

This lack of clear disclose is a big risk.

Myth 5: The withdrawal rules give flexibility.

It is a long-term commitment between you and NPS up to 60 years of age. I agree that certain liquidity is possible but only under strict conditions.

Irrespective of the performance or your need, you have to stick to the 8 fund managers and their style.

Basavaraj Tonagatti blogs at www.basunivesh.com