The path to saving is simple, not easy. Simple, because it is not difficult to comprehend. Not easy, because putting it into practice can be incredibly tough.

Spending money offers a sense of elation and makes you feel top of the world. Saving comes with the sense of being punished and deprived. Implementing a savings plan requires a particular mindset.

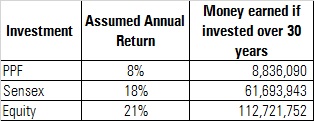

P V Subramanyam tackles this issue in his book Retire Rich. He works with numbers to enable the reader latch on to the reality of saving. I shall use his calculations to make a point.

Let’s say you spend Rs 1,500 a week on coffee with a snack. Don’t scoff at that figure – Starbucks, Gloria Jean’s (though I believe they have exited India), Coffee Bean and Tea Leaf, Di Bella, and Blue Tokai are not cheap.

That tab translates into a cool Rs 78,000 over the year. Let’s say, you invested that amount.

The book does not suggest a frugal lifestyle. It just points you in the right direction. By just cutting down on retail therapy, or eating out, or smoking, you can actually begin to accumulate huge savings. Not only will this help you in the future, but it is also healthy.

Subramanyam makes a lot of interesting points:

- Your life is a function of habits, not common sense. You can save only if you inculcate the right ones and make sacrifices. It does not mean you have to deprive yourself of a good life.

- You can make a lot of money by being disciplined. You just don’t believe it. Start small. Savings will accumulate. Then invest it.

- An SIP of Rs 10,000 for a period of 35 years, will amount to Rs 5,17,99,620 at 12% per annum. Most individuals can put aside Rs 10,000/month. But increase the SIP amount by 10% per annum, and the final accumulated investment surges to Rs 14,81,83,096.

- Compounding is a great habit. Whether in life or in investing. Try it with your money. With your workouts. With running.

Small changes, big impact.

Of course, with such a long horizon, bumps in the road are inevitable. And you can be extremely sure that the journey will be pockmarked by at least one major bear market. An equity market shock is not the only scenario you may have to grapple with. Interest rates could also fall and hit your fixed-income savings, such as fixed deposits and Public Provident Fund, or PPF.

All this can cause queasiness and a sense that things are out of control. Stay the course. Be disciplined. The rewards will be well worth it.

My suggestion to those who are serious about retirement planning is to purchase the book Retire Rich: Invest Rs 40 a day. It will guide you as to how much you need to save for retirement, how to draw up a retirement strategy statement, where to invest for retirement and retirement instruments, and lots more. All explained in a simple and non-intimidating fashion with actual examples and case studies.