Mohit Handoo grew up in Indore and completed his Masters in Business Administration (MBA) in Marketing from Institute of Management Studies (IMS). Through campus placement, he bagged an offer with ICICI Bank’s wealth management division. Subsequently, he had stints with HDFC Bank, Axis Wealth and ING Vysa. Working with banks gave him a good understanding of investor psychology. Mohit’s extensive experience across banks made him realize that he needs to move from product-based selling to goal based advisory, a practice not so prevalent in Indore those days. To fill this void, he contemplated to float his own advisory firm.

Initial Days

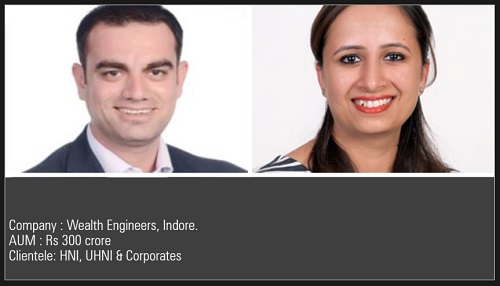

Meanwhile, his wife Anshu Jaisinghani Handoo also aspired to strike out on her own. An ex-banker and Phd in Finance, she started her mutual fund distribution practice in 2013. Anshu got a head start in her business. Her success gave a further boost to Mohit’s entrepreneurial dream which led him to float Wealth Engineers in 2015.

Unlike other bankers who generally bring their former clients whom they served in previous organizations in their new practice, Mohit felt he should build his own client base. Thus, he started approaching his acquaintances and friends who formed his initial client base. His business has purely grown from referrals from existing client’s wo include a large mix of high net worth individuals and corporates. He has a team of six who take care of client service and administration. He has no sales team.

In four years, the husband wife duo have built assets under advisory of close to Rs 300 crore across 500 clients. While they also deal in other products like PMS, AIF, private equity funds, close to 80% of their assets are concentrated in mutual funds, which is their core focus.

The Challenges

Mohit says that people in Indore have a keen interest in stocks but he feels a lot of education is required to help them understand the virtues of long-term investing. “The appetite for equity is very high in Indore. This is the reason you will find many RIAs offering trading and equity investment research registered in Indore. That said, a lot of education is required on the importance of long-term investing and compounding. People tend to trade in equities to make quick bucks. The mind set has to change,” observes Mohit.

Indore was once among the B30 cities underpenetrated in mutual fund penetration. The AUM rank of Indore has gone up from 22nd in March 2012 to 16th position in March 2019. From April 2018, the regulator brought Indore in the new Top 30 cities, effectively ending the higher incentive which beyond Top 15 cities were entitled to. This coupled with the recent reduction in commissions imposed by AMCs due to TER rationalization has dampened the sentiments of distributors, especially in smaller towns. “The reduction in margins will discourage new distributors to come in this business. At the same time, the focus of existing distributors could shift from retail to HNIs. This is not good for retail as they can end up buying other toxic products,” observes Mohit. Mohit feels that large MF distribution outfits like banks could shift their focus away from mutual funds to AIF, PMS and ULIPs which offer upfront commissions. Nevertheless, he feels that mutual fund advisers will flourish if they are not distracted by the challenges.

When asked if direct plans have impacted his business, Mohit says that since most of his clientele is HNI, there is a tendency to invest in direct. For such clients, he advises them to split assets in regular and direct, which compensates for his advice.

Constantly Evolve

Mohit believes that advisers should adapt their businesses to evolving trends and look to diversify their sources of revenue to shield their practices. One of the things which will help differentiate themselves is through showcasing their value add. Mohit is a firm believer of asset allocation. Before onboarding any prospect, he tries to understand their goals, aspirations and risk appetite to formulate an investment plan. He has been using Morningstar Adviser Workstation actively to cull out reports and research on funds which helps him enhance his research capabilities.

Leap of Faith

Going ahead, he aims to launch his own Portfolio Management Services (PMS) which will operate on the principles of Berkshire Hathway. The fund will only charge a performance fee.

Mohit and Anshu's journey is a shining example of how an advisory firm can flourish even is smaller cities.