An acquaintance, let's call him Rajesh, sent me his mutual fund portfolio, which was heavily skewed towards mid-cap and small-cap funds. It had no pure large-cap fund. He began investing in these funds via systematic investment plans, or SIPs. When the market began to get choppy, Rajesh terminated his SIPs in September 2018, but never sold his holdings.

His concern: His friend informed him that he would have to wait for 10 years to make money on his funds, since a market crash is imminent. He is not comfortable with such a long time frame in an uncertain market. And now wants to stick to a conservative profile.

His question: Should I exit all my funds and put the money in debt funds or large-cap funds?

Sunil Jhaveri, Founder, MSJ MisterBond Pvt Ltd and Mister Bond, a consulting firm for advisers, shares six lessons from the above situation, and ends with some advice.

#1 Be wary of a market-cap bias.

I am not an advocate of a market-cap bias. I have always advised investors to stick to multi-cap funds. Let the tilt towards large, mid and small caps be left to the discretion of the fund manager.

Worth remembering is that the conversion from mid cap to large cap is high (i.e. today’s mid caps can be tomorrow’s large caps); but conversion from small caps to mid caps is not as evident. It is preferable it avoid small caps.

Rajesh should not have packed his portfolio with small-cap funds that are the most volatile in the market-cap spectrum.

#2 Don’t terminate SIPs when the market hits a rough patch.

Seeing the carnage in mid and small caps, Rajesh terminated his SIPs.

What investors must realize is that they should never stop their SIPs during market correction phases or bearish periods. During such periods; for the same amount of SIP every month; they are accumulating more units. The intention should be to collect more and more units during a correction phase; which will give a major boost to their wealth creation exercise when the market turns positive.

Most goals like the Child’s Education Fund, Marriage Fund, and Retirement Fund are 15 to 30 years away. So logically, investors should be thrilled when the market is correcting and the benefit of an SIP kicks in. This is when the concept of Rupee Cost Averaging works in the favour of the investor. Why should an investor be happy with his SIP portfolios generating good return in the initial phase of his investment journey? Is he not accumulating less units?

Let me illustrate. Let’s say you earmark Rs 10,000 every single month to buy gold. In the first month, you get 10gm for that amount. The following month, prices drop and you get 12gm. Would you not be happier with 12gm? Now apply the similar logic to financial assets. More units is better than less units.

Investors should be happy when the market corrects so that their SIPs get more bang for their buck. The problem arises when investors monitor their portfolios on a day-to-day or month-on-month basis and start panicking when they see their SIPs bleeding.

#3 Don’t terminate SIPs till you at least have a 10-year run.

Running away after a bad run will ensure that you lose out.

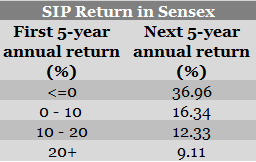

Another data point I would like to bring to the attention of the readers is that if your first 5-year SIP returns have been negligible or negative; the probability of the next 5-year SIP giving stupendous returns is very high.

The image below employs data from January 1995 to October 2018.

The average return over the past 10-15 years has been in the region of 14-15% CAGR.

So dig in your heels and hang on. And accumulate when the market corrects.

#4 Don’t fool yourself about your capability to handle downturns.

Rajesh now wants to pull his money out of mid and small caps and park it in debt funds, or at the most, large cap funds. All because his profile is now conservative, as against aggressive when the market was on a roll.

This is the classic case of the Greed-Fear syndrome. Going by his portfolio, he was an aggressive investor when the going was good. And a downturn has turned him into a conservative one.

I often tell financial advisers that there is nothing like an AGGRESSIVE or CONSERVATIVE investor. Most aggressive investors turn into conservative ones when panic sets in, and most conservative investors transform into aggressive versions when greed sets in. The goal has not changed, just the market dynamic has, and their emotions have got the better of them.

#5 Don’t switch asset allocation foolishly.

I draw the following analogy when I want to drive home the point that it is disastrous to switch from one asset class to another based on market news and events.

When at a toll naka, invariably the lane in which you are in moves very slowly while others pass quickly. So you change your lane only to realize that the lane that you just exited has now started moving faster.

Similarly, investors move from fixed deposits to equity to debt, or from mid to large caps, and so on and so forth. Completely unaware that in the bargain, they are losing out on wealth creation altogether.

In this specific example, the investor wants to exit his mid and small cap funds, and transition to large caps. Little does he realise that the current stretched rally is happening only in around 5-10 large cap stocks, and large-cap valuations have stretched way beyond expensive. If the market corrects from hereon, large caps will be the first ones to correct followed by mid and small caps.

By emotionally responding to the market, he will lose out on all counts.

#6 Have an exit strategy in place.

Ideally, investors should have an exit strategy in place.

Eventually, an SIP portfolio is nothing but a lumpsum and needs to be protected from market corrections. Based on valuations, the market became expensive from July 2017 onwards. Since then to now, it is in the RED Zone (expensive valuation zone based on Market PE, PB, etc). I had proactively switched my investor portfolios from pure equity to conservative asset classes like Dynamic Equity or Balanced Advantage Funds (which rebalance the portfolios based on market valuations i.e. low in equity when market valuations are high and vice versa. Most of these schemes have minimum 30% in equity when the market is expensive and go up to 100% in equity when it is cheap).

Advice for Rajesh, and others too..

- Stick to multi-cap funds. If you want to dabble in more riskier funds, then stretch to mid caps.

- After some time, your SIP portfolio is nothing but a lumpsum that needs to be protected from market volatility. Introduce an Exit Strategy/Profit Booking Strategy based on market valuations.

- If you have adopted SIP as a strategy for investments, be happy that your initial SIP returns are negative or negligible as you are collecting more units during such periods.

- Remember, your goals are 15 to 30 years away. So do not discontinue SIPs during volatile or bearish markets. Continue with them, and even increase your SIP amounts.

- Stop looking at your portfolio at regular intervals. That creates panic and makes you take irrational decisions. Avoid the action bias.

- Select your funds and asset allocation and strategy and stick to it. Do not be like a driver at a toll naka.

- If this investor’s current portfolio has generated decent returns based on his expectations, he should exit and switch into Dynamic Equity/Balanced Advantage Funds of same fund houses where his SIPs are happening; but continue his SIP (at least in mid cap schemes. He can discontinue the SIPs in small caps and maybe add multi cap SIPs to his portfolio).

Also read the views of two other financial advisers on this very portfolio in 2 mistakes investors make.