In 2014, Barry Ritholtz interviewed James O'Shaughnessy for the Masters in Business podcast on Bloomberg Radio.

James O'Shaughnessy of O'Shaughnessy Asset Management narrated a rather mind-boggling anecdote. A new employee had told him about a study done by Fidelity to figure out which customer investing accounts performed the best, and why. The results revealed that they were the ones held by individuals who had forgotten they had Fidelity accounts. This “amnesia” resulted in no selling or mindless tinkering of the portfolio, which allowed the investments time to compound and grow.

Ritholtz followed up with an observation of his own with regards to families squabbling over inherited assets. Due to litigation, the investments are untouched for a decade or longer. This turns out to be the best time for the investments to perform well and allow for accumulation of wealth.

Investing is one of those rare human endeavors where constant monitoring and effort doesn't necessarily pay off anyway. You’ve got to have a hands-off approach to some extent. As Benjamin Graham said, “while enthusiasm may be necessary for great accomplishments elsewhere, on Wall Street it almost invariably leads to disaster.”

I recently came across a post titled 'Doing Nothing' Investing: A Thought Experiment written a few months ago by DINESH SAIRAM. By measuring the standard deviation, the author attempts to show how 'doing nothing' is a powerful virtue necessary for any investor.

(Standard Deviation, or SD, is a statistical term to measure the amount of dispersion around an average. Technically it is a measure of volatility. Dispersion is the difference between the actual and the average value. The larger this dispersion, the higher the SD.)

Let me quote from the blog post:

Investors base their 'Buy' or 'Sell' decisions on many factors, chief among them being the price of the stock. If a stock moves up too much, selling would seem reasonable and vice versa for buying.

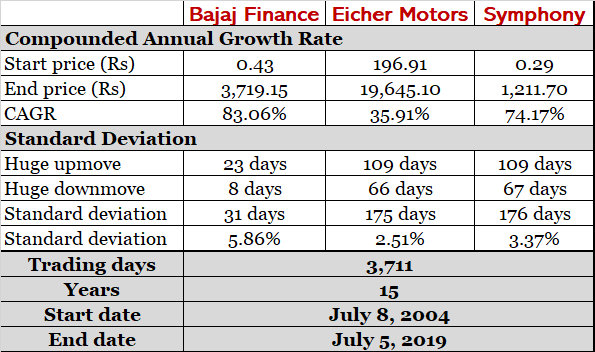

But how much is 'too much'? Usually, 3 SDs from the average is counted as an 'Outlier'. But we shall consider 2 SDs from the average as substantial deviation. By looking at the daily returns of three stocks (Bajaj Finance, Eicher Motors, Symphony), we can see how many of these days had substantial deviations.

Out of 3,711 days, Bajaj Finance counted 99% as neutral movement days. In the case of Eicher Motors and Symphony, each recorded non-substantial movement on 95% of the days.

On an average, these stocks didn't make any substantial movement for 96% of the time in their journey to becoming excellent investments. Translating that into a time frame that you can identify with; assuming you had 50 years of investing life, you probably wouldn't have to do anything for 48 of them.

You don't make money why you buy stocks. You don't make money when you sell stocks. You make money by waiting.

- Mohnish Pabrai