Pharma/healthcare funds have turned out to be a knight in shining armour among domestic equity funds category.

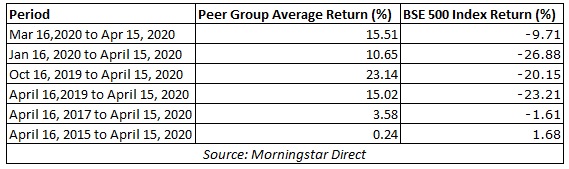

From March 16, 2020 to April 15, 2020, healthcare funds have delivered category average return of 15.51% while the broader BSE 500 Index has yielded -9.71%. The YTD returns of sector funds as a category stood at 10.65% versus -27% delivered by BSE 500.

Similarly, healthcare funds have outperformed the BSE 500 index during one-year and three-year period. There are nine pharma funds in the industry, collectively managing Rs 5,486 crore worth assets as on March 2020.

Healthcare funds category returns

Category returns above one year are annualised.

Besides expectations of earnings revival and attractive valuations, the renewed interest in these funds is due to the exports of hydroxychloroquine from India to other countries, which is predicted as a potential cure for treating Corona Virus.

Investment Case

In a presentation shared with media, DSP Mutual Fund stated that healthcare sector is trading at below ten-year average of 42% premium to Sensex and at a ten-year low of just 2%. This valuation is based on earnings before interest, depreciation, tax and amortisation (EBIDTA) to enterprise value (EV) of Sensex and BSE Healthcare Index. Similarly, valuations appear attractive on Price to Book Value basis.

According to Aditya Khemka, Fund Manager, DSP Healthcare Fund, the improvement in business and ROE may lead to earnings growth and a sector rerating. “Indian pharma firms source 60%-80% of their raw material from China. With partial normalisation of manufacturing activities, some pharma companies have started getting raw material shipments from China. The excessive reliance on China is a long-term issue and thus the government has announced measures to provide incentive to the industry to manufacture raw materials indigenously,” said Khemka.

However, Aditya cautions that the lucrative return profile of the sector has attracted new participants which created pressure on margins. Regulatory headwinds and exchange rate risk for export-oriented companies are some of the risk factors.

Portfolio

These funds typically invest in pharmaceutical companies which form core part of the portfolio. They also invest in allied businesses such as hospitals, chemicals, healthcare services/diagnostics and financial services firm linked to this sector. For instance, Mirae Asset Healthcare Fund has invested in financial services stocks like HDFC Life Insurance and Max Financial Services. It has exposure to Tata Consumer Products as well.

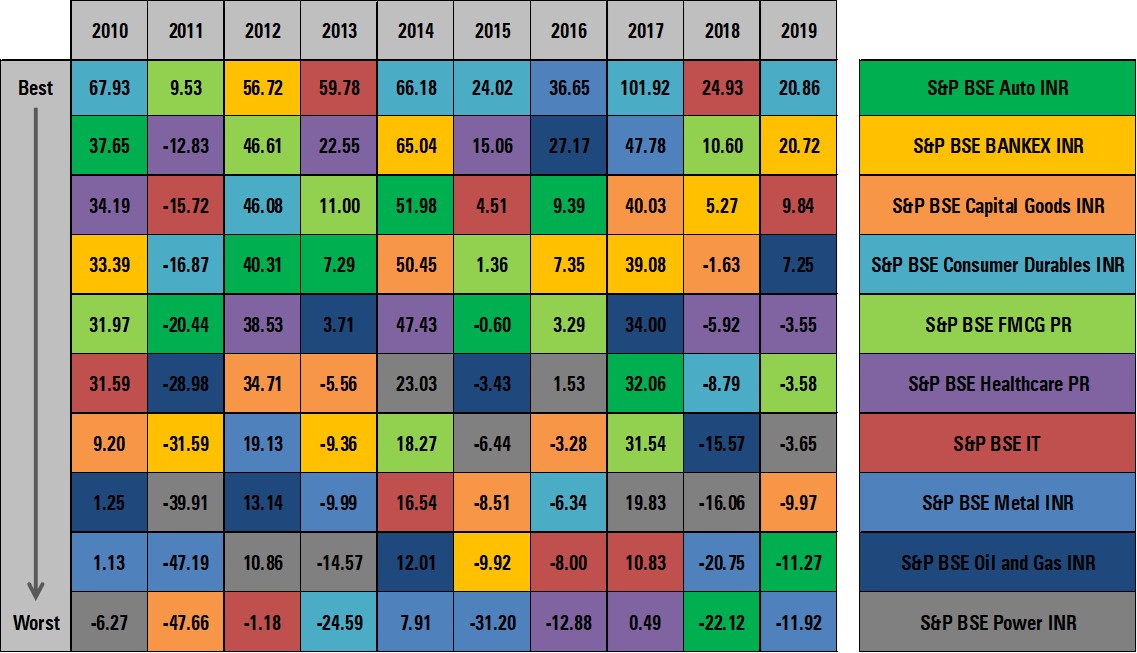

Historical Performance of Different Sectors

This table shows the calendar year returns of different sectors from 2010 to 2019. In 2010, the best performing sector was Consumer Durables which delivered 67.93% return. In 2011, when all indices were in red, only FMCG sector stood out by delivering 9.53% return. In 2012, BSE Bankex was the top performer, yielding 56.72% return. In the same year, IT Sector delivered - 1.18% return. In 2013, the IT sector bounced back and posted the highest return among all sectors at 59.78%. This clearly indicates that the winners rotate. No single sector delivers consistently every year. Thus, investing in sector funds is akin to timing the market by taking tactical calls. The tactical call may play out as per your expectation, but the returns may not be positive or consistent every year.

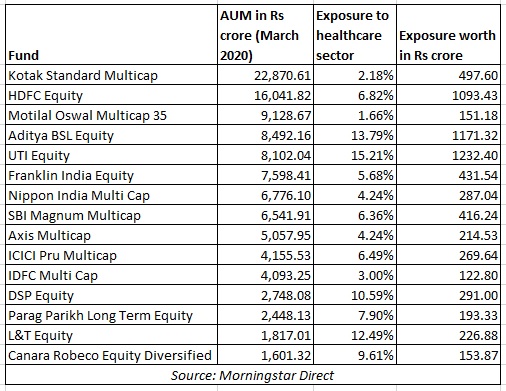

Exposure of multi cap funds to healthcare (March 2020)

The table shows the list of top 15 multi cap funds by assets under management and their exposure to healthcare sector. UTI Equity has the highest exposure to healthcare at 15.21% which is worth Rs 1,232 crore. Similarly, Aditya Birla Sun Life Equity Fund has allocated almost 14% of its net assets allocated to healthcare. This indicates that multi cap funds do have exposure to healthcare sector and investors need not rush to invest in a theme which is suddenly doing well.

Should you invest?

Mumbai-based Registered Investment Adviser (RIA) Kavitha Menon asks investors to steer clear from short-term trends. “Every few years, we have new themes playing out in the markets and this time it is the healthcare sector. It will be very myopic to invest in healthcare sector only to take advantage of the Covid crisis. I’m asking investors to allocate funds on the basis of time-tested principles and not get swayed by short-term trends.”

Suresh Sadagopan of Ladder7 Financial Advisories says that while he does not recommend his clients to invest in sector funds, if someone wishes to take a tactical call, it should not be more than 10% of their overall portfolio. “Most large cap or diversified funds would have a higher allocation to financial services sector which constitutes 40% weightage in BSE Sensex. Thus, it may not make sense for investors to have an additional allocation through another banking and financial services sector fund since many funds would naturally have allocation to financial services. The same logic applies for any sector fund. Fund managers of diversified funds can increase or decrease exposure to sectors depending on their thesis,” explains Suresh.

We believe investing across sectors is an ideal way to diversify, which can be achieved through a mix of large, mid cap, and multi cap funds. Multi cap funds are well suited for investors as they have the mandate to invest across sectors and market capitalisation, giving leeway to fund managers to manoeuvre where the opportunity exists. On the other hand, sector funds typically are constrained by their investment mandate towards one sector/theme, making them a risky bet for investors. Thus, sector/thematic funds should ideally not form a core part of investors portfolio.