As counterintuitive as it seems, getting a raise could actually make it more difficult for investors to retire comfortably.

A new report by Morningstar titled More Money, More Problems finds that people who don’t increase their savings rate when their pay goes up will have a harder time in retirement. Well, that sounds logical. But how does that justify a raise putting a spoke in the wheel?

Getting a raise invariably means that an individual’s expenses will increase. Think about it. You can now afford to eat out more. You can afford a car upgrade. With your next raise you will be able to afford more trips to the spa. This is a gradual increase in your standard of living; something we call lifestyle creep. If you give yourself permission to let your lifestyle creep higher as the years go by, it has two ramifications.

- The first being that you have less to save because your spending is increasing along with the rise in your income.

- The second being that you need to pad up your retirement kitty accordingly. You need more in order to retire because your lifestyle has gotten upgraded.

As Michael Kitces once explained to my Morningstar colleague in Chicago. I used to mow the lawn, but now I got a little more money. So, I'm going to pay someone to mow my lawn. Once I pay someone to mow my lawn, I rarely go back and mow lawn again. We do it with cars. We do it with houses. We do it with a lot lifestyle maintenance-oriented things.

Do you know why it is called lifestyle creep?

Because you really don’t see it inching up. None of them are individually budget breakers. But they start piling up and without you being aware, which then leads inexorably to higher living expenses.

Throughout your working life, the added costs go unnoticed and the reality is that your lifestyle cost has increased at a much faster rate than your income and subsequent savings.

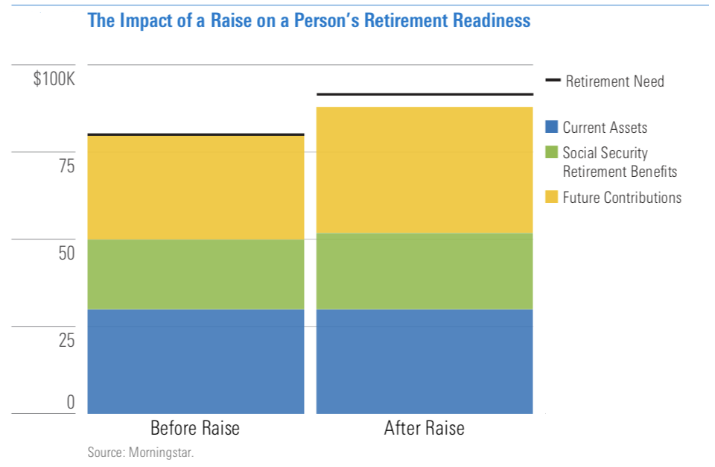

The report used the above graph to show how retirement assets can be quickly outpaced by retirement needs when someone gets a raise. Assuming that a person’s salary goes from $100,000 to $120,000 at age 47 and a constant 11% of their salary is saved. After getting a raise, many people adopt a higher standard of living they feel they’ll need to match in retirement, and they don’t commit the necessary funds to reach this new goal.

How must you combat it?

When getting a raise, many investors’ first reaction is to celebrate and not think of the consequences. Contrary to our best intentions, many of us don’t actually increase our savings rate when we get a raise. Change that. Immediately increase your savings and then think of spending the extra.

The more aggressively you save, the less you spend since there is only so much money that comes in.

The more aggressively you save, the less you spend, the less goes in upgrading your lifestyle.

The more aggressively you save, the less you spend, and the more you have to invest.

You could come up with your own formula. Morningstar came up with some thumb rules based on the data of the U.S. 2016 Survey of Consumer Finances.

- Spend twice your years to retirement: If you are going to retire in 10 years, spend 20% of your raise and save the remaining 80%.

- Save your age, as a percentage of the raise. If you are 50 years old, save 50% of the raise.

- Save at least 33% of your raise. If your take-home income increased by $1,000, you should save $333 of that new income.

Don’t go by this U.S. data, create your own formula. But do increase your savings with your increment.