In The difference that Asset Allocation and Rebalancing makes, the authors show how both strategies can stem the slide of a portfolio in a falling market.

Now, SHWETABH SAMEER, applied statistical researcher from Morningstar’s Behavioral Science team, and SANDEEP, quantitative analyst from the Morningstar Indexes team revisit the subject with an actionable strategy.

Understand your Risk Capacity and employ risk assessment tools to comprehend your reaction to different market conditions.

Financial goals play an important role in deciding your ability to take risk.

An individual in his 20s, who wants to retire at 60, has ample time to save for retirement. The dynamic changes if you are in your 40s, even if your retirement goal is also at the age of 60. A short investment horizon would necessitate a higher percentage of your investments to fixed income. The longer the horizon, higher the allocation to growth or risk assets such as equity, subject to willingness.

If you are a Do-It-Yourself, or DIY, investor, it’s important for you to understand how you will feel and react to situations when your portfolio drops by a significant amount.

An aggressive investor may not be unduly perturbed by a drop of 40%-50% of the portfolio’s value. But if a drop of 20% gives you sleepless nights, opt for a conservative approach; that is, a lower allocation to risky assets, including equity.

A comparison of portfolios with different assets and allocations can help an investor understand how much risk she can take to not succumb to the selling pressure and hold on to her investments even in times of volatility.

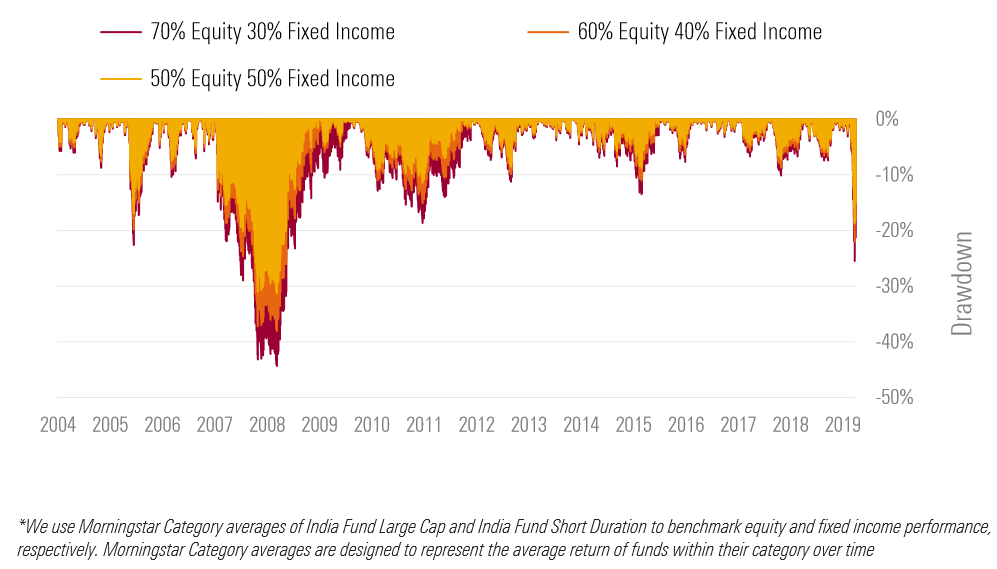

What can you live with? Here are three asset allocation (Equity:Debt) strategies with a semi-annual rebalance:

- 70:30 - Maximum drawdown of -44%

- 60:40 - Maximum drawdown of -38%

- 50:50 - Maximum drawdown of -31%

How a DIY investor can implement an effective asset allocation strategy.

The first step is to understand your willingness and ability to take on risk in the portfolio.

If you are unsure about your ability to take risk, take a risk tolerance questionnaire.

Once determined, take a call on your preferred asset class; the common ones being Equity, Fixed Income, Gold and Real Estate. While equity is usually the engine of wealth appreciation, fixed income is considered a means of capital preservation with a steady increase. On the other hand, gold is considered a ‘hedge’ and helps in diversifying the risks.

Use equity and fixed income mutual funds and allocate to each category separately.

The Pros: You get to choose pure equity and pure bond fund managers who have the ability to show great potential in their area of expertise.

The Cons: Investors may use a wrong metric to choose funds in each category, such as past performance. A fund might have just been lucky and may not be able to replicate its past performance once the cycle turns. Also, frequent rebalancing would be difficult. It would require constant monitoring on part of the investor as well as increased costs due to short-term capital gains and exit loads. Human emotions like greed and fear can cloud their judgment in taking rebalance calls.

Use hybrid funds such as aggressive and conservative allocation.

The Pros: The investor delegates the asset allocation calls to the fund manager and trusts their judgement. She doesn’t need to constantly rebalance her portfolio. Based on her risk appetite she could choose either aggressive, conservative or moderate allocation. Also, equity-oriented funds (i.e., equity exposure greater than 65%) would allow the investor to reap in the tax benefits of an equity fund while limiting the downside risk.

The Cons: The equity and debt allocation can vary among fund houses. For example, a fund house might invest the equity portion predominantly in large caps whereas some manager might go for a more diversified portfolio. The debt papers also might not be conservative for a conservative hybrid fund. The investor needs to deep dive and understand the scheme’s mandate before investing.

Use Dynamic Asset Allocation Funds (DAAF).

The Pros: The fund manager tries to strike an optimum balance between equity and debt based on the current market conditions and valuation. This allows fund managers to generate high rates of return if they are right on their expectations over a long term.

The Cons: The methodology used by the various funds in this category might be too complex for an investor to choose from. Since there is no target allocation mix, the inherent risk assumed by these funds may not be ideal for investors based on their expected risk tolerance. Additionally, a manager’s valuation calls might go wrong at times.

Just understand what you are getting into.

Every approach mentioned above helps provide diversification to investors, hence limiting their downside risk. But there is seldom one investment strategy that can outperform others consistently across time. What’s important is to understand is what you’re getting into.

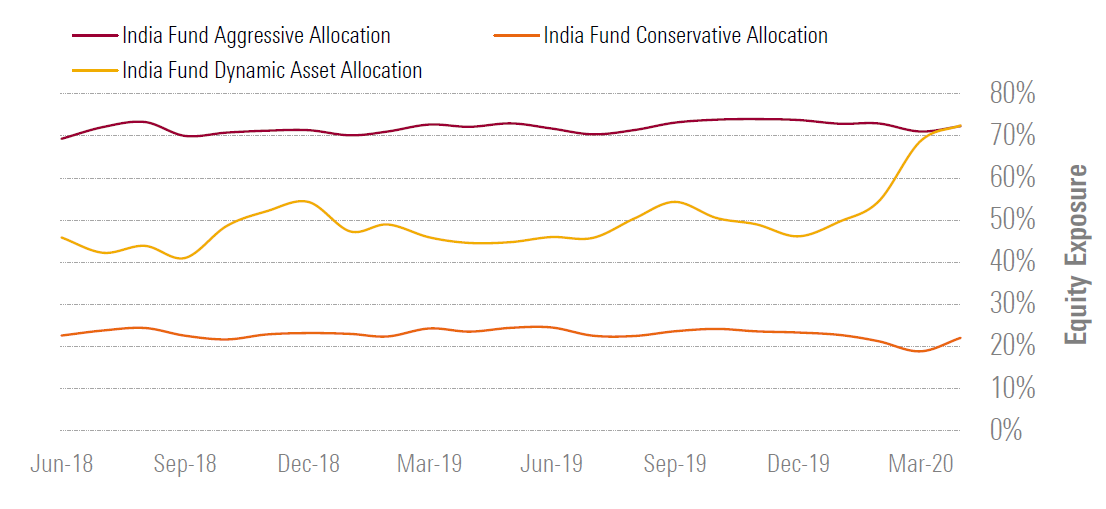

For instance, look at how different schemes change their equity and fixed income exposure over time. This graph illustrates the median equity exposure of different allocation categories since the SEBI recategorization of fund schemes in 2018.

While aggressive and conservative allocation funds have kept their equity exposure around 70% and 20% respectively, DAAF have exercised their freedom to change equity allocation depending on the prevailing market conditions.

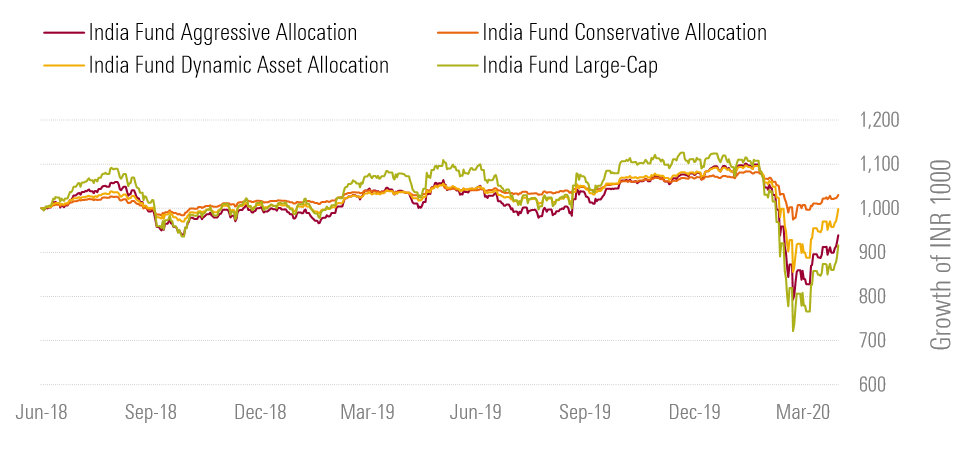

This can also be reflected in their past performance, as illustrated below. They have been able to outperform Large Cap Equity and Aggressive Allocation Funds due to lower exposure to equity in the last three months and then increasing it by the end of March that helped them capitalize on equity markets gains made in April 2020.

So do ask yourself:

- Are you comfortable with a DAAF scheme making such changes across time?

- Would you rather choose allocation funds that meet your risk tolerance level consistently?

Based on honest answers you can proceed.