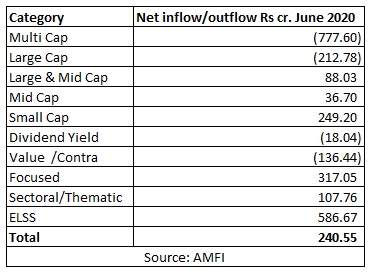

Equity funds received net inflows of just Rs 240 crore in June 2020 as investors rushed to book profits after some recovery in indices. The Sensex gained 8% in June 2020.

In June, equity mutual funds received gross inflows of Rs 13,760 crore while gross redemptions stood at Rs 13,520 crore which resulted in a net inflow of Rs 240 crore. The redemptions increased by 76% from Rs 7,693 crore in May 2020 to Rs 13,520 crore in June 2020. The redemptions were spread across all categories.

Meanwhile, the SIP inflows were steady at Rs 7,927 crore in June 2020. This helped SIP assets under management cross Rs 3 lakh crore mark.

G Pradeepkumar, CEO, Union Mutual Fund, is hopeful that the equity inflows will increase as the economic situation improves. "More investors appeared to be shrugging off their risk aversion as evidenced by the increase in folios and the higher gross mobilisation in equity funds. While net flows into equity funds have been tepid, month on month increase in folios of equity funds is encouraging. The drop in net flows into equity funds could be attributed partly to profit booking on the back of the rally in equity markets witnessed in June 2020. The monthly SIP contribution has been slowing down is worrying, but it is not completely unexpected given the strain on cash flows and incomes experienced by many investors on account of the COVID-19 situation. Once the economic situation improves, the flows should also pick up."

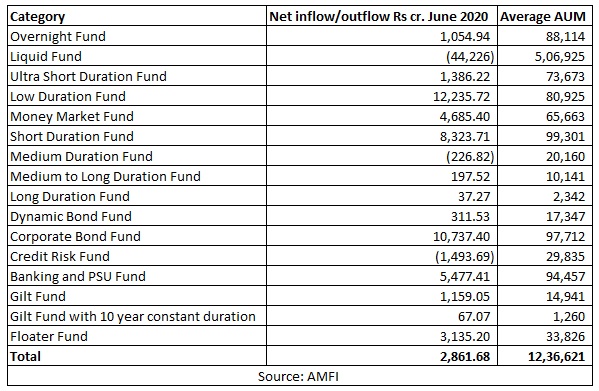

Debt Funds

Fixed income funds received net inflows of Rs 2,862 crore. Liquid funds saw net outflows of Rs (44,226) crore due to quarter-end. Low duration, corporate bond, Banking & PSU, money market and short duration funds received healthy inflows.

The average assets under management of the industry stood at Rs 26 lakh crore in June 2020.