The Gross Domestic Product, or GDP, contracted by 23.9% during the last quarter. But the stock market has been on a different trajectory leaving many flummoxed.

The reasons for a galloping stock market could be varied. Stock prices reflect market expectations of future profits. In a low interest rate scenario, there is little incentive for fixed income instruments. Foreign flows could also contribute. Speculation (as measured by delivery percentage) is also worth considering.

In an interaction with Bloomberg, Somnath Mukherjee, managing partner and chief investment officer at ASK Investment Managers, explains this phenomenon.

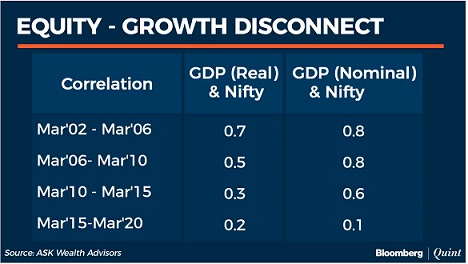

The high correlation between India’s GDP and stock market performance existed many years ago. But over the last 18 years, the correlation has been steadily coming off. In the last 6-7 years, the correlation is almost statistically negligible (see image below).

Investing in fixed income is macro driven.

It is the sovereign yield curve and credit spreads that are closely linked to the state of the macro. The shape of the yield curve, the direction interest rates will take, the view on overall credit spreads and the health of the broader segment of enterprises and whether that spread is getting priced efficiently are of utmost importance.

Investing in equity is micro driven.

Stocks do not get priced on account of macro parameters. They get priced when they generate high returns on equity and high returns on reinvested capital.

It is oligopolies and monopolies that excel on these fronts. They generate the maximum returns on equity and get rewarded in the stock market. If you look at data over the past few years, about 20-15 companies in India generate 70% of total corporate profits.

(In agreement with Somnath, Saurabh Mukherjea of Marcellus Investment Managers also noted that 20 most profitable firms in India now generate 70% of the country’s profits, up from 14% thirty years ago. The rise of India’s networked economy (highways, cheap flights, broadband, GST) has allowed large, efficient firms to use superior technology and better access to capital to squash smaller competitors.)