Since 2017, Morningstar Investment Research India Private Limited (formerly known as Morningstar Investment Adviser India Private Limited) has been publishing an annual report on female fund managers in the asset-management industry. We attempt to acknowledge the presence and highlight the achievements of women in this space and share a perspective on gender diversity in the industry. This is the eighth edition of the report.

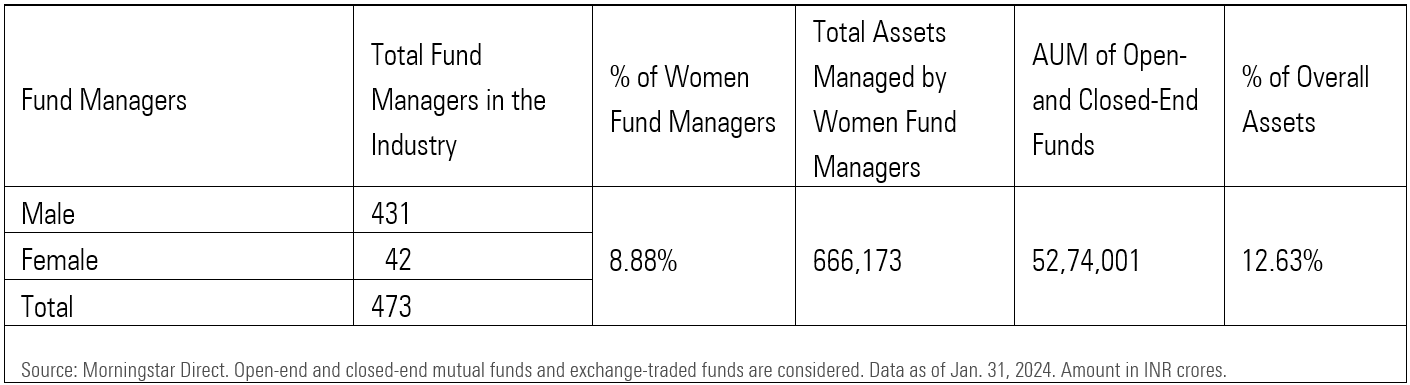

The year 2024 saw the mutual fund industry break through the INR 50 lakh crore mark in assets under management for the first time. The total AUM grew by an astounding 33% to INR 52.74 lakh crore as of Jan. 31, 2024, up from last year's AUM of INR 39.62 lakh crore. These assets are managed by 473 fund managers across all fund houses.

When it comes to gender diversity, the latest findings of our report show that of the 473 fund managers, 42 are women who are managing funds either as primary or secondary managers. While there has been a steady increase in the number of fund managers as compared with the 428 seen last year, the number of women fund managers has been static.

The 42 female fund managers were spread across 21 fund houses. Five fund houses had three or more female fund managers, five fund houses had two female fund managers, and 11 fund houses had at least one female fund manager.

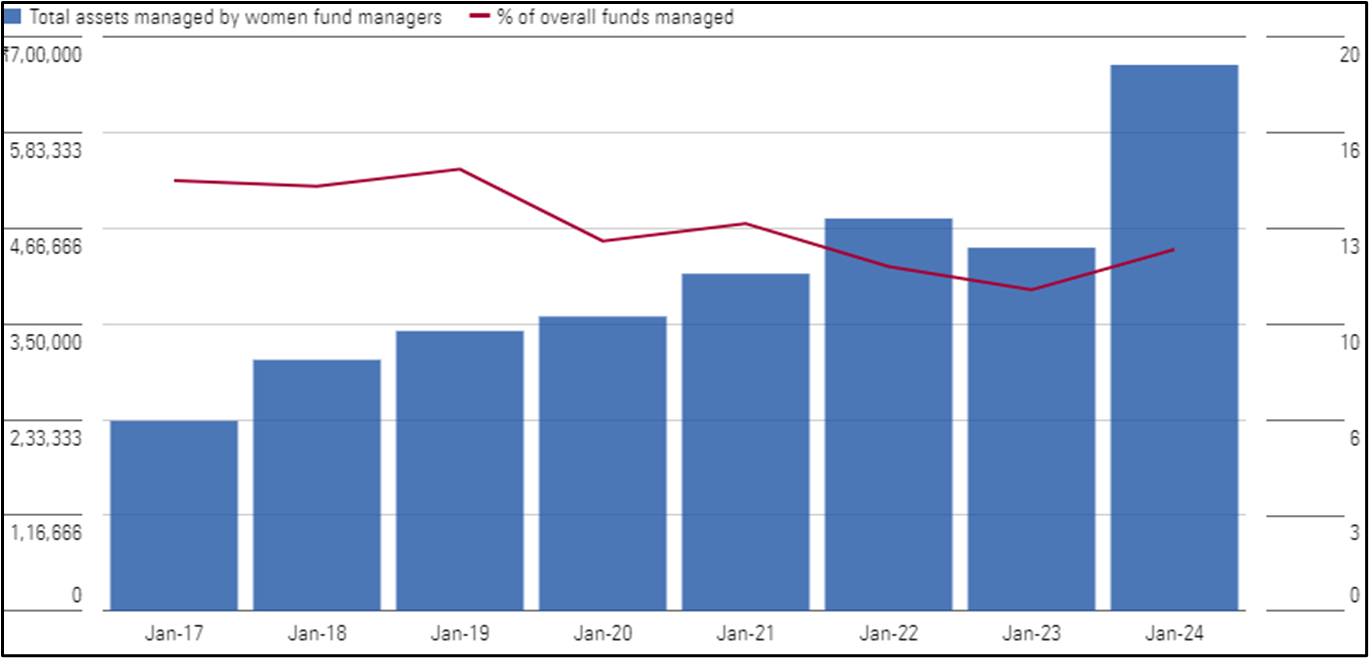

The total open- and closed-end assets managed/comanaged by female fund managers was approximately INR 6.66 lakh crore, or 12.63% of the total mutual fund assets. The assets managed/comanager by women saw a sharp uptick compared with last year when women managed/comanaged about INR 4.44 lakh crores, a phenomenal growth of 50%.

Although the assets managed/comanaged by women are increasing, their percentage relative to the overall industry assets hasn't reached a noteworthy level yet. However, on a positive note, the assets in percentage terms did see an increase this year after witnessing regression in the past two years.

Assets managed by Women Fund Managers.

Female fund managers exhibit versatility across various asset classes. The most assets—INR 2.86 lakh crores, or 43%—are managed/comanaged in the equity/growth asset class, followed by the allocation asset class at INR 1.68 lakh crores, or 25.3%. This diverse distribution showcases the nuanced expertise that women contribute to different segments of the industry.

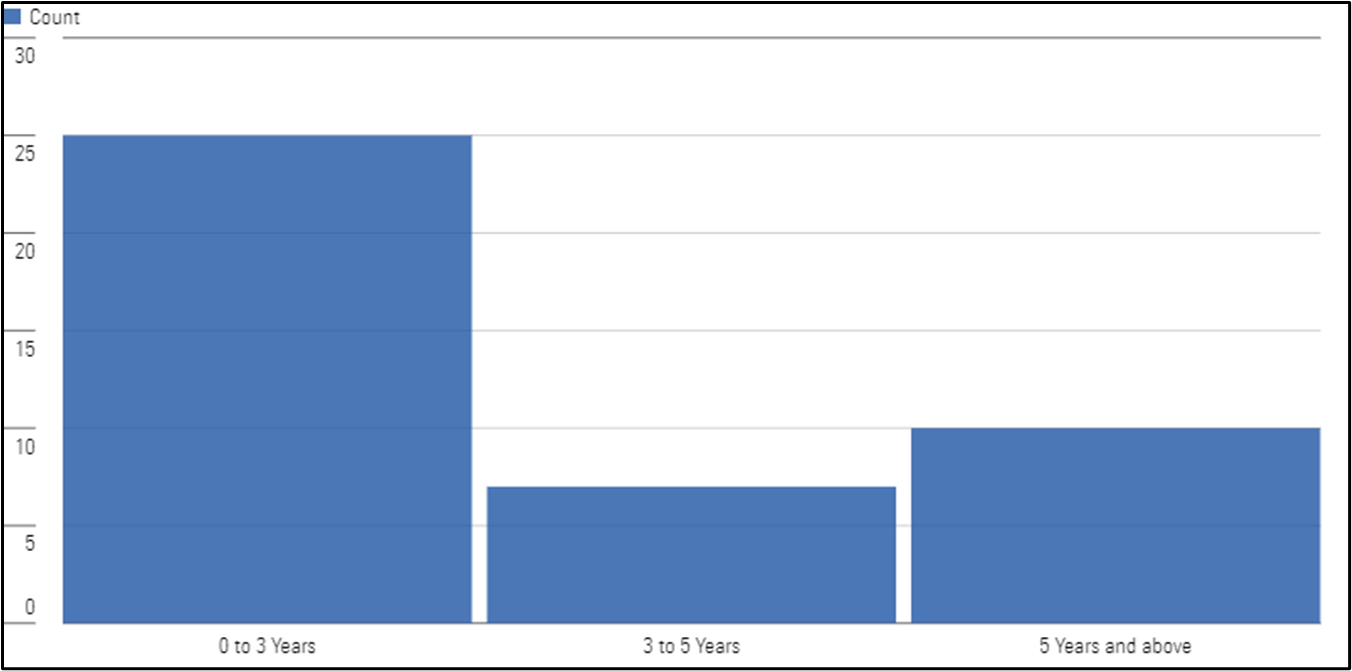

Fund management tenure in years

When it comes to tenure, 10 fund managers are managing/comanaging funds consistently for five years or more. Seven fund managers are managing/comanaging funds between three and five years, and 25 fund managers are managing/comanaging funds for less than three years.

Important Disclaimers

© 2024 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. This research on securities (“Investment Research”), is issued by Morningstar Investment Research India Private Limited (formerly known as Morningstar Investment Adviser India Private Limited). Morningstar Investment Research India Private Limited (CIN: U74120MH2013FTC249024), having its registered office at Platinum Technopark, 9th Floor, Plot No 17 & 18, Sector - 30A, Vashi, Navi Mumbai, Maharashtra, 400705, is registered with SEBI as a research entity (registration number INH000008686).

Morningstar Investment Research India Private Limited has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. It is a wholly owned subsidiary of Morningstar Investment Management LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc. In India, Morningstar Investment Research India Private Limited has only one associate, viz., Morningstar India Private Limited, and this company predominantly carries on the business activities of providing data input, data transmission and other data related services, financial data analysis, software development etc.

The author/creator of this Investment Research (“Research Analyst”) or his/her associates or immediate family may have (i) a financial interest in the subject mutual fund scheme(s) or (ii) an actual/beneficial ownership of one per cent or more securities of the subject mutual fund scheme(s), at the end of the month immediately preceding the date of publication of this Investment Research. The Research Analyst, his/her associates and immediate family do not have any other material conflict of interest at the time of publication of this Investment Research. The Research Analyst or his/her associates or his/her immediate family has/have not received any (i) compensation from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; (ii) compensation for products or services from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; and (iii) compensation or other material benefits from the relevant asset manager(s)/subject mutual fund(s) or any third party in connection with this Investment Research. Also, the Research Analyst has not served as an officer, director or employee of the relevant asset manager(s)/trustee company/ies, nor has the Research Analyst or associates been engaged in market making activity for the subject mutual fund(s).

The terms and conditions on which Morningstar Investment Research India Private Limited offers Investment Research to clients varies from client to client, and are spelt out in detail in the respective agreement. The Investment Research: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar Investment Research India Private Limited; (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar Investment Research India Private Limited; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources. No part of this information shall be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar Investment Research India Private Limited, nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the use of the Investment Research. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Wherever any securities are quoted, they are quoted for illustration only and are not recommendatory. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and re-evaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about the Medalist Ratings, including their methodology, please go to the section titled “Methodology Documents and Disclosures” at http://global.morningstar.com/managerdisclosures.