This is just a data point with respect to estimated flows and asset trends for offshore funds focused on the Indian equity market. An offshore India fund is one that is not domiciled in India but invests primarily in the Indian equity market. We have included the asset flows of mutual funds and exchange-traded funds (ETFs) with an allocation to Indian stocks as of September 2023.

- All figures are in USD ($) unless otherwise stated.

- All quarters refer to calendar-year quarters.

- All assets and flows data refer to funds and ETFs combined unless specified otherwise.

- We have combined the flows and assets of all India-focused offshore funds and ETFs from different regions into one.

- The flows are estimated from assets and total returns for the quarter ended September 2023.

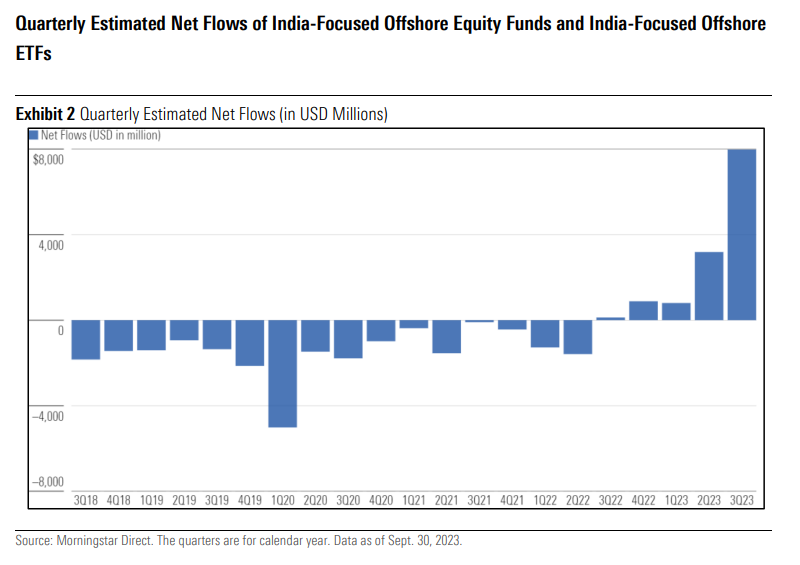

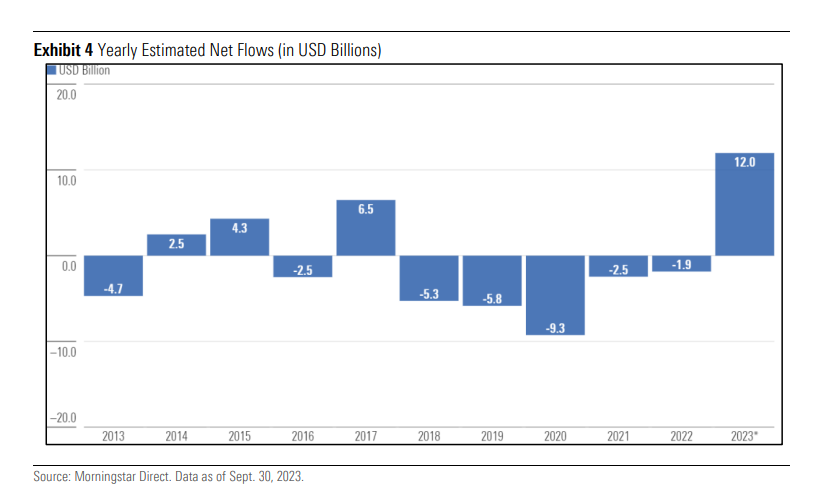

After 17 consecutive quarters of net outflows, the India-focused offshore fund and ETF segment witnessed net inflows during the quarter ended September 2022. This trend has continued since then, with the category now witnessing five consecutive quarters of net inflows.

The category received a net inflow of $3.19 billion (June 2023 quarter), and $7.97 billion (September 2023 quarter). The latter is its highest to date over a quarterly period.

Robust net inflows and a strong rally in the Indian equity market drove the asset base of the India-focused offshore fund and ETF category to swell by 18.2% to $59.8 billion from $50.6 billion in the previous quarter.

After a strong rally in the June 2023 quarter, the Indian equity market inched up across the board in the quarter ended September 2023. The S&P BSE Sensex registered a gain of 1.71% through the quarter, S&P BSE Midcap Index surged by 12.39%, and S&P BSE Small Cap Index appreciated by 15.21%.