In recent years, Indian equities have experienced a significant rally driven by strong GDP growth, robust corporate earnings, ample market liquidity, and increasing domestic retail investor participation. This upward trajectory has led global funds, particularly those focused on emerging markets, to boost their allocation to Indian equities. The underperformance of Chinese equities, entangled in domestic macroeconomic challenges, has amplified this shift. The combination of strong market performance and an uptick in global investors’ sentiment has notably raised India's weight in the Morningstar Emerging Market Index and the MSCI Emerging Market Index in recent years, while concurrently witnessing a significant slide in Chinese equities’ weight.

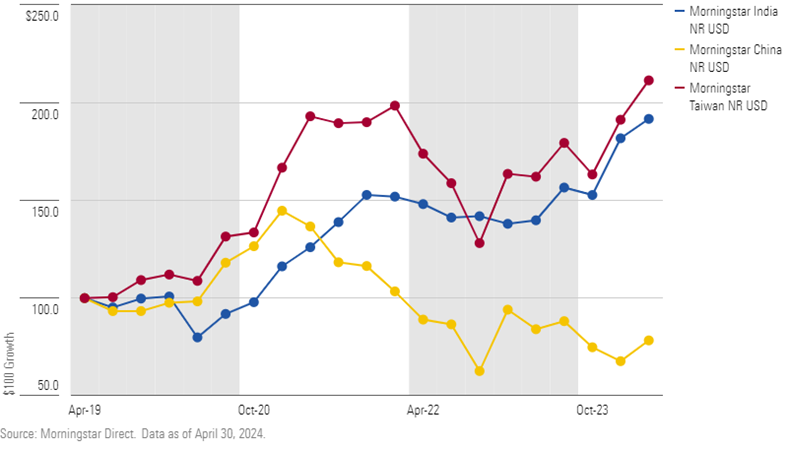

Exhibit 1

Among Major Emerging Markets, India Has Been a Strong Performer During April 2019-April 2024

Alongside India, Taiwan has also witnessed strong market growth over the past five years. However, Taiwan's market remains highly concentrated, with Taiwan Semiconductor Manufacturing Company (TSMC) driving much of the rally. This concentration poses a significant risk for investors.

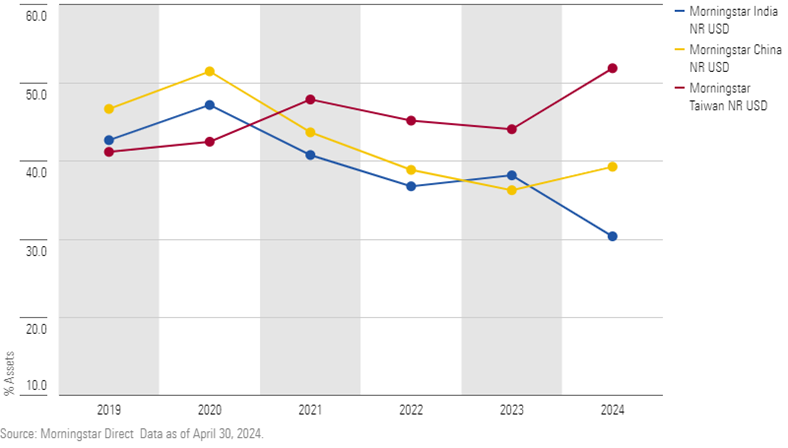

A key reason for the increased allocation to India is the structural transformation within its equity market. Over the last five years, the market has expanded significantly, driven by a surge in new stock listings, particularly from mid- and small-cap companies. This broad-based growth has reduced market concentration and shifted sector composition, with the financial sector's weight increasing substantially.

Exhibit 2

% Assets in Top 10 Holdings

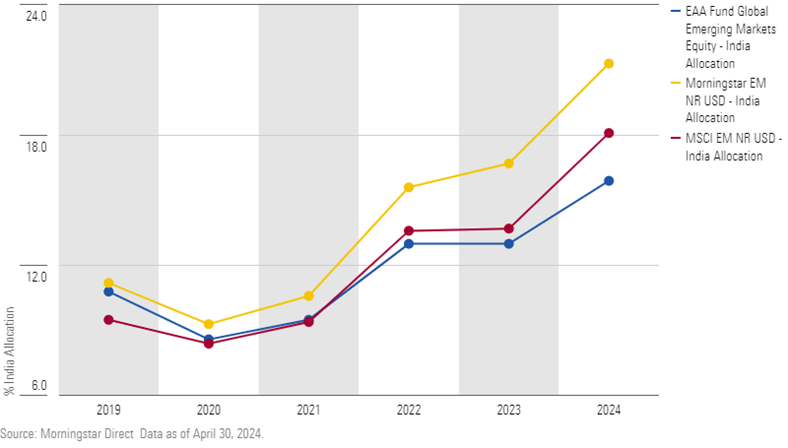

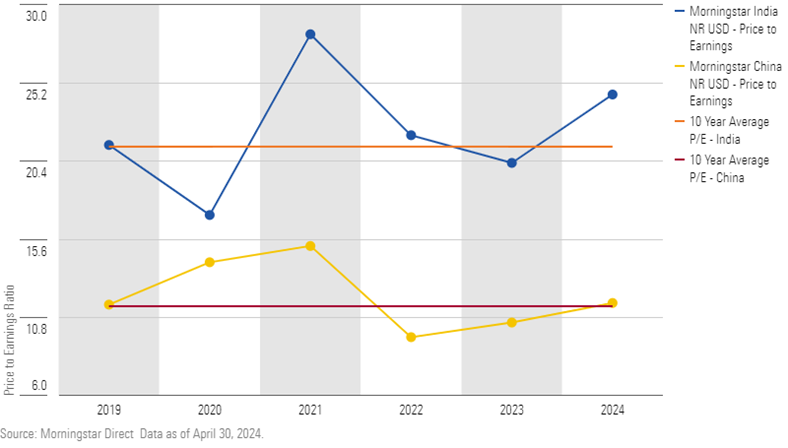

The interplay of robust market performance, favorable market structure shifts, and China's underperformance has driven a significant rise in the average allocation to India by funds in the Morningstar Europe, Asia, and Africa (EAA) global emerging-markets equity category over the past five years. Despite this surge, the average allocation remains underweight compared to the market index, with the managers' clear preference for large-cap Indian stocks. Conversely, despite the relative underperformance of Chinese equities, the average allocation to China by these funds has been adjusted to align more closely with market indexes. Some of the asset managers under our Morningstar Analyst Rating coverage attribute this allocation disparity to the varying equity valuations between the two countries, as they remain cautious about the generally elevated valuation levels of Indian equities.

Exhibit 3

Trend of Average Allocation to India by Global Emerging-Markets Funds

As India’s weight in various global emerging-markets indexes witnessed a surge in the trailing five years, many of our analyst-rated funds in the EAA global emerging-markets category have generally increased their exposure to India in response. However, this trend has not been consistent across all funds. The level of exposure to India has varied significantly among these funds in recent years. This trend indicates that some managers are carefully balancing India's growing weight in the emerging-markets indexes with their cautious view of Indian equities’ rich valuations. This balance shows a nuanced approach among different managers when it comes to managing investments in India.

Exhibit 4

Valuation of Indian Equities Look Steep Compared with China

Conclusion

The convergence of Chinese and Indian stock weights in global emerging-market indexes is remarkable, given the historical differences. This alignment signifies a significant shift in the emerging-markets landscape. The continued momentum in Indian equities will likely depend on sustained economic growth, corporate earnings performance, and political stability. While the broader base of market growth in India presents a lower concentration risk compared to markets like Taiwan, investors should remain vigilant about valuation levels and sector-specific risks. As global funds increasingly favor Indian equities, this trend could provide both opportunities and challenges, necessitating a balanced and informed investment approach.

For detailed data and analysis, refer to the full study by Morningstar Manager Research Services here.