As the financial year end approaches, there is always a rush to invest in tax-saving products. Equity linked savings scheme, or ELSS, have the shortest lock-in period of three years and the potential to generate superior returns in comparison to other traditional tax-saving avenues.

Due to the recent rally, the ELSS category has delivered 25% return over a one-year period. The top performer (over a one-year period) delivered 56.82% return while the bottom performer, has delivered 11.66%. A word of caution. Having said that, one should not merely choose to invest in funds based on their recent performance. Rather, understanding the characteristics of each fund and whether it suits your risk profile is important. In How to Select and ELSS, we looked at that.

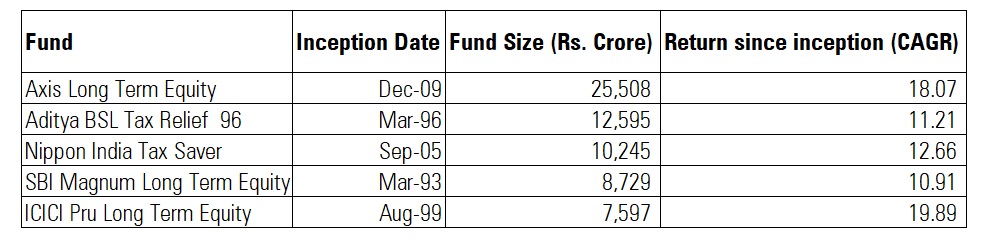

Here are five ELSS funds with the highest assets under management as on January 2021.

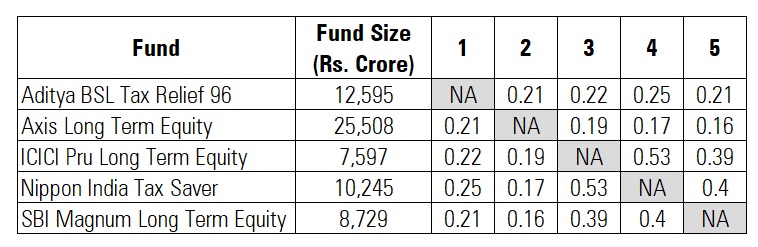

While there are 42 ELSS funds in the industry, each fund can differ in its investing style, sector and market capitalisation concentration. The below table illustrates the common holdings between these five funds.

If you plan to invest Rs 1.50 lakh in ELSS, it would be wise to split the corpus among a few different funds in order to achieve diversification. This means that two ELSS funds could have similar stocks in their portfolios. Thus, investing in funds that have a large overlap of common stocks would result in owning the same stocks through two different funds. One way to choose funds is by looking at their common holdings.

From the above table, you can see that Aditya BSL Tax Relief 96 and Axis Long Term Equity have 21% common holding. Similarly, Aditya BSL Tax Relief 96 and ICICI Prudential Long Term Equity Fund have 22% overlap of stocks. ABSL Tax Relief 96 has 25% overlap with Nippon India Tax Saver. One should select a fund which has low overlap with another fund. Of course, that is not the only criteria to choose funds. One should look at the consistency of return and the ability to protect the downside in a bear market.

To sum up, allocation to ELSS category should be in sync with one’s risk appetite and financial goals.