There’s a new fund in the market that stands out for two reasons: global exposure and its adherence to ESG (environmental, social and governance) principles.

Indian investors looking for a sustainable foreign-stock fund can consider the HSBC Global Equity Climate Change Fund of Fund. This FoF will feed into HSBC Global Investment Funds - Global Equity Climate Change, managed by Angus Parker.

Do note, this is not a recommendation and we advise you to talk to your financial adviser before investing.

The NFO will be available from March 3, 2021 to March 17, 2021. It will then reopen on March 30, 2021.

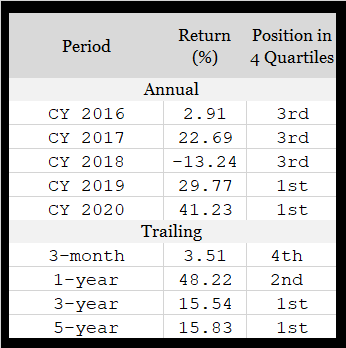

Returns

Though the fund currently has a 5-star rating, its returns have been sporadic. It was a top quartile performer in 2012, and for the next 6 calendar years (2013 - 2018) was a third quartile performer. Since 2019, it has put its best foot forward.

Do note, the category with which it is being compared is the Global Large-Cap Blend Equity. The YTD and trailing returns are as of March 1, 2021.

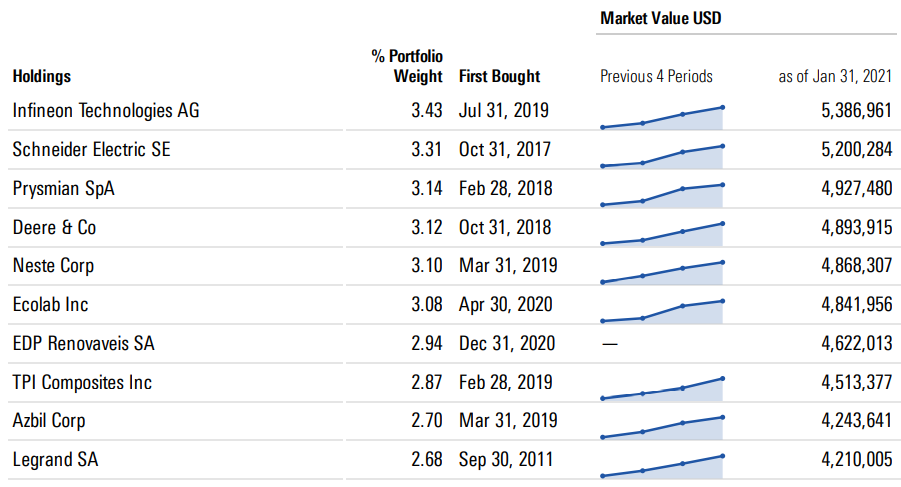

Portfolio

The January 2021 portfolio has 46 stocks from across the world. With the largest allocation being 3.43%, it is a well-diversified offering across sectors and countries.

The global exposure currently stands at:

- U.S. (35.16%)

- U.K. (11.83%)

- Japan (10.42%)

- France (9.55%)

- Germany (6.9%)

- Spain (5.42%)

- Denmark (4.29%)

- China (4.10%)

- Italy (3.14%)

- Finland (3.10%)

- The Netherlands (2.45%)

- India (1.22%)

- Mexico (0.69%)

- Switzerland (0.03%)

- Sweden (0.01%)

ESG

The fund aims to provide long term total return by investing in companies that may benefit from the transition to a low carbon economy.

It hopes to achieve this with a lower carbon intensity and a higher ESG rating, calculated respectively as a weighted average of the carbon intensities and ESG ratings given to the issuers of the fund’s investments, than the weighted average of the constituents of the MSCI AC World Net index.

For example, the stocks mentioned above would fall under the themes:

- Energy Efficiency: Infineon Technologies, Schneider Electric

- Renewable Energy: Prysmian, EDP Renovaveis

- Natural Capital and Ecosystems: Deere & Co

- Pollution and Waste Prevention and Control: Neste

- Sustainable Water & Wastewater Management: Ecolab

- Green Buildings: Azbi, Trane Technologies

- Circular Economy and Resource Efficiency: Ball

Morningstar Analyst View

HSBC Global Investment Funds - Global Equity Climate Change is not currently covered by our analysts.

However, we have developed a machine-learning model that uses the decision-making processes of our analysts, their past ratings decisions, and the data used to support those decisions. The machine-learning model is then applied to create the Morningstar Quantitative Rating, which is analogous to the rating a Morningstar analyst might assign to the fund if an analyst covered the fund.

The Morningstar Quantitative Rating™ assigns a Neutral rating for this fund. (Gold, Silver, Bronze, Neutral, Negative).

Morningstar initially had a 5-pillar framework (People, Performance, Process, Parent, Price). That has been replaced by three -- People, Process, and Parent.

We’ve absorbed the Performance Pillar into the People and Process pillars to ensure performance analysis takes place as part of a broader assessment of a fund’s strategy and the people behind it. We’ve removed the Price Pillar as part of a rethink of how we evaluate fund costs. Previously, we ranked a fund’s price tag against those of others in its peer group. Now, we’ll compare a fund’s costs to our estimate of what value it can deliver before fees.

While the ProcessPillar for this fund gets an ‘Above Average’ rating, the People and Parent pillars have ‘Average’ ratings. The Process Pillar is our assessment of how sensible, clearly defined, and repeatable the fund’s performance objective and investment process is for both security selection and portfolio construction.

Morningstar Sustainability Rating™ for this fund is 5 globe icons. The Sustainability Rating is depicted by globe icons where a low ESG risk score equals 5 globes and a high ESG risk score equals 1 globe.

© 2020 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. Research on securities, referred to for the purpose of this document as “Investment Research”, is issued by Morningstar Investment Adviser India Private Limited, which is registered with SEBI as an Investment Adviser (Registration number INA000001357), providing investment advice and research, and as a Portfolio Manager (Registration number INP000006156). For the complete disclaimers, click here.