Since 2017, Morningstar has been bringing out an annual report on women fund managers in the asset management industry. We attempt to acknowledge the presence of and highlight the achievements of women in this space and share a perspective on gender diversity in the industry.

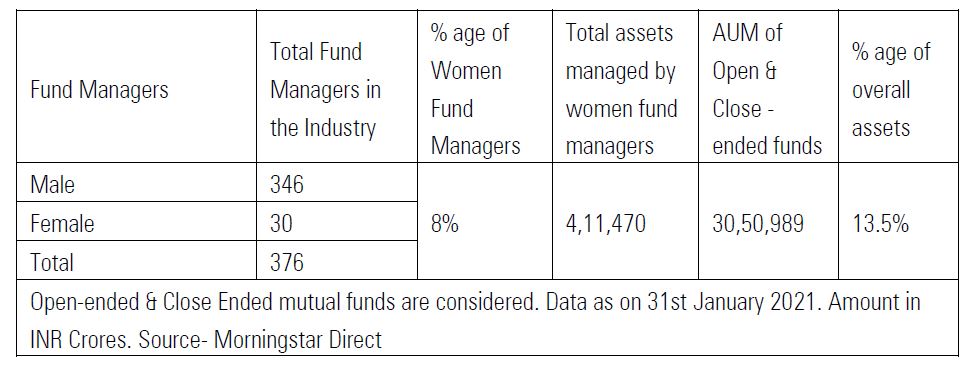

Despite facing a treacherous period of sharp market corrections, a full blown pandemic and strict lockdowns, the mutual fund industry’s assets during the last year have increased by 9.5%, with the total assets being managed now standing at approximately Rs 30.50 lakh crore as on January 2021, up from Rs 27.85 lakh crore a year earlier. These assets are managed by 376 fund managers across all fund houses. When it comes to gender diversity, the latest findings of our report show that of the 376 fund managers, 30 are women, who are managing funds either as primary/secondary managers or have oversight as heads of equity/debt.

Currently, the total count of women fund managers has increased from 28 last year to 30. Interestingly, the total number of fund managers saw a healthy increase this year up from 352 managers seen last year. With a meagre 8% representation, women still remain drastically under-represented among the ranks of mutual fund managers.

The 30 women fund managers were spread across 19 fund houses, with two fund houses having three or more women fund managers. Six fund houses had two women fund managers while 11 fund houses had at least one woman fund manager.

When it comes to tenure, 10 fund managers have managed funds consistently for over five years. 12 fund managers have been managing funds between two and five years, and 8 fund managers have a relatively lower experience of managing/co-managing funds below two years.

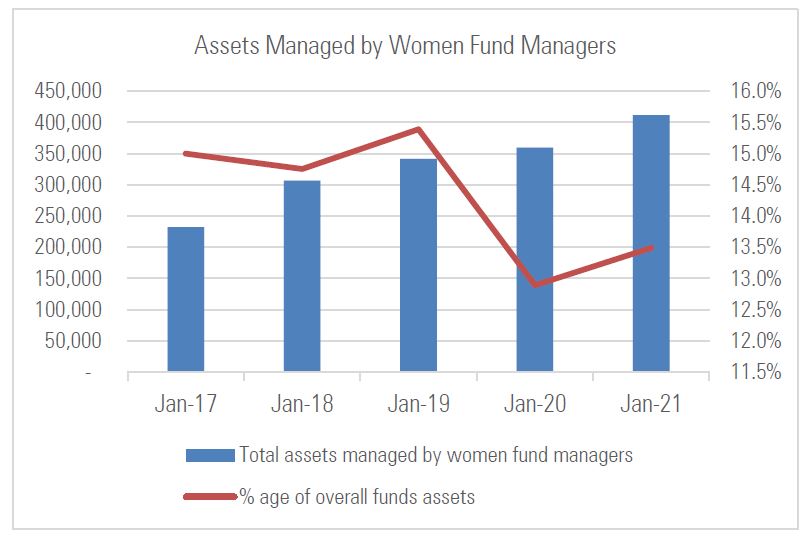

The total open and close end assets managed by women fund managers is approximately Rs 4.11 lakh crore, which is 13.5% of the total mutual fund assets. Over the last few years, while the assets managed by women are on the rise, in percentage terms of the overall industry assets, this number has not been something to boast about. Having said that, there is certainly a rise in the number of women fund managers in the mutual fund industry. When we first came out with a report on women fund managers in 2017, there were only 18 women fund managers. This increased to 24 in 2018, 29 in 2019, was 28 in 2020, and again increased to 30 in 2021.

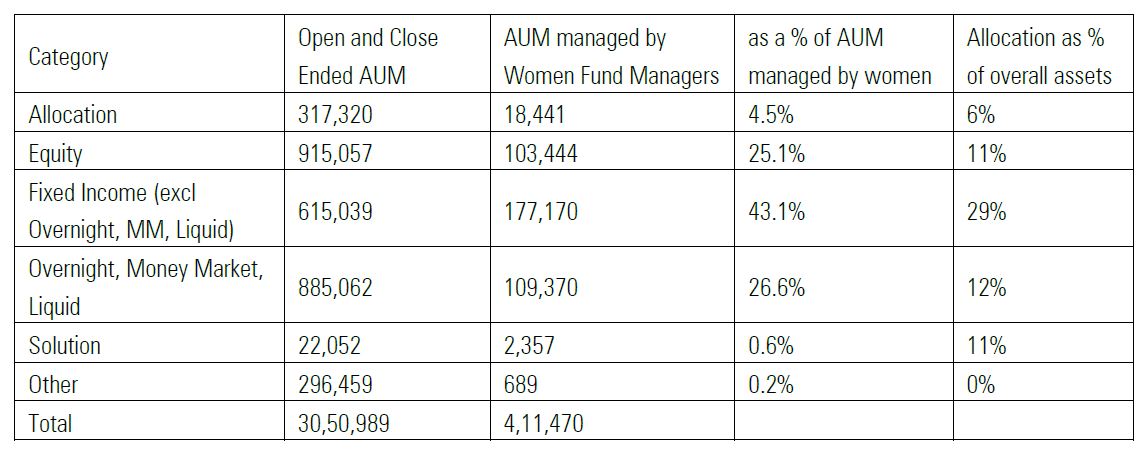

From the perspective of assets managed across various asset classes, out of the total open and close end fund assets managed by women (Rs 4.11 lakh crore), approximately Rs 1.77 lakh crore (43%) were fixed income funds (excluding money market, liquid and overnight funds), Rs 1.09 lakh crore (26.6%) were money market funds, liquid and overnight funds, Rs 1.03 lakh crore (25.1%) were equity funds, Rs 0.18 lakh crore (4.5%) were allocation funds and the solution and other category cumulated to 0.03 lakh crore (0.7%).

This accounts for 29% of all fixed income assets (excluding money market, liquid and overnight funds), 12% of all money market, liquid and overnight assets, 11% of equity assets, 6% of allocation assets and 11% and 0.2% of solution and other assets respectively.

Scrutinizing the data further throws up some interesting bright spots especially related to fund performance. Our reports show that of the total open-ended assets managed by women fund managers, 80% of the AUM outperformed the peer group average on a one-year basis, 80% of the AUM outperformed on a three-year basis and 74% of the AUM outperformed on a five-year basis - a feat truly worth commending.

(Data source: Morningstar Direct)