Amid the volatility caused in the market due to the second wave of COVID, dynamic asset allocation funds/balanced advantage funds, which invest in a mix of debt and equity, are gaining traction.

From January till March 2021, dynamic asset allocation/balanced advantage funds have received cumulative inflows worth Rs 5,375 crore. In March 2021, this category received inflows worth Rs 2,711 crore, which was higher than the inflow received by any equity fund category.

The main advantage of these funds is their ability to manoeuvre between equity/cash/debt dynamically which puts investors at the ease of not worrying about increasing or decreasing exposure to equities when valuations run-up. Such funds are being positioned by asset managers as apt for taking tactical calls.

Currently, dynamic asset allocation funds on average are holding 44% in cash, indicating that fund managers are waiting for opportunities to enter the market when valuations turn attractive. Principal Balanced Advantage and BOI Axa Equity Debt Rebalancer are holding more than 60% of net assets in cash currently.

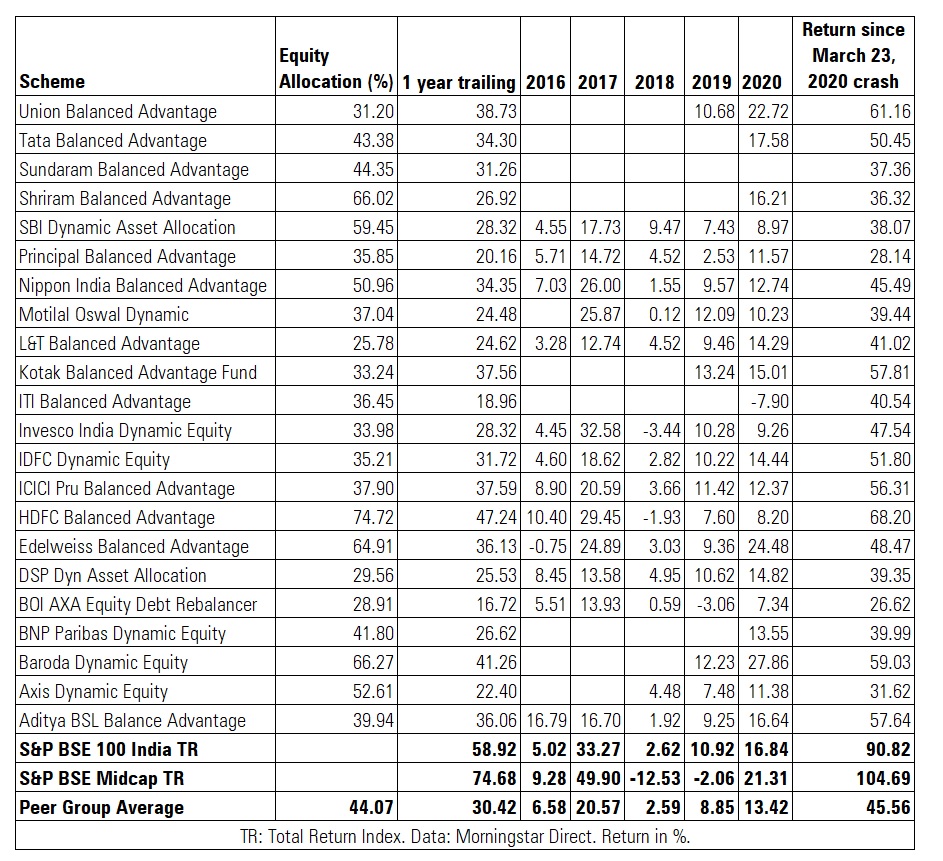

The table below shows the current allocation to equity, one-year trailing return, and recovery from the crash.

“Balanced advantage funds are ideal for most investors. It takes out the hassle of timing the market for investors. The main advantage is that these funds can give returns close to the equity market over the long term with significantly lower volatility. Currently, equity markets are trading at a premium to their fair value. However, the market can run up further on the back of liquidity and hence being out of the market is also not advisable. These funds give investors moderate exposure to equities at this juncture and when valuations become more attractive, the fund manager will automatically increase the equity allocation. Anyone who is not comfortable with the current valuations can consider BAFs rather than being out of the market,” says G Pradeepkumar, Chief Executive Officer, Union Mutual Fund.

Since debt funds are unlikely to deliver double-digit returns in the near future, some fund managers are recommending investors to shift to dynamic asset allocation funds.

“We need to shift focus from long-term debt funds to asset allocation funds where investors get a mixture of equity and debt. While the debt cycle has possibly ended on the duration side, equities have had a healthy period. Equities can deliver returns despite being a much riskier asset class. On the other hand, debt is a lower-risk asset class in comparison to equities, but debt funds could offer sub-optimal returns during this phase. Hence, we are recommending investors to move to dynamic asset allocation category,” says Sankaran Naren, Executive Director and Chief Investment Officer, ICICI Prudential Mutual Fund.

How do they work?

Each fund within this category is free to choose the methodology for deciding when to increase or decrease allocation to equities. Most often, fund managers use Price to Earnings (P/E) ratio, Book to Value, interest rates, and medium to long term outlook of the economy and markets while taking a call on the exposure.

SEBI does not mention any lower or upper cap on the quantum of exposure this category can have in debt and equity. Thus, these funds can go 0-100% in either debt, equity or cash. But most funds try to maintain a balance of allocation between equity, debt and cash. Dynamic asset allocation funds could attract debt fund taxation if the equity exposure is below 65% Thus, most funds try to maintain 65% average exposure to equity through arbitrage/derivatives throughout the year even if the allocation falls below 65% in a few months.

How have these funds performed?

The category has delivered 29.48% over a one year period as of April 13, 2021.

HDFC Balanced Advantage Fund is the largest fund in this category with assets under management of Rs 39,784 crore as of February 2021. This top-performing fund has delivered 49.05% over a one-year period. The bottom performer BOI Axa Equity Debt Rebalancer has delivered 16.45% during the same period. As on February 2021, the fund holds 71% in cash. This implies that the returns of each fund within the category could vary depending on the exposure to equity/debt/cash and market capitalisations.

“These funds take away our stress of rebalancing equity and debt for conservative investors or for investors with shorter tenure of investing. We selectively offer these funds only from a few AMCs since all DAAF funds do not follow their mandates exactly. We prefer to offer DAAF as a strategy rather than tactical allocation,” says Nisreen Mamaji of Moneyworks Financial Services.

These funds can protect the downside during a bear market but it would purely depend on the fund’s exposure to equities during that phase. During the March 2020 crash, when the S&P BSE 500 TRI fell by -32.55% (January – March 2020), dynamic asset allocation funds category fell by -21% average. Of course, some funds in the category fell by 27% to 33% during this period.

Thus, these funds do come with their own share of risks.

“As per historical data, dynamic asset allocation funds have corrected quite sharply during market crashes. For instance, in calendar year 2020 and 2008 a few funds witnessed sharp correction of more than -30% and -50%, respectively. Investors should understand that even well-managed funds will see a fall during market corrections. Also, it is very difficult to keep a track of the debt portfolio in these funds and many managers may venture into low credit quality instruments which can put the fund at high risk,” cautions Rushabh Desai, Mumbai-based mutual fund distributor.

Who should control asset allocation?

Rushabh feels that since each investors’ risk profile and time horizon is different, it is advisable to take separate exposure to debt and equity through different funds. Further, investors should look at the portfolios of dynamic asset allocation/balanced funds closely to see if the funds hold credible debt paper in their debt allocation.

“It is advisable for investors to keep their equity and debt portfolios separate to avoid any mishaps faced by both equity and debt segments, especially at the same time. During times of risk, it is very difficult for investors to immediately exit from these funds. Every investor will have a different time horizon and risk profile thus the power of asset allocation should lie in the hands of the investor. Observing the risks, investors should not put their entire money in one category like this though it can be some part of the portfolio,” adds Rushabh.

Investors who are indecisive about entering the market or are entering the market for the first time and hence are not sure how much to allocate between equity and debt and in which segment (large, mid, small-cap) of the market can consider dynamic asset allocation funds. But do note that these funds are not completely immune to equity market volatility and thus investors should have a reasonable time horizon while investing in such funds.