Fund of Funds are typically meant for investors who find it difficult to ascertain which funds to pick from the 1,000 plus schemes.

Unlike regular equity funds which invest in stocks/securities directly, FoFs invest in mutual funds schemes either managed by their own fund house or funds managed by their competitors.

There are two types of fund of funds on offer. The first category of FoFs invest in domestic funds. The second category of FoFs invest in funds domiciled in international markets managed by foreign fund houses.

While FoFs take away the effort for investors to choose from different funds, there are now a plethora of options (54 schemes) available within domestic fund of funds category. This could make choosing even FoF a daunting task since each fund is different. For instance, some FoFs invest purely in equity, some invest in a mix of three asset classes, some invest in passive funds while others are thematic FoFs.

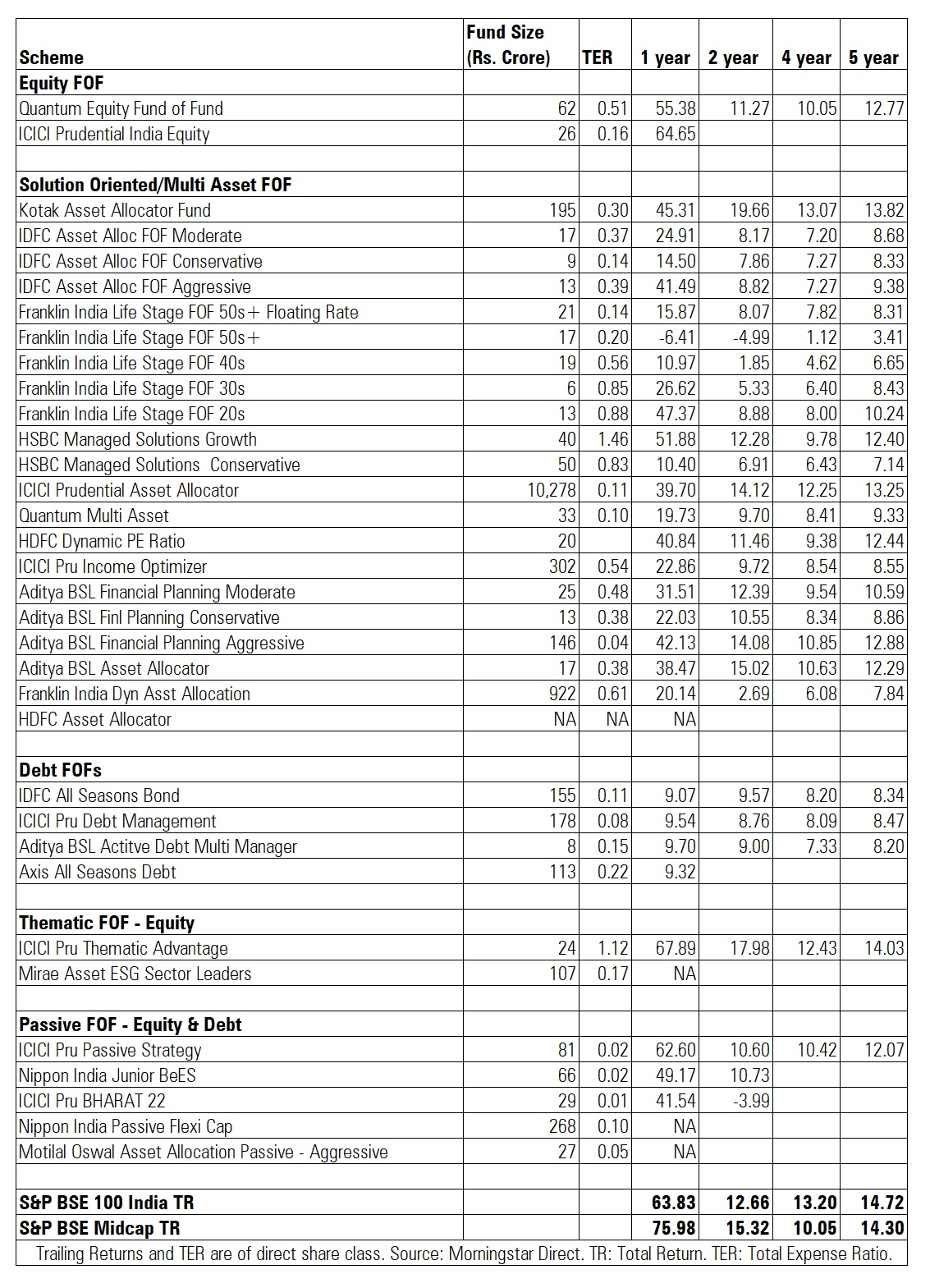

Let’s take a look at the broad categories. The assets under management under these schemes is low, indicating tepid investor interest. ICICI Prudential Asset Allocator is the largest fund in the category with AUM of Rs 10,278 crore.

Let’s take a look at the options available for investors in the domestic FoF space, their types and how they invest.

Equity FoFs

There are only two funds in the industry which invest purely in actively managed equity funds. They are Quantum Equity FoF and ICICI Prudential India Equity FoF. Both schemes currently have 95% of assets invested in equity funds with 5% allocation to cash. These funds have invested in a mix of large, mid cap and flexi cap funds.

Debt FoFs

Some AMCs like IDFC, ICICI, Axis offer debt FoF which invest in either in-house debt funds or a mix of in-house and other AMC’s debt funds. These funds are typically positioned for investors who are not sure about which debt fund to select from the 16 categories. Such funds invest across categories/strategies like credit risk, low duration, income funds, gilt and liquid funds.

Multi Asset FoFs

These FoFs invest in a mix of asset classes like equity, debt and gold. Some funds which are known as aggressive funds, invest a higher proportion in equity while conservative FoFs have lower exposure to equities. Solution oriented funds like retirement savings, life stage funds are grouped under multi asset FoFs.

Passive FoFs

In the recent past, some AMCs have launched passive fund of funds which invest in a mix of ETFs. For instance, ICICI Prudential Passive Strategy FoF has invested in its own ETFs like ICICI Prudential S&P BSE 500 ETF, ICICI Prudential Nifty ETF, Bharat 22 ETF and ICICI Prudential Nifty Low Vol ETF. These funds give an option to retail investors who do not have demat accounts to get exposure to ETFs.

Nippon India Passive Flexicap FoF is another offering in this space that exclusively invests in ETFs managed by Nippon India MF. It has invested in Nippon India ETF Nifty 100, Nippon India Nifty Smallcap, Nippon India ETF Nifty Mid Cap 150.

Pros and Cons

Viral Bhatt of Money Mantra says that such funds have a disadvantage when it comes to taxation and expenses. “Fund of funds are generally better suited for smaller investors who wish to gain access to a range of different asset classes to minimise the risk. FoF is treated as a non-equity fund and consequently taxed accordingly. In other words, even though a FoF may be investing in equity-oriented funds, the FoF itself is not regarded as an equity-oriented fund, and consequently, the tax benefits currently available to an equity fund are not available to a FoF. There is a dual levy of Dividend Distribution Tax (DDT), viz. when the domestic companies distribute dividends to their shareholders and again when the FoF distributes the dividends to its unit holders. Considering the expenses and dividend part in mind - investors should invest in target fund rather than FoFs,” believes Viral.

Domestic fund of funds invest in direct share class in order to keep the expense ratio low. Chirag Mehta, Senior Fund Manager, Quantum Mutual Fund, explains how Quantum Equity FoF selects underlying funds. “Instead of investing in multiple equity funds, investors get exposure to different strategies through one fund. Quantum Equity FoF does not invest in our own funds so that there is no bias. We follow a rigorous process of shortlisting funds, including meeting the fund manager before investing in funds. Instead of looking at the Securities and Exchange Board of India, or SEBI, defined classification, we look at portfolio holdings to decide which fund to invest in because two funds, even from different categories tend to have an overlap of stocks. One advantage equity FoFs have is that fund managers take a call when to exit funds based on quantitative and qualitative factors. We often review and exit the fund methodologically. For instance, if the fund doesn’t appear in the first quartile for three consecutive quarters, we exit the fund. We have exited funds in the mid and small cap space where the fund size had grown beyond the capacity to manage it. It is difficult for retail investors to take such exit calls,” says Chirag.

Performance of domestic FoFs

To sum up, each fund is different within this category of domestic fund of funds and the range of options can overwhelm you. Also, do note that equity FoFs attract debt fund taxation. Long term capital gains tax holding period is three years in debt funds which comes with indexation benefit. If you sell these schemes before three years, any gains will be taxed as per your income slab. So even if a FoF underlying holding is more than 65% in equities, they still attract debt fund taxation. “The change in the taxation of debt funds has made investing in domestic FoFs almost on par with equity funds taxation because of indexation benefit,” says Chirag.

Further, check the expense ratio of the scheme to see how competitive it is relative to other funds offering the same strategy. That said, the expense ratio should not be the sole criteria for shortlisting funds. The fund should meet your investment objective and risk appetite.

Investors need to look under the hood by checking the scheme’s factsheet/portfolio to understand whether the FoF is investing in its own schemes or in funds managed by other AMCs in order to provide diversification beyond a single AMC.