The Indian market lost some of its steam lately due to a fresh wave of Covid-19 and sell out by Foreign Institutional Investors. After touching an all-time high of 50,000, the BSE Sensex is currently trading at 48,600 levels. The market crashed to a low of 25,638 on March 24, 2020. Investors who invested in this dip have doubled their money in a less than a year as Sensex crossed 50,000 on February 3, 2021.

As a result, funds across categories did well. Even value and contra stocks made a comeback due to a broad-based rally.

Let’s take a look at funds that delivered over 100% return over a one year trailing period as on May 3, 2021.

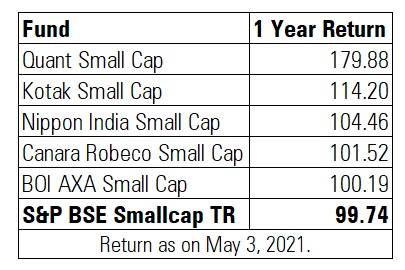

Small Cap

The Nifty Smallcap 100 TR has been the second-best performing index delivering 114.01% return over a one-year period as on May 3, 2021. As a result, most Small Cap funds have delivered stellar returns. Quant Small Cap Fund has topped the chart with 179.88% return, followed by Kotak Small Cap at 114.20%. Nippon Small Cap trailed at the third position by delivering 104.46% during the same period. As you can see in the table below, five funds have outperformed the Nifty Small Cap 100 Index over a one-year period as on May 3, 2021.

Mid Cap

In the mid cap space, 11 funds have outperformed the S&P BSE Mid Cap TR Index over a one-year period, as on May 3, 2021. The mid cap category has delivered 70.16% during the same period. PGIM India Mid Cap topped the chart with 100.28% return during the same period.

How to pick mid cap funds.

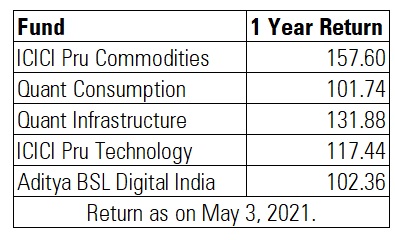

Sector/Thematic Funds

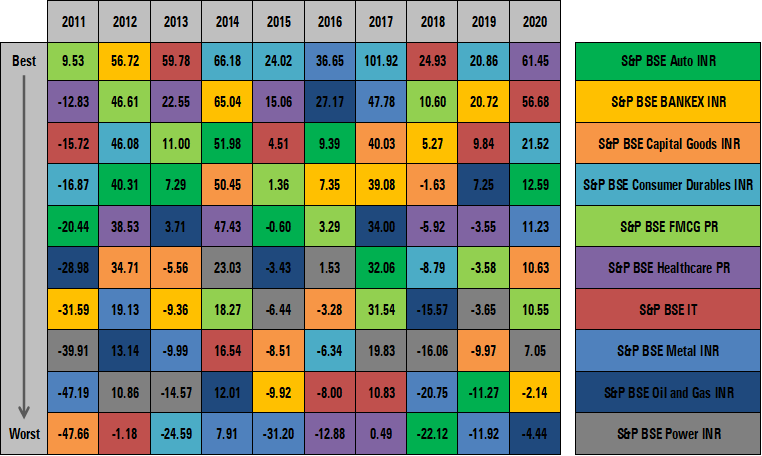

Social distancing and remote working culture nudged many companies and individuals to adopt technology. Technology and Healthcare Funds were the initial beneficiaries amid the turbulence last year. A broad-based rally due to various measures by RBI, global liquidity, and vaccine rollouts raised hopes on economic recovery leading to a broad based rally.

(Data Source: Morningstar Direct.)

Investing in sectoral funds can be fraught with risk. As you can see from the above table, no single sector performs consistently well every year. For instance, S&P BSE IT Index delivered the highest return in 2018. In 2019, the best performing index was S&P BSE Consumer Durables. In 2020, S&P BSE Healthcare Index Price Return Index delivered the highest return at 61.45%. On the other hand, S&P BSE Oil and Gas Index delivered negative -4.44% in 2020. Thus, the fortunes of sector funds entirely depend on the fund mandate.

“Equity markets go through cycles, and sector rotation in terms of performance is often seen. So, it becomes important for investors to have the wherewithal to be able to take views on the sector and market cycle and invest accordingly. Only those who are in a position to evaluate specific sectors should take the exposure,” says Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Advisers India.

7 questions before you invest in a sector fund

Should you invest in tech funds?

Multi Cap

This category delivered an average of 60.27% over a one year period. Quant Active Fund delivered the highest return in the category at 109.56% over a one year period, as on May 3, 2021. After SEBI mandated Multi Cap Funds to invest a minimum of 25% each in large, mid and small cap stocks, respectively, many funds moved to the Flexi Cap category. Flexi Cap Funds have no such investment restrictions, giving fund manager the agility to move across market capitalisation. There are currently 13 Multi Cap funds in the industry.

What should investors do?

While financial advisers say that investors should move to safer categories of funds when their goal is near completion, it is also useful to rejig one’s portfolio when markets see a sharp uprun. This helps investors re-enter markets when valuations become attractive. Portfolio rebalancing also helps to stick to one’s target asset allocation. “Investors should not sacrifice their long term goals for short term profit but must take the decision if the goal is nearing for which the investment was made. Also, portfolio rebalancing is an important aspect of wealth management,” says Pankaj Mathpal of Optima Money.

Reduce mid and small cap allocation

Dhaval Kapadia, Director - Portfolio Specialist, Morningstar Investment Advisers India, is of the view that investors can reduce allocation to mid and small cap space. “Indian mid and small-cap stocks have traded at lofty P/Es. The current valuations indicate a premium to our fair value assumption. Aggressive investors can reduce mid and small cap allocations by 4-5% from their targeted allocations. In our 'Aggressive' managed portfolio, we have reduced midcap allocation from 13% to 10% and small cap from 7% to 6%.”

Do not redeem the entire amount

Amol Joshi of PlanRupee says, “For long term investors or for investors with a few more years to go, I recommend systematic withdrawal instead of booking profit or withdrawing entire corpus. Rebalance the portfolio in line with your asset allocation. Rebalancing will take care of profit booking. It will take you back to your risk-profile based asset allocation as well (assuming due to robust equity returns, equity % component has gone up in portfolio). Lastly, profit booking at least in theory may mean that you sell entire equity. If market continues its upward march, investors will mis out on future gains. Rebalancing ensures that you are not reducing equity allocation to zero and hence you will be in the market to participate in future growth.”

Have an emergency corpus

Some advisers say that due to the ongoing pandemic, some clients have moved to cash entirely to meet medical emergencies while others have booked profits. “The pandemic has made people realise about the benefits of having medical insurance. People who have exhausted their insurance coverage have redeemed from funds for medical exigency as some hospitals are only accepting cash. We advised investors to book profit at 50,000 level. Some clients withdrew and booked profits themselves by switching to liquid funds. Some investors took out the money to invest in real estate,” says Warangal-based distributor Shiva Prasad Konduru.

Diversify

To sum up, one of the common mistakes investors make is to go for funds that have delivered the highest returns in the past. This strategy may not work as winners keep rotating. Thus, one should diversify across market capitalisation, asset classes, geographies, and styles (growth and value) that provide maximum diversification to the portfolio.

(The funds mentioned in this article are not a recommendation from Morningstar and are merely a listing. Please consult your financial adviser to ascertain which funds suit your goals and risk appetite.)