You recently wrote about whether it is a good time to invest in equity. I have a counter question. Is it time to sell some of my equity funds?

Let me start by citing a personal experience shared by Morningstar’s director of personal finance, Christine Benz.

It was late September 2008, and she and her extended family were on a holiday. The market was tumbling, and one of the family members was in a state of panic. Although she was still several years from retirement, she was convinced that she wanted to sell all of her stock holdings. The news about the markets and the state of the global economy seemed to be going from bad to worse by the moment.

Finally Christine’s husband asked her: "Are you getting ready to retire? Will you need your money soon?" No and no, she answered. "Then stop worrying!" That worked. But that is not necessarily good advice for the same family member today.

Now, she is ready to retire and will be drawing upon her portfolio for living expenses. That means that the approach that made sense for her 10 years ago--don't sell any stocks!--may in fact be ill-advised today. If she had not taken steps to reduce her equity exposure in the interim, cutting the stake now in favour of safer investments is the right course of action.

That individual’s experience that Christine Benz narrated has a valuable learning.

There is no one-size-fits-all recommendation. And what might have been right for you one time, may not be the correct course of action today.

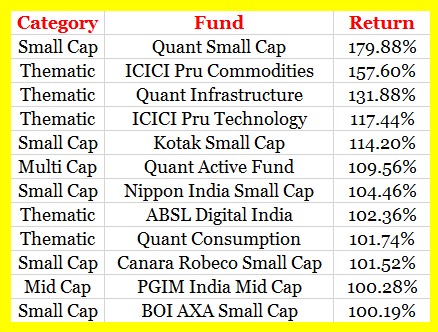

Morningstar India editor Ravi Samalad listed 11 funds that delivered over 100% return in a 1-year period as on May 3, 2021. Looking at those stupendous returns, one does wonder whether it is time to sell.

- Is it a sector fund that you are considering?

Looking at the returns above, certain sector and thematic funds had a good run. If the trend played out as expected and your fund was well positioned to take advantage of it, maybe it is time to exit. When you invest in a sector fund, you must have a harvest strategy in place. What is your criteria to offload? Do you have a return in mind? Then when you attain it, walk away. Don’t be upset about leaving potential gains on the table. You took a call and made money – don’t let greed mess it up.

If you are a long way from retirement, you need to stay the course. Continue investing. Keep at it.

People getting close to retirement or those who are already retired and have an equity heavy portfolio are courting serious risks. So there is no need for them to “stay the course”. They could sell some of their equity holdings.

Were you saving for a particular goal? If yes, have you accumulated the amount you needed? Then you could consider selling.

- Do you need to rebalance?

Even if you are years away from retirement, but if your equity exposure has gone up tremendously, it is time to rebalance. Stick to your pre-determined asset allocation, you will not regret it when the market falls.

Or maybe you need to rebalance within an asset class – equity in this case. Mid and small-cap stocks are trading at lofty valuations. You could consider reducing your mid and small cap allocations.

How you rebalance is something you will need to give thought to. Either you book a lumpsum or opt for a Systematic Withdrawal Plan.

- Has the positioning in your portfolio changed?

Himanshu Srivastava, Associate Director - Manager Research, puts forth numerous questions that one needs to answer. Does the equity fund in question gravitate towards a market cap that is making your equity portfolio tilt in one direction? Has the purpose of investing in it changed? Were you comfortable with a particular fund manager and now that has undergone a change? Has the fund’s mandate changed? Is the fund manager taking much more concentrated bets that you are not comfortable with?

Answering these queries will guide you as to what you need to do with regards to your equity funds.

I faced a similar situation a while back and I wrote about it in Why you should never regret a profit. Do read it to understand the various dilemmas about selling.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.