Morningstar India offers a host of tools to analyse the performance and underlying holdings of funds. In this post, we explore the Return Calculator Tool through which you can quickly see the performance of funds.

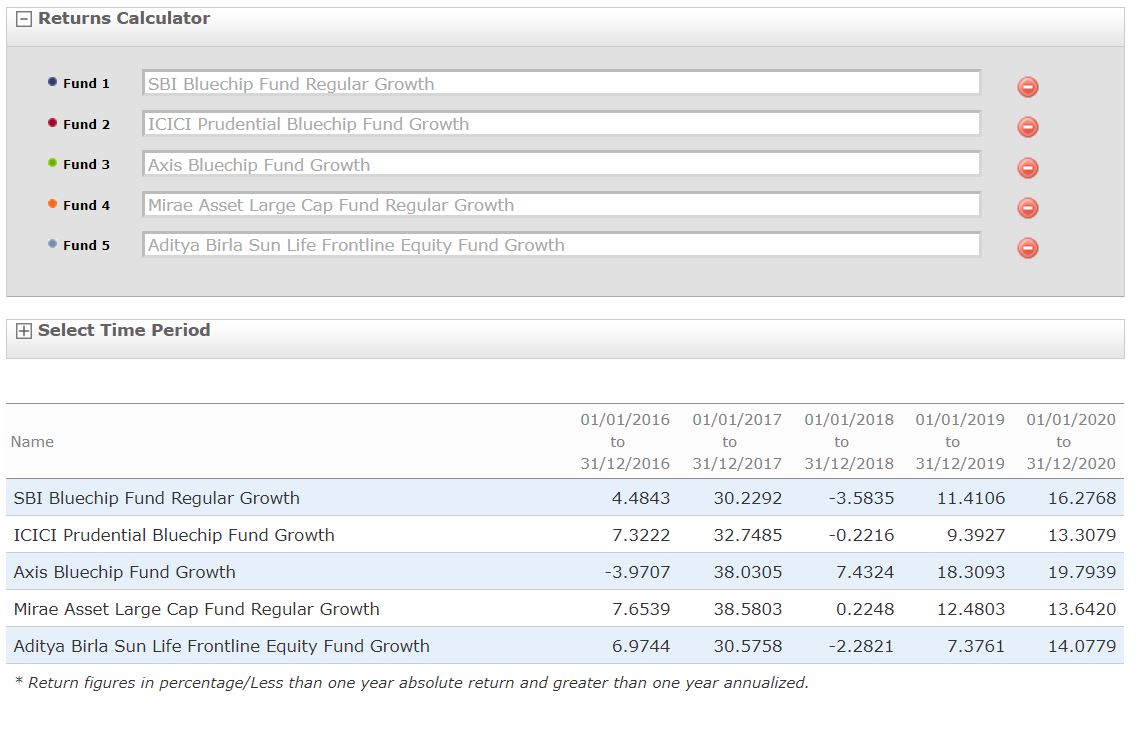

Type in the fund name in the Fund Tab. The search tab will list down the funds. Select the scheme of your choice by hitting enter tab on your keyboard or through the cursor. You can add up to five schemes. In the Select Time Period option, select the start and end time period of your choice. In this example, we have filtered the five largest funds in the Large Cap category calendar year wise since 2016. You can choose a start and end date of your choice. It can be monthly, weekly, one day, one week, one year or since the fund’s inception.

(Click on the image to enlarge.)

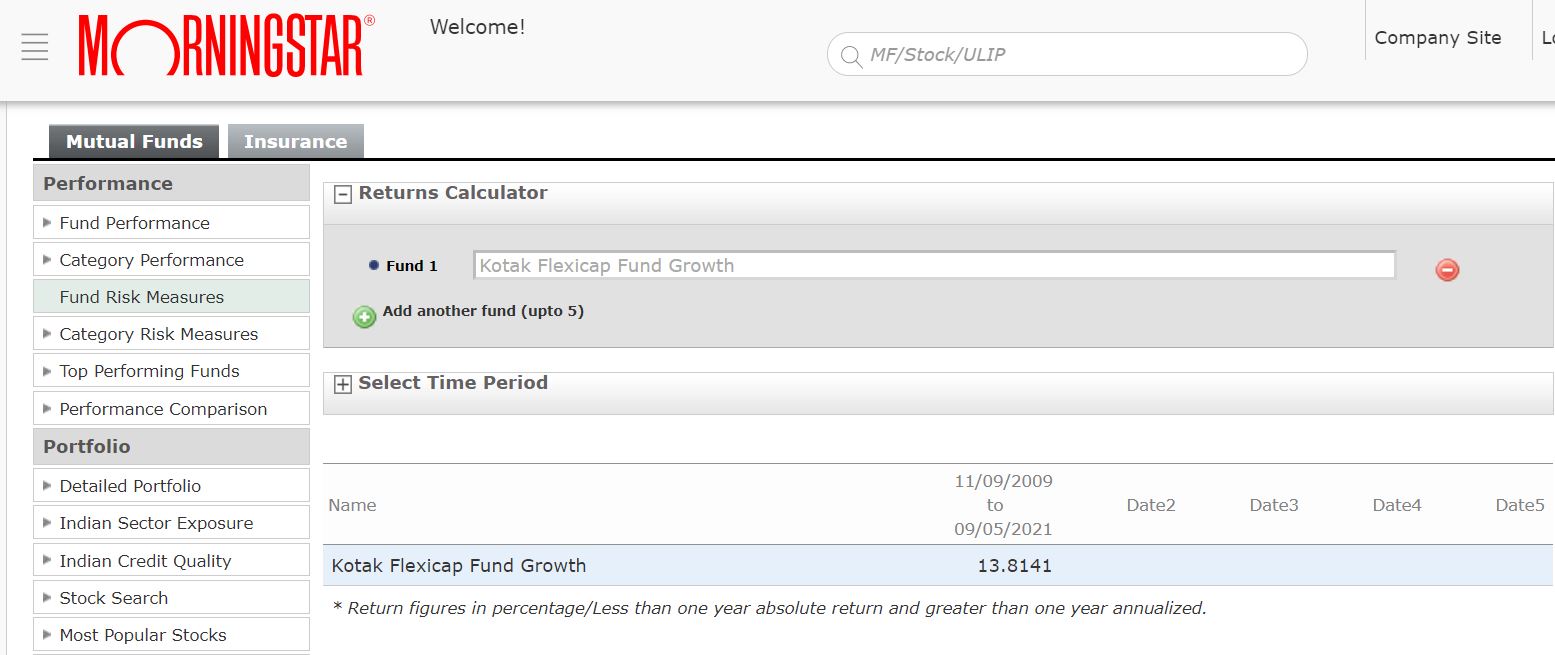

You can also check the trailing return of funds by selecting a start date and the latest closing market date. Do note that the tool which shows blank result if you select the start date which is prior to the inception date of the fund. Thus, you need to check the fund’s inception date first while filtering the results.

Here is the since inception return of Kotak Flexi Cap Fund. The fund was launched on September 11, 2009. The result shows that the fund has delivered 13.81% compounded annual growth rate (CAGR) since inception as on May 7, 2021. In this example, we have chosen only one fund. You can choose up to five funds.

One limitation of the Return Calculator tool is that you can’t view the performance in relation to the benchmark. There are other tools available on our website which show fund performance in relation to the benchmark and category which we shall explore in the next post.

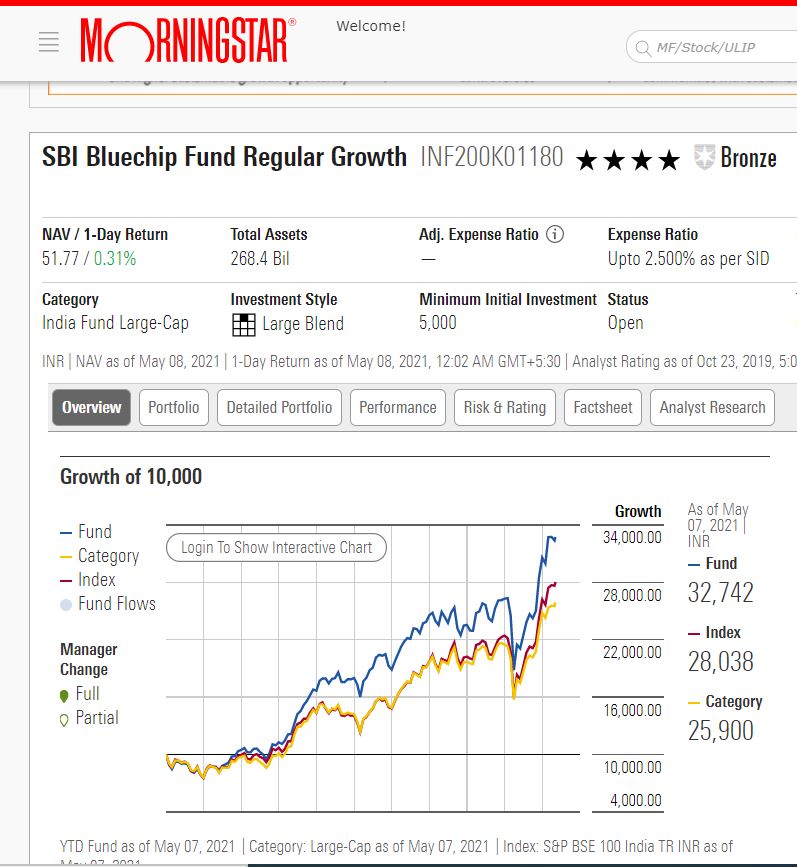

If you wish to look at the performance of a single fund, you can alternatively search on the homepage of Morningstar.in search tab as shown below.

This option will give you a lot more information about the fund. For instance, you get to know the calendar year returns against the benchmark, trailing returns against benchmark and category average, fund’s style (growth, value, blend), risk & volatility measures, star rating, analyst rating, fund manager details, detailed portfolio and the analyst view on the fund.

The factsheet tab shown above gives details about the investment objective of the fund, top stock/bond holdings of funds, sector weightage, geographic exposure of the fund, and more.

(The schemes mentioned in the article are for illustration purpose only.)