Fund houses are launching a slew of new fund offers especially after the spectacular returns delivered by most equity funds over a one-year trailing period. The market had recovered 100% from the March 2020 lows and a broad-based rally has helped.

As a result, funds across categories have delivered handsomely over a one-year trailing period. Small Cap, Mid Cap and Technology sector funds are leading the charts. Small Cap funds have delivered 109.28% category average over a one-year period. Technology Sector funds have delivered 104.50%, followed by Infrastructure Funds (81.01%) and Mid Cap Funds (80.44%). FMCG Funds have delivered the lowest category return at 33.25% over a one year trailing period as on May 11, 2021.

In FY 2020-21, the industry has launched 110 funds which have collectively raised Rs 48,988 crore.

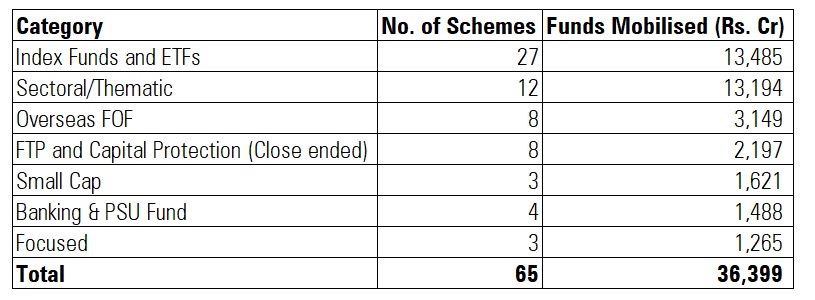

The below table illustrates categories that have raised a lion’s share of money from NFOs last fiscal.

In the recent past, three categories of funds are gaining traction. They are passives, sectoral/thematic and international fund of funds.

7 questions before you invest in a sector fund.

In the passive category, a major chunk of inflows (Rs 11,024 crore) came in to two tranches of ETFs launched by Edelweiss Mutual Fund which were BHARAT Bond ETF - April 2025 and BHARAT Bond ETF - April 2031.

We are also seeing the launch of smart beta funds which are a blend of active and passive investing in the ETFs/index funds space.

Read more about passive investing here.

In the sectoral/thematic category, the industry launched 12 new funds. Sectoral funds accounted for 27% of the total Rs 48,988 crore NFO collections in the industry last fiscal.

Environmental, Social and Governance (ESG) funds are also categorised under the thematic category.

ICICI Prudential ESG Fund, quant ESG Equity Fund, Aditya Birla Sun Life ESG Fund, Kotak ESG Opportunities Fund and Invesco India ESG Equity Fund were launched in the recent past. HSBC Global Equity Climate Change Fund of Fund which focuses on climate change as a theme was launched under the international fund of fund category.

Read more about ESG investing here.

New strategies

Advisers say that some fresh investment strategies are emerging in the passive investing space which investors should not ignore. “New funds do not have a track record. For established scheme categories, we recommend existing well-managed funds, with a track record across market cycles. Something unique that we are currently watching is UTI Nifty 200 Momentum 30 Index Fund. Since this is the first such Index Fund, investors looking for exposure in momentum-based offerings may allocate a small portfolio. Other than being unique offering, passively managed nature, and set rules on which stocks will be selected, weight, auto-rebalancing, are few characteristics that we like about the fund,” says Amol Joshi of PlanRupee.

Rajesh Hattangady of THiiNK says, “The success stories of NFOs turning out to be top performers is far too negligible compared to the number of NFOs. Hence, we are extremely choosy in picking up NFOs. That said, one cannot completely ignore NFOs. There could be some good investment ideas that could emerge.”

Due Diligence

Vinod Jain of Jain Privy Client says that investors need to evaluate factors like the history of the fund house, fund management team track record and the mandate of the fund before investing in a new offering. “Investors can consider new funds if the strategy helps in diversifying portfolio as well as offers a favourable risk-reward ratio. While selecting an NFO, it is extremely important to do proper due diligence. We have not recommended any NFO last year. Our last NFO recommendation was IDFC Emerging Business Fund.”

Here’s a guide on how to select the right funds.

Myths

Investors sometimes draw similarities between the initial public offering (IPO) price of a stock and NFO price which is Rs 10. The low net asset value makes investors assume that it is available at a cheap price. But this is far from truth. The returns delivered by both existing funds and an NFO depend on the underlying returns of the securities during a similar time frame. For instance, if an NFO’s NAV goes up from Rs 10 to Rs 11 in one week and an existing fund’s NAV goes up from Rs 240 to Rs 264 during the same time. Both funds in this example have offered 10% upside.

Cost

Actively managed equity fund NFOs charge a higher Total Expense Ratio (TER) until they reach a certain AUM size. The highest base TER that can be charged is 2.25% for equity funds and 2% in case of debt funds. The TER goes down as the fund size breaches Rs 500 crore mark. But do note that TER is not the sole determinant of returns. The fund’s mandate, market opportunities and fund manager’s skills have an equal role to play in the fund’s success.

On the other hand, one advantage older funds (assuming they have a sizeable AUM) have over NFOs is that they charge lower TER. Lower TER results in better returns for investors. That said, TER is not the only criteria to select funds and it should look at in conjunction with the uniqueness of the fund and whether it fits into your risk profile.

Should you invest in NFO?

Fund houses launch new fund funds for different reasons. Some launch NFOs to fill gaps in their existing suite of products. Some AMCs prefer to launch new schemes only if they can bring differentiation in the market or after they build a certain track record in existing funds.

“We do not recommend our investors to invest in NFOs as these funds do not have a track record and most of the funds that are launched already have existing funds with history in the same category. From an investment perspective, it makes sense to invest in NFO if it is offering a unique product that is not available in the industry and has the potential to deliver the returns as per investor’s risk profile. One such fund is Mirae Asset NYSE FANG+ ETF. This focused international fund is for investors with high-risk appetite as it invests only in 10 big technology leaders listed outside of India. These companies are constantly transforming the world through innovations and investing at this stage can generate good returns for investors. We suggest limiting the allocation in the fund to around 5 to 10% of the overall portfolio as the fund’s portfolio is highly concentrated," says Harshad Chetanwala of MyWealthGrowth.

Investing in NFO is not bad as long as it adds fills a void in your portfolio. One important thing to remember is that fund houses are known to launch new funds that are ‘flavour of the season’ (Technology, Healthcare, Infrastructure and other thematic funds) and especially when markets are at a peak. This is when most investors are bullish about markets/economy and fund houses are able to capitalise on the prevailing sentiment. Investors would do well to invest in existing funds having a good track record unless there is a compelling reason for adding a new fund that is able to provide you diversification beyond an asset class, strategy or geography.