The BSE Small Cap has been the best performing index Year to Date at 26.69%, outperforming broader indices as well as Mid and Large Caps. Over a one year period, the index is up 121.43%. As a result, most small cap funds have done well. The Small Cap Funds category has delivered 119.42% during a one year trailing period as on May 19, 2021. The best performer quant Small Cap has delivered a whopping 220.50% while the bottom performer Axis Small Cap has delivered 97.39% over a one year period.

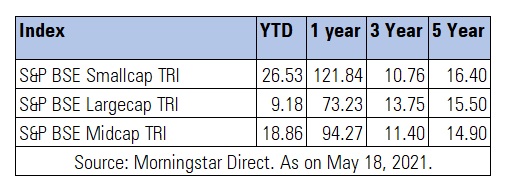

Trailing Return

While the Small Cap Index has beaten Large Cap and Mid Cap on YTD and 1 year period, the returns of these three indices are almost similar on a five year basis. However, in comparison to Large Caps, Small Caps tend to witness significant drawdowns. Hence, investors need to have a longer time horizon while investing in small caps.

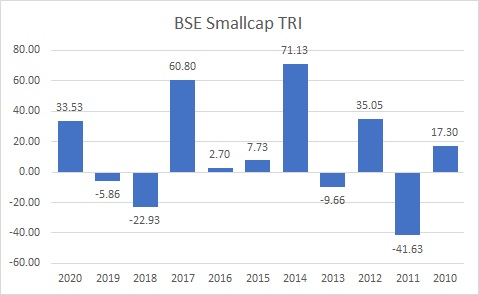

Calendar Year Return

The BSE Small Cap index posted 33.53% return in calendar year 2020 after yielding negative returns for two consecutive years in 2018 and 2019. Over the past ten years, 2014 was the peak for Small Caps when the index delivered 71.13%. In 2014, National Democratic Alliance (NDA) came to power with a sweeping victory.

We asked fund managers what lies ahead for the Small Cap segment, where they are finding opportunities at this juncture and their advice for investors.

Moderate Return Expectations

“While Small Caps have outperformed Mid Caps and Large Caps meaningfully over the past one year, they have trailed Large Caps in the past three years and are just about comparable over a 5-year period. We believe Small Caps are generally viewed and considered on a bottom-up basis and on their individual merit. Broadly, an improving domestic economic cycle bodes well for Small and Mid Caps and are thus preferred by us from that perspective as we expect India’s growth cycle to improve over the next 2-3 years.

Small Cap valuations have risen over the last 12-15 months and are at modest premiums to Large Caps today. In our view, returns from Small Cap Funds hereon are likely to be driven by the quality of earnings growth of the underlying portfolio and much less through valuation expansion. While Small Caps can still deliver better returns than Large Caps in general, investors are advised to moderate return expectations post the massive surge in this segment over the past 1 year.” - Taher Badshah, Chief Investment Officer - Equities, Invesco Mutual Fund.

Remain invested in Small Caps

“The Small Cap category peaked in December 2017 and was in a correction mode for two years. It finally bottomed in March 2020 due to the pandemic. In the last year, after there were signs of a cyclical recovery in the domestic and global economy, this category has performed well. However, the Small Cap indices are yet to cross their previous 2017 highs. Since it is a very diversified category with companies from a variety of sectors, there are still pockets of value available to invest in.

Small Cap category has a very diverse set of companies. It is not dominated by a single or a couple of sectors. Through our research, we are able to find many companies that have strong financials, scalability of growth and reasonable valuations. There are pockets within Small Caps where either the growth is underappreciated or valuation deserving an upward rerating. If one has a long-term view, there are enough opportunities to choose from.

For investors, it is important to be invested in the category since economic recovery is robust and the growth outlook remains strong. For investors who are considering fresh investments here, can stagger their investment through Systematic Investment Plans (SIPs). It is difficult to time a correction but the SIP way of investing will take advantage of a correction whenever it comes and use the volatility to create long term wealth.” - Nimesh Chandan, Head of Investments (Equities), Canara Robeco Mutual Fund.

Liquidity is a challenge

Small caps are not a homogenous category and as a thumb rule a majority of small caps are not even worth looking at. We prefer to think about the category in terms of specific bottom-up picks. In that context, we have always had ideas to buy, the challenge has, almost every time, been adequate liquidity.

Within the market, our house view is that the Small and Mid Cap indices will do better than the Large Cap Nifty or Sensex. Breadth in the market has increased in the current rally and we believe it will continue. Booking profits from markets, generally speaking, makes intuitive sense given that equity allocations would have gone up while uncertainties remain. – R Srinivasan, Head of Equities, SBI Mutual Fund.

Short term volatility will be high

“It is advisable to enter the category with a long term view as we expect the short term volatility to remain high on likely demand slowdown due to rising inflation and uncertainties because of the second COVID wave. Markets could disappoint investors expecting quick gains like last year. The better way would be to look at this category with long term view. I have always believed in the ability to select small and mid-cap companies to create wealth over the long term. Also, this wealth creation exercise is never linear and the return generation process remains bumpy with long period of underperformance as well, which investor needs to be cognizant about. In our DSP Small Cap Fund, we select well-run companies with potential for growth and high Return on Capital Employed (ROCE), which gives us confidence about its ability to create wealth over long term. Further, as the economy expands it would create opportunities for more segments within small cap space. Hence it is a good time for investors with a long-term view to enter the category.

We believe there are opportunities across few sectors like auto-ancillary as the auto sector is likely to emerge from the down cycle of last two years, there are opportunities in textile sector, both home textile and garment manufacturers as the demand improves upon opening up of economies, we see opportunities across few small banks and Non-Banking Financial Companies (NBFCs) that have not recovered to the extent some of the large private sector banks have done. Besides, our positive stance on agriculture and healthcare continues as we consider these segments to have long run-way for growth available given the under penetration in these categories. We are positive about building materials as a category but the stocks are not cheap and we would like to look at them as weakness.” - Vinit Sambre, Head – Equities, DSP Mutual Fund.

Wait for a correction to buy

"While we are bullish on markets for the long run we feel markets are complacent at this stage the way they are pricing risk. After such a huge rise risk-reward is not favourable for fresh buying. It is prudent to wait for some correction before buying.

Looking at valuations at this juncture is a bit tricky. FY21 was impacted by lockdown in first quarter which was sort of extraordinary in nature. In FY22, we are seeing lockdowns in many places. Even companies are not sure how the situation is going to pan out. Also, due to high liquidity in systems and lower interest rates, comparing current valuations with past valuations may not necessarily provide right clues.

Capital Goods is one segment where we see opportunities. Finally, after many years we are seeing some signs of pick up in capex. Also, export opportunities are emerging thanks to China plus one strategy. The sugar sector though has gone up fast in the last couple of weeks, provides a good opportunity for long term investors on a correction. Companies dealing in telecom projects or equipment would be big beneficiaries of the banning of Chinese companies as well as of the Production Linked Incentive (PLI) scheme. Technology and Digital spending is again a big multiyear trend and would benefit companies in this space." - Samir Rachh, Fund Manager, Nippon India Mutual Fund.