Unit linked insurance plans (ULIPs) and mutual funds are often compared by investors because of their similarities. However, there is no straight comparison of these two products as the features and objectives of these products differ widely.

ULIP is a mix of investment cum insurance product. On the contrary, mutual funds are pure investment products. Some mutual fund schemes do offer life insurance, but they are a rarity. Here are some features of ULIPs and mutual funds which should help you make an informed choice.

Lock-In (Mutual Funds)

The biggest advantage of mutual funds is liquidity.

Equity Linked Savings Scheme (ELSS) which offer tax benefit on investments up to Rs 1.5 lakh per annum have a lock-in period of three years. Each installment of a systematic investment plan is locked in for three years. This is the lowest lock-in among all tax saving options.

Other funds, which do not offer tax benefit, do not have any lock-in. However, an exit load is levied which depends on the fund category. For equity funds, it is usually 1% if you redeem before one year.

Lock-in (ULIPs)

ULIPs have a lock-in period of five years.

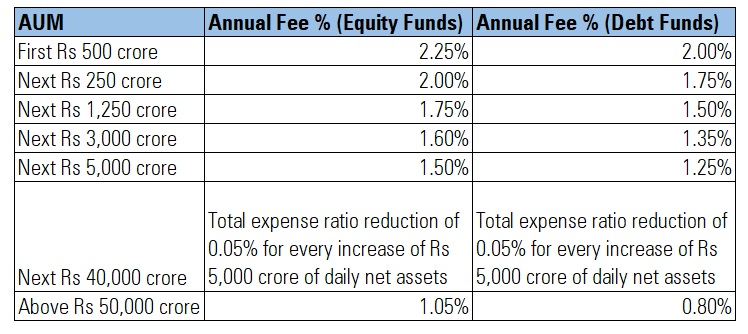

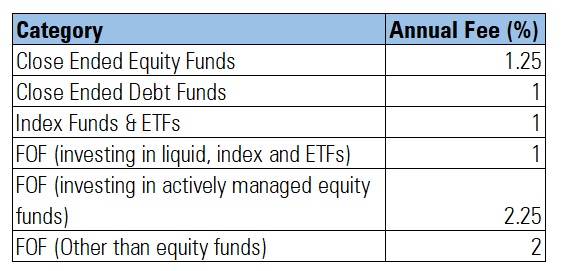

Cost (Mutual Funds)

Mutual funds charge a graded Total Expense Ratio (TER) which differs across scheme categories. The expenses come down as the scheme’s assets under management (AUM) go up.

Funds also charge an additional 0.30% for inflows of up to Rs 2 lakh per transaction from retail investors from beyond the top 30 cities.

Further, from July 1, 2020, mutual funds deduct a stamp duty of 0.005% on the amount invested through both lumpsum and SIP. If you invest Rs 1 lakh in a scheme, Rs 5 will be deducted and Rs 99,995 will be invested.

Mutual funds offer regular and direct share class. The TER of direct share class is cheaper to the extent of commissions paid to distributors in the regular plan.

Cost (ULIPs)

In the past, ULIPs earned a bad reputation for being mis-sold and for their exorbitant charges and commissions. In September 2010, Insurance Regulatory and Development Authority of India (IRDAI) capped the annual ULIP charges at 2.25% for the first ten years. The fund management charge is also capped at 1.35%. There are caps on premium allocation charges, mortality charges and on the commission paid to insurance agents as well.

ULIPs charge a slew of fees. They include Premium Allocation Charge (up to 12.5% of annual premium), Mortality Charges (depends on your age and sum assured), Fund Management Fees (up to 1.35%), Guarantee Charge (0.50%), Policy Administration Charges (up to 5% per annum or Rs 500 per month), Surrender Charges (depends on the year of surrender and premium amount. Nil after 5 years), Fund Switching Charge (Rs 500 per switch), Rider Charge, Alteration Charge (for modifying policy term, sum assured, premium redirection at Rs 500 per transaction), Partial Withdrawal Charge (Rs 500 per transaction) and Service Tax.

Besides these charges, insurance firms can also levy top up (for investing surplus money in existing fund) charge and policy discontinue charge if you stop paying premiums before the five-year lock in period. Some fourth-generation ULIPs do not charge premium allocation charges and fund administration charges.

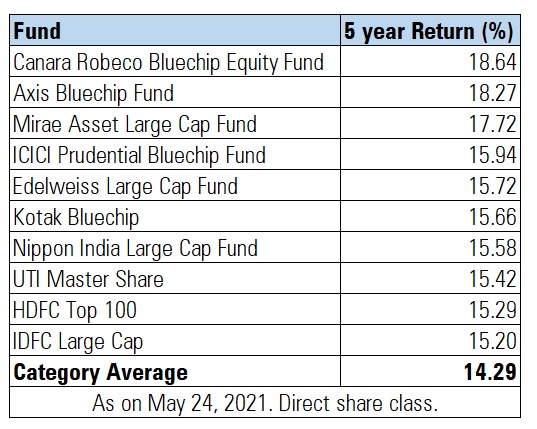

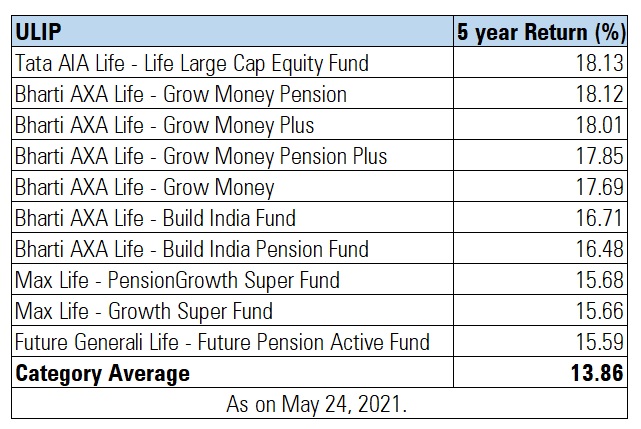

Performance

If we compare the performance of ULIPs and Mutual Funds in the large cap space over a five-year period, the returns are almost similar. The top performer Canara Robeco Bluechip Equity has delivered 18.64% while the ULIP peer Tata AIA Life - Life Large Cap Equity Fund has delivered 18.13%. There is only 0.43 percentage point difference in the category average performance of these two categories over a five-year period.

Top 10 Best Performing Mutual Fund Large Cap Funds

Top 10 Best Performing Large Cap ULIPs

From the above table, it is evident that returns from ULIPs and MFs in the large category are almost similar, with ULIPs lagging by a small margin.

Over a ten-year period, the category average returns of Large Cap Mutual Funds is 12.23% while ULIPs delivered 11.52%, a difference of 0.71 percentage point.

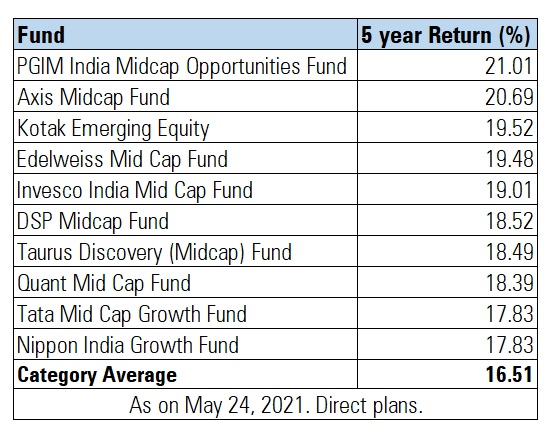

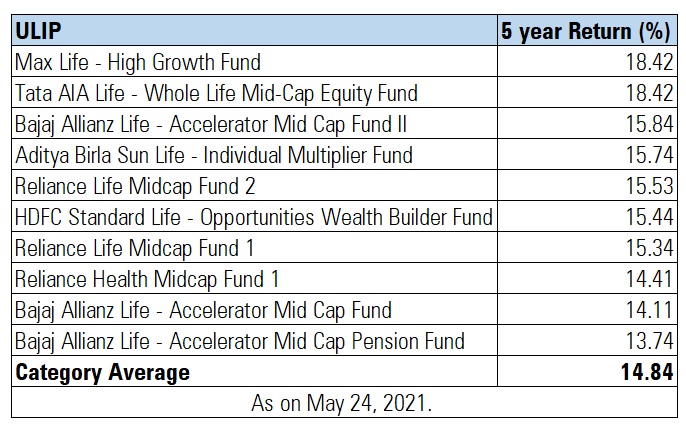

Performance of Mid Cap Mutual Funds

Mid Cap Funds from mutual funds have performed slightly better than ULIP peers over a five year period. However, the gap in performance is not huge. Over a five year period, the category average return of ULIP Mid Caps is 14.84% while the Mutual Fund mid cap category has delivered 16.51%, a difference of 1.67 percentage point.

Performance of Mid Cap ULIPs

Over a ten-year period as on May 24, 2021, Mid Cap Funds category delivered 16.30% while the ULIP category delivered 13.92%.

You can compare the performance of ULIPs and mutual funds here:

Top Performing ULIPs

Top Performing Mutual Funds

Deepak Jaggi, Co-Founder and Managing Director, SATCO Wealth, says that the cost of running a ULIP has come down over the years and a long term tenure of ULIPs has helped deliver good returns. “The minimum time frame of a ULIP policy is ten years and the longest is 30 years. ULIP fund managers don’t face redemption pressures during adverse market movements or when market rallies. The inflows are consistent. As a result, fund managers are able to buy at lower levels. Mutual fund managers are judged on quarterly performance and there is always fear of redemptions. The inflows in mutual funds dry up if performance slips for a few quarters. In ULIPs, the money is not coming only for investments. It is also coming for insurance.”

Flexibility/Convenience

In mutual funds, you can stop or pause your SIP at any time. You can restart the SIP at a later date, increase or decrease the installment amount any time you wish without any charges.

In contrast, one has to pay ULIP premiums for five years. If you discontinue paying premiums before five years, insurers charge you a penalty and after a grace period of 15-30 days, your policy lapses. Once your policy lapses, the insurance cover ceases. You can revive your policy in three years from the first unpaid premium date. The premiums paid less any charges are shifted to a discontinuance fund where insurers offer a minimum guaranteed return of 4%. Insurers charge a fund management fee of 0.50% on this corpus.

Partial withdrawals are allowed only after the lock in period of five years.

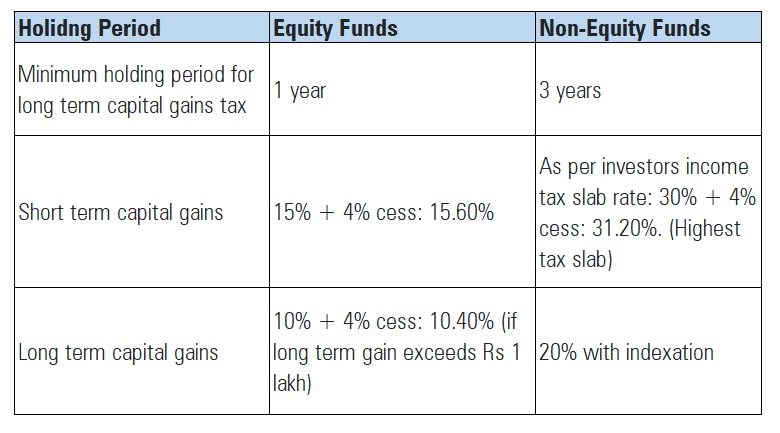

Taxation (Mutual Funds)

Long term capital gains of up to Rs 1 lakh are tax free under equity mutual funds. Any gains in excess of Rs 1 lakh are taxed at 10%. For instance, if you invest Rs 1 lakh and redeem Rs 2.10 lakh after 12 months, you will have to pay tax on Rs 10,000 which will be Rs 1,000.

Mutual funds also levy dividend distribution tax (DDT) of 11.648% in equity funds and 29.120% in non-equity funds, inclusive of surcharge and cess. If you opt for dividend plans, dividend in excess of Rs 5,000 attracts tax deduction at the source at 10%. To avoid this tax, investors opt for growth plans of mutual funds where the dividend income is reinvested in the fund.

Switching from one fund to another is considered redemption and hence attracts exit load and taxes depending on the time horizon of investment.

Taxation (ULIPs)

For ULIPs purchased on or after February 1, 2021, the maturity proceeds of policies with an annual premium of more than Rs 2.5 lakh are taxed on par with equity-linked mutual fund schemes.

Capital Gains

If your gains in equity oriented ULIP exceed Rs 1 lakh, the excess amount above Rs 1 lakh is taxed at 10% while a short term capital gains tax of 15% is levied.

High net worth individuals were investing in ULIPs to take advantage of tax-free withdrawal/redemption. Hence, ULIPs (where annual premium exceeds Rs 2.5 lakh) are no longer attractive from a tax point of view. “If the total premium payable during any financial year is less than Rs 2.50 lakh (including all the multiple policies), then you still enjoy the tax-free maturity benefits under Sec.10(10D),” says Basavaraj Tonagatti of Basu Nivesh.

The corpus received on death continues to remain exempt without any limit on the annual premium.

Tax Saving

Similar to ELSS, investments made up to Rs 1.50 lakh in ULIPs are eligible for tax deduction under section 80 C of the Income Tax Act. This deduction is restricted to 10% of the sum assured.

Securities Transaction Tax

The insurance company deducts Securities Transaction Tax (STT) of 0.001% on the amount of maturity proceeds for equity ULIPs on policies issued on or after February 1, 2021.

Switch

Tax-free rebalancing (switching from one fund to another) in high premium ULIPs (annual premium exceeds Rs 2.5 lakh) is no longer available. There is no tax liability for switches in ULIPs where the annual premium is less than Rs 2.5 lakh.

What one needs to keep in mind

Viral Bhatt of Money Mantra says that investors look at factors like the portfolio of the product, expenses, past performance, liquidity and the goal for which one is investing. “Choosing a product depends on your goals. Do you want insurance or looking for wealth creation?” says Viral.

“It is not a good idea to compare ULIP and mutual fund. Even though the underlying is the same asset class (equity or debt), ULIP units are withdrawn regularly for various charges like mortality, policy admin and so on,” says Mumbai-based Insurance Adviser Deepak Khemani.

Jaggi says that if one compares the mortality cost in ULIPs, charged on sum-at-risk, with premium of an equivalent reducing-term plan, cost may be lower in ULIPs. “The reason is, in ULIPs the insurance company takes its cost from fund management charges whereas in term plan it is added to cost in premiums paid, over and above mortality cost.”

While ULIPs may have become competitive in terms of performance and costs with mutual funds, investors need to take into account that ULIPs have a lock-in period of five years while there is no lock-in period in mutual funds (except three years in case of ELSS).

(Financial advisers can access data on ULIP and mutual funds through some of our offerings here).