The pharmaceutical/healthcare sector has been in the limelight due to the pandemic. As a result, pharma funds have been a major beneficiary.

As of June 11, 2021, pharma funds have delivered 56.08%.

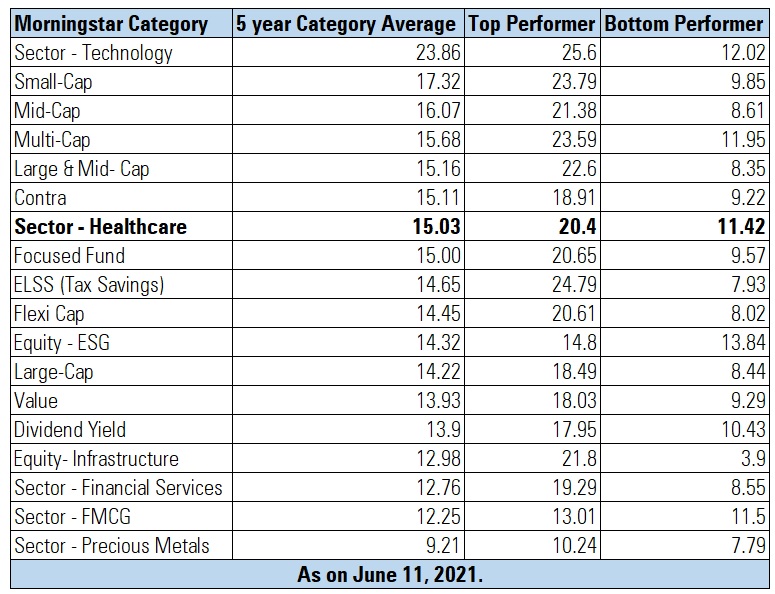

Over a five-year period, pharma funds category has outperformed other fund categories like Large Cap, FMCG, Financial Services, Infrastructure, Value, Dividend Yield, Focused, and Flexi Cap.

We asked four fund managers about how they see the sector performing once Covid is behind us, how they see the current valuations and whether investors who have made profits should exit/book profits or remain invested.

Tanmaya Desai, Fund Manager at SBI Mutual Fund

- Regulatory landscape will gain prominence once the pandemic eases

Clearly, the healthcare sector is in limelight today due to the pandemic and is expected to remain so at least in the near term. As the situation normalises, the focus would be back on base business growth wherein we believe, the prospects of growth are good for the sector across business segments. At the same time, interestingly, over the last few years, with prudent capital allocation, greater focus on cost efficiencies and a lighter balance sheet, healthcare companies have emerged stronger entities and this should result in a more predictable and sustainable growth profile for the sector in the medium-to-long term along with an improved return profile. As the pandemic subsides and travel restrictions ease, the regulatory landscape will gain prominence as companies have not had regulatory inspections during the pandemic which can pose some challenges to the healthcare story in general.

The near-term performance for the sector is expected to receive a fillip led by Covid led opportunities as well as the low base of last year which should support the growth in India's formulation business. At the same time, the healthcare sector has secular growth prospects with opportunities across geographies (namely India, the U.S., and a host of other regulated and emerging countries) along with good growth prospects in the active pharmaceutical ingredient (API), contract manufacturing and healthcare services business. Over the medium term, we expect a double-digit earnings Compound Annual Growth Rate (CAGR) for the healthcare sector which makes us believe, one should remain invested in the space.

On an absolute basis, the valuations for pharmaceuticals and healthcare sector do seem rich and by and large, they are at one standard deviation above the average valuation the sector has commanded over the last 10 years. However, the sector, in general, has traded at a 30% premium to the valuations of the broader indices and current valuations too are at similar levels. Taking into cognisance the decent earnings growth expectations from the sector, we feel comfortable with the current valuations and expect the premium to at least sustain.

Vrijesh Kasera, Fund Manager at Mirae Asset Mutual Fund

- Healthcare will continue to outperform over the mid to long term

Given the increased awareness of people towards health, we expect spending for healthcare as a % of GDP to increase with all segments (pharma, hospitals, diagnostics) benefitting from the same. We believe things are unlikely to go back to the previous normal and Covid is likely to stay in some form or the other providing opportunities for drug manufacturers, distributors, hospital players and diagnostics chains to play a part in this endemic. Further, pharma companies have also had their share of disruptions in various markets with lower incidence of diseases, postponement of treatment, delay in approvals of key products, etc. which are expected to revive going forward.

Above all the investment that companies have been undertaking in the U.S. specialty and complex generic space is expected to get monetized over the next 2-3 years which would further aid growth. Our approach remains bottoms up and we would pick companies with strong competitive advantages that provide them a long runway for growth. We believe the sector will continue to outperform over the mid to long term as earnings growth visibility across large caps and mid-caps remains strong despite the run -up that the sector has seen over the last 12 to 14 months.

We advise investors to remain invested as multiple narratives such as:

1) China+1 in API

2) Monetization of complex pipeline for generics

3) Market share gains and shift to organized for diagnostics and hospitals; have just started to play out and we believe these themes will continue to provide strong tailwinds to quality companies within this sector over the next 3-4 years."

Meeta Shetty, Fund Manager at Tata Mutual Fund

- India will see higher healthcare penetration

The pandemic does give some additional tailwind to the sector as being in the essential service, it was relatively less impacted due to the lockdowns. The Covid treatment and the vaccination would also lead to some near-term lever for growth. But if one steps back and looks at the sector beyond Covid, the sector is witnessing a steady improvement on the balance sheet as well as the cash flows. This is driven by continuing growth in the overall domestic market and trend reversal in the declining U.S. sales as well as cost control measures and efficient capital allocation.

Over the medium term, we expect this trend to continue. The growth will remain steady for both domestic and the U.S. market. The domestic market is likely to see higher healthcare penetration with better healthcare facilities as well as awareness aiding a steady high single-digit to low double-digit growth. On the U.S. front too, we see improving visibility of complex launches in the U.S. for a certain set of companies. This should lead to better financials, cash flows and higher return ratios for the sector.

Apart from the core pharma and the healthcare service providers, there are also tailwinds in the AP segment driven by the China plus one as well as the focus of the Indian government on local manufacturing. This can provide a multi-year growth opportunity for the segment.

- Valuations are lower than the earlier peak of 2015

The sector is trading higher than its long-term average and slightly lower than its earlier peak of 2015. The PAT distribution currently is skewed towards the domestic branded market versus generics and hence we do not see any significant risk to these valuations.

On relative valuations of Nifty vs Nifty pharma, the sector is trading closer to its long-term average adding comfort to the current valuations.

Chirag Dagli, Fund Manager at DSP Mutual Fund

- Regular business has been impacted due to Covid

The healthcare sector has many sub-segments like India formulations, export formulations, APIs, hospitals, pathology, etc., each of which has different drivers. We expect the sector as a whole to do well driven by export formulations particularly to the U.S. and recovery in Indian business. The pandemic may have led to certain opportunities for companies in form of therapeutic drugs which may not be sustainable at those elevated levels. Businesses like pathology companies and hospitals have seen some business from Covid but have seen regular business getting impacted through the pandemic due to lower footfalls and partially operating doctor practices. The acute care business which is approximately half of the Indian formulations market has also suffered through the pandemic due to lower patient visits. Some of these businesses will bounce back.

- The sector looks reasonably valued based on free cash flow yield

Looking at Price to Earnings Per Share (P/E) it seems that the sector is closer to its highs as compared to the past. Free cash flow generation for every rupee of profit is much higher today versus in the past. Thus, if we look at free cash flow yields then the sector as a whole is reasonably valued. Moreover, one also needs to adjust for the value of the pipeline for certain opportunities which are not going to be reflected in earnings immediately.