There is a lot of skepticism when it comes to ESG, and a lot of muddled thinking too.

While there are issues that need to be ironed out, the prime cause is because it is conflated with the sin stock strategy. The antiquated screener whereby the universe of listed companies is filtered through a moral lens to do away with the “bad” companies.

But your sin is not my sin. And I find your favourite vice to be loathsome.

And therein lies a tale. No one can take the moral high ground when it comes to establishing what a sin stock is.

Alcohol, gambling, tobacco and pornography are the low hanging fruits. Peace activists may throw in weapons manufacturing while environmentalists might consider oil and coal. Animal rights activists will similarly categorise companies that deal in animal products such as leather and fur. ASOS, for example, has banned mohair, cashmere and silk. A vegan may consider companies in dairy production to be taboo. Some would lump the cannabis industry with sin stocks.

Who decides what is a sin? And do you have any right imposing your moral standards on others? Why is drinking wine unethical? Why are the terribly unhealthy aerated drinks not a sin stock? If tobacco is legal and the statutory warnings are there for all to see, aren’t the adults who choose to smoke only exercising their free will? If cannabis is legal and the corporations are paying their taxes, why should there be an ethical debate?

These questions have given rise to the discontent with sin stocks. But investing strategy evolves. And what started off as negative screening has paved the way to a holistic and forward-looking investment strategy.

Now corporations face unprecedented risk related to the climate crisis and its environmental impact, their use of water and other natural resources, how they treat workers throughout their supply chain, and the safety and usefulness of their products. Increasingly, many investors are eager to assess and measure companies’ progress in addressing those risks.

Consequently, the concept of sin stocks has given way to viewing businesses that have a positive impact on three parameters – Environment, Social, Governance.

ESG attempts to capture the complexity of social and environmental systems, and business organizations. It is not narrow, where the fixation is on identifying the final output and classifying it as a sin stock. It goes beyond its 3-letter acronym to address how a company serves all stakeholders: employees, communities, customers, suppliers, shareholders, and the environment.

Say No to sin, say Yes to ESG.

To make it clearer, let’s look at how Sustainalytics, a global leader in ESG and Corporate Governance research and ratings, assigns ESG Risk Ratings. Analysts choose best-in-class companies which score high on specific criteria. On a spectrum of 0 to 40+, there are five levels of risk: Negligible, Low, Medium, High, Severe. Each company is given a rating to reflect its standing within its specific industry.

ITC: Medium Risk (27.4)

ITC fits in smugly with the “sin stocks” categorisation. The analysts have viewed the negative consequences of tobacco (cigarette selling is its main revenue driver) on societal health and the environment, in conjunction with other hugely consequential issues: waste management, carbon footprint, water efficiency, business ethics, corporate governance, gender diversity, human capital, and factors within the supply chain (human rights, resource use, land use and biodiversity).

Diageo: Low Risk (15.5)

One of the world’s largest producer of liquor, another “sin stock”, is focused on improving its water use efficiency (based on the litres of water used to distil or package 1 litre of product). In 2008, the company set a target of a 50% improvement in water-use efficiency by 2020, using 2007 as the baseline. The distillery in Tennessee now saves more than 30 million litres of water annually and 10 million litres in Canada. It also leads the way by way of women representation on its board.

Big Tech

When it comes to Big Tech firms, corporate governance, business ethics and data privacy and security are what need to be scrutinized in detail. Sustainalytics gives Alphabet a 22.3 (Medium) as against Facebook’s 31.6 (High).

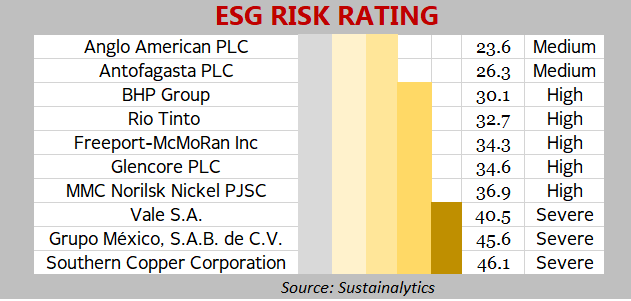

Mining

When it comes to mining companies, the top material ESG issues are Corporate Governance / Community Relations / Emissions, Effluents and Waste / Resource Use. Here’s how these companies stack up against each other.

I explain this in more detail in Why ESG is going mainstream.

I explain this in more detail in Why ESG is going mainstream.