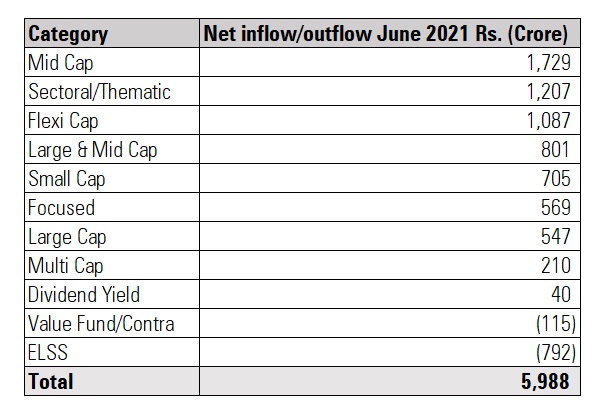

Mid Cap Funds accounted for 29% of the total Rs 5,988 crore net inflows in equity funds in June 2021, shows the latest Association of Mutual Funds in India (AMFI) data.

The S&P BSE Mid Cap Index is up 68.13% in one year as on July 7, 2021. As a result, Mid Cap Funds category has outperformed the index by delivering 72.76% return during the same period.

Small Cap Funds category has topped the return chart over a one year period by delivering 102.91% during the same period, followed by Technology Funds which delivered 100.03%.

Dynamic Asset Allocation Funds are gaining traction. These funds take away the need for investors and advisers to change asset allocation based on valuations as these funds automatically adjust the equity and debt allocation. From January 2021 till June 2021, the category has received cumulative net inflows worth Rs 10,495 crore. Dynamic Asset Allocation category has delivered 24.32% return over a one-year period as on July 7, 2021.

Fixed Income

Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Advisers India, shares his perspective on the fund flows in the debt funds space.

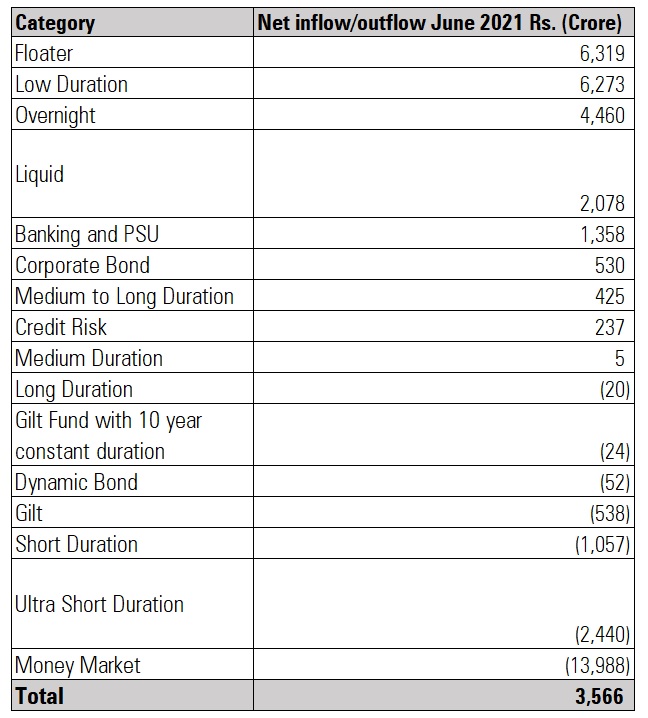

“Investors continued their affinity with Low Duration Funds in line with the prevailing interest rate scenario as they invested net assets worth Rs 6,273 crore in June. The category has also performed well over the last one year. Money Market Funds, which witness good net inflows in April and May, was the worst hit during the month with investors pulling out net assets of around Rs 13,987 crore. The relatively low returns from the category in the last one year could be the reason for the same.

After witnessing consistent net outflows for long time, Credit Risk Fund are again getting back under investors' radar. It received net inflows of Rs 236 crore in June and Rs 258 crore in May. The improvement in scenario on the fixed income side would have prompted investors to take a calculated risk by allocating some portion of their investments in credit funds.

Floater funds continue to receive net positive flows given the limited probability of interest moving down significantly. With a net inflow of Rs 6,318 crore, it was the biggest beneficiary in June among the debt-oriented categories. After witnessing significant outflows on the back of new guidelines around valuations and fund exposure norms for AT1 bonds, the scenario appears to be stabilising for Banking & PSU funds. In June, investors invested net assets worth Rs 1,357 crore, which could be due to the safety that these funds offer.”

New Fund Offers

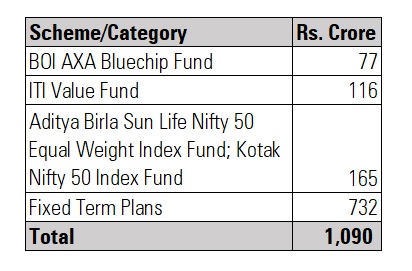

The industry launched seven new schemes which collectively mopped up Rs 1,090 crore.

The industry’s asset base stood at Rs 33.66 lakh crore as on June 2021.