A company or financial institution may need money for a variety of purposes. It may want to expand its business, build a new plant, buy machinery, buy new land to build a factory, or even purchase another company. One of the ways to raise money is to issue a bond.

When you, as an investor, buy a bond, you lend money to the company that issued the bond (issuer). In exchange, the company promises to return your money (principal) on a predetermined date (maturity date), and till it does so, it will pay you a specified rate of interest (coupon rate).

Let’s start with an example.

On February 28, 2020, HMEL issued bonds with a 10-year maturity. The return was 9.18%, and each was issued for Rs 10 lakh.

What did this mean? It meant that an investor would loan HMEL Rs 10 lakh for a period of 10 years, and would earn an interest rate of 9.18% over this time period.

Let’s examine the terminology.

Maturity: This is the length of time of the financial contract. In this case, it is 10 years.

Coupon Rate: The CR is the annual rate of interest that the owner of the bond will receive. This is static, in the sense that it is fixed when the bond is issued. In the example given, it is 9.18% every year, over 10 years. The coupon rate is always linked to the Face Value.

Face Value, or Par Value: The FV is the value assigned to the bond. This is the amount of money you loaned to the issuer and it will be returned on maturity. Unlike the market value, this too is static. In the above example, it is Rs 10 lakh.

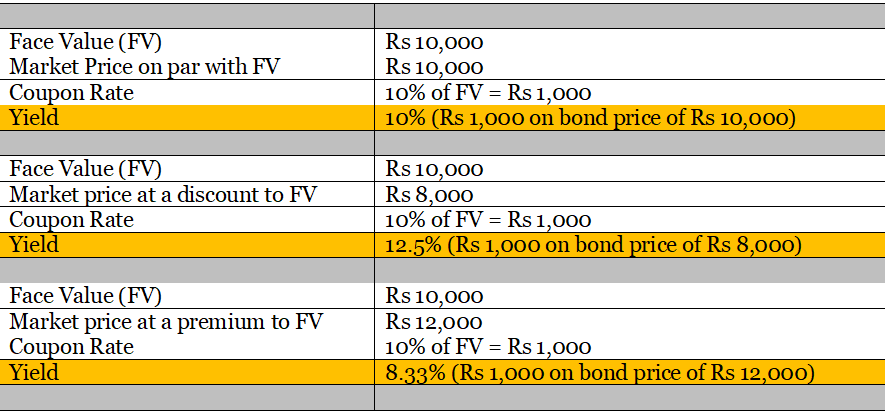

Yield: During these 10 years, the bond will be traded in the market. So the market price of the bond will differ from the FV. Yield is the return you get by applying the coupon rate to its market price. It is the return you will get when you buy the bond at that given price and hold it till maturity. You will understand it by looking at the image below.

As you can see, the yield rises because the bond price has fallen. Or the yield falls because the bond price has risen. There is an inversely proportional relationship between the two.

YTM: YTM is yield to maturity.

YTM is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate as its current yield.

So it depends on the price you paid when you purchased the bond - if it was on par or at a premium or a discount. The interest you will earn during the balance period. And the assumption that this interest will be reinvested at the same yield. In other words, YTM accounts for the present value of a bond’s future coupon payments. Put together, these are the components of YTM.

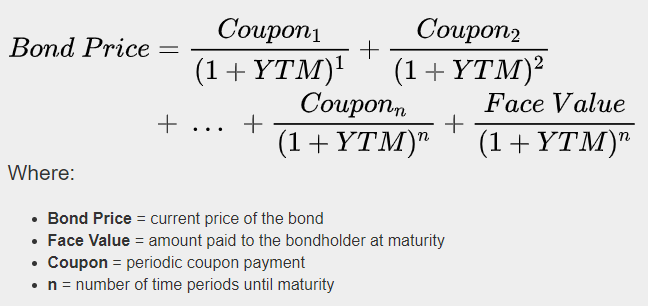

The formula for calculating YTM is: