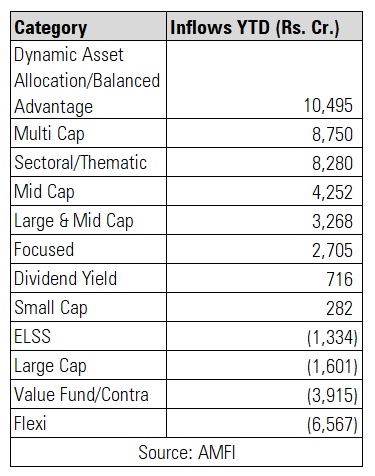

Dynamic Asset Allocation Funds or Balanced Advantage Funds are gaining traction lately. These funds have received cumulative net inflows aggregating Rs 10,495 crore YTD, which is higher than the inflows received by any equity fund category.

How do they work

Dynamic Asset Allocation Funds have the leeway to juggle between equity and debt exposure as per the fund manager’s discretion. Fund managers can increase or decrease allocation to equity based on the prevailing valuations. For instance, some funds increase exposure to equity if valuations are low and vice versa. They also take into account other indicators such as Price to Book Ratio, market cap to GDP, and so on. A majority of these funds portfolios are large cap oriented. They can also take a position in derivatives. Since these funds also invest in debt, you need to check the portfolio’s underlying credit quality. Most of these funds invest in sovereign and AAA rated paper and very minimal exposure to AA.

What advisers/MFDs have to say

Fund companies are promoting these funds lately which aim to reduce downside risk, offer investors a chance to participate in equities, and at the same time take away the hassle of deciding asset allocation. But not all are convinced with the pitch. Essentially, there are two camps when it comes to investing in Dynamic Asset Allocation Funds. One believes that the equity and debt exposure should be kept separate. The supporters believe that such funds take away the hassle of managing asset allocation from the adviser and can be a good way for new investors to participate in equities.

“I recommend Dynamic Asset Allocation Funds if the client is conservative but needs some equity exposure. The flip side of Dynamic Asset Funds is that they are taxed as debt funds if their equity holding reduces below 65%. For investors looking for conservative investment and if they can hold for more than three years, these funds can be considered as they will get indexation benefit in case debt taxation is applicable,” says Sridhaba Mahapatro, Hyderabad-based MFD.

Some distributors like to keep the allocation distinct. “We are not recommending Dynamic Asset Allocation as of now as most of our clients are heavy on equities. We focus on keeping debt and equity allocation separately. That said, there are funds that can do the asset allocation for investors, but we prefer to invest separately in debt funds as it helps to withdraw from the right asset class during an emergency,” says Vinod Jain, Founder, Jain Privy Client.

Mumbai-based MFD Rushabh Desai seconds Jain’s view. “Keeping equity and debt portfolios separate makes sense as it helps to mitigate risk in a much better way. The portfolios (especially the debt credit quality & liquidity) and fund strategy are easy to track. During an emergency, if the market conditions are not right it can be very difficult for investors to pull out their entire corpus at once and may have to bear substantial losses during redemptions.”

“I usually do not recommend Dynamic Asset Allocation Funds. Even though fund companies claim that they try to time the market in a better way, past history showed that neither Dynamic Funds nor anyone can time the market perfectly. Such funds can protect the downside though. When we do asset allocation and rebalancing once a year with complete control over equity and debt, I feel more comfortable than giving full freedom to someone else blindly,” says Bengaluru-based RIA Basavaraj Tonagatti.

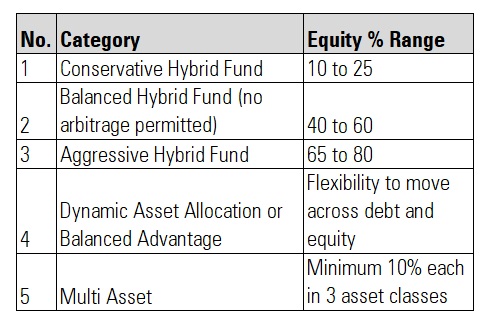

Types of Hybrid Funds

Do note that there are five types of funds under the Hybrid Funds category which can be confusing for first-time investors. Here’s the extent of exposure each of these funds can take under equity.

(Remaining in debt, cash and others)

Performance of Dynamic Asset versus other Hybrid Funds (Morningstar Category)

Over a five-year period, the difference between the returns of Balanced Allocation Funds (minimum allocation to equity at 40%) and Dynamic Asset Allocation Funds is 61 basis points. This seems to suggest that actively managing allocation by timing the market hasn’t helped much since returns converge over time.

Current equity exposure

In response to the rally since March 2020, many funds have reduced equity exposure. For instance, Aditya Birla Sun Life Balanced Advantage Fund has slashed its equity exposure from 81% in May 2020 to 48% as on June 2021. Similarly, ICICI Prudential Balanced Advantage Fund has reduced equity exposure from 73% to 38% during the same period.

But not all funds are managed in a similar fashion. HDFC Balanced Advantage Fund takes a more aggressive exposure in equity. Its average equity exposure in the last five year has been around 78% as compared to in the range of 30-60% average for other funds in the category. Since March 2020 crash, HDFC Balanced Fund has maintained average equity exposure at 80%, which helped the fund capture the upside. Thus, HDFC Balanced Advantage has topped the return chart at 47.63% over a one-year trailing period as on July 29, 2021. On the other hand, BOI Axa Equity Debt Rebalancer Fund has delivered the lowest return at 10.70% during the same period as the fund has maintained an average 36% since the March 2020 crash.

Choose wisely

Rushabh says that DAAFs are not bad if managed well. He recommends that investors should not put their entire corpus in this category assuming that their asset allocation will be taken care of. “Investors looking for low volatility within equities, who do not understand when to buy and sell, having a medium risk appetite and are ready to be invested in these funds for a minimum 3 to 5 years can look at venturing in these funds in their equity portfolios.”

You need to choose these funds after ascertaining the extent of volatility/risk you are comfortable with. You should not expect these funds to deliver returns on par with other actively managed equity funds which take exposure to equity up to 90%. “There is no doubt that during market crashes some of the well managed DAAF’s will fall comparatively lesser than the pure equity funds but investors should be aware that even well managed DAAF’s can see negative double-digit returns during market crashes. This means these funds do not fully protect from downside volatility,” cautions Rushabh.

In CY2020, DAAFs witnessed maximum drawdown in a range of -12% to -34% while the Sensex dropped by -38%. Thus, these funds are not completely immune to downside risk and your principal is at risk.