The Indian market continues to scale new highs on account of signals of an economic revival. The Sensex crossed 54,000 level today.

The S&P BSE Mid Cap has been the second-best performing index delivering 30.04% year to date as on August 2, 2021. The S&P BSE Small Cap has delivered 49.59% during the same period.

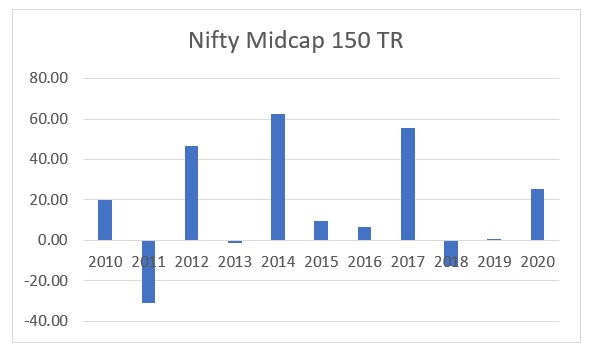

Calendar Year Return of Nifty Midcap 10 Index

As you can see from the above chart, 2014 and 2017 were spectacular for Mid Cap stocks. The Index delivered 62.67% in CY 2014 and 55.73% in 2017. In CY 2020, Nifty Midcap Index has delivered 25.56%. As a result, Mid Cap Funds category is seeing sustained net inflows from the last four months. Mid Cap Funds have received cumulative net inflows aggregating Rs 5,558 crore from March 2021 till June 2021. Mid Cap Funds constitute 12% of the total Rs 10.95 lakh crore actively managed equity assets as on June 2021.

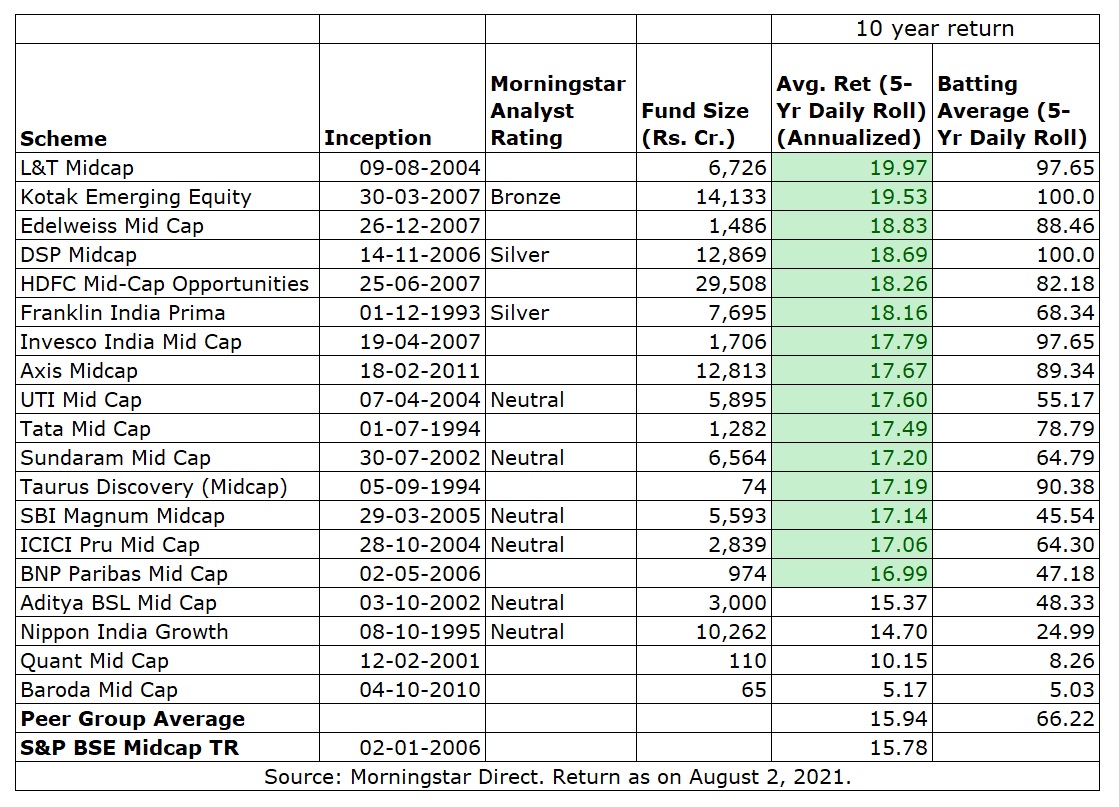

Performance of Mid Cap Funds

We looked at how Mid Cap funds that have completed ten years have performed. Of 19 funds that have completed ten years as on August 2, 2021, 79% or 15 funds have outperformed the S&P BSE Mid Cap Index. Launched in 2004, L&T Midcap Fund tops the list with a 19.97% 5-year average daily rolling return over a ten-year period. It has outperformed the index by 4.19 percentage points. S N. Lahiri, erstwhile CIO at L&T MF, was managing this fund from 2013 till November 2019. The fund is going through a rough patch lately. The fund has underperformed its benchmark and peer group in CY 2020 and over a one-year trailing period as of August 3, 2021.

The second-best performing fund is Kotak Emerging Equity which has outperformed the index by 3.75 percentage points. Kotak Emerging Equity is the second-largest fund in the category with AUM of Rs 14,133 crore. The Fund carries a Morningstar Analyst Rating of Bronze. You can read a synopsis of our analyst research about this fund here.

Edelweiss Mid Cap occupied the third spot. It outperformed the index by 3.05 percentage points. The third-largest fund (Rs 12,869 crore) DSP Midcap Fund occupied the fourth position. The fund outperformed S&P BSE Mid Cap Index by 2.91 percentage points. This fund has a Silver Morningstar Analyst Rating.

Nine funds had a batting average of more than 70%. Two funds (Kotak Emerging Equity and DSP Mid Cap Fund) had a batting average of 100 which means they have outperformed the index in every 5-yr holding period in the last 10 years. Batting Average is measured by dividing the number of periods a fund outperforms a benchmark by the total number of periods. Funds highlighted in green cells have outperformed the S&P BSE 100.

Here are funds that outperformed and underperformed over a ten-year period as on August 2, 2021.

Green cells indicate that these funds have outperformed S&P BSE Mid Cap Index.

In 2020, when the market witnessed heightened volatility due to the Corona virus pandemic, Mid Cap Funds category saw drawdown in the range of 35-40%. From the calamitous drop on March 23, 2020, Mid Cap Funds category has recovered 140% on an absolute basis till August 2, 2021.

The fall as well as the recovery of Mid and Small Cap Indexes tend to be sharp. For instance, from the peak of December 2017 the S&P BSE Midcap Index has seen a fall of 41% till March 2020. The S&P BSE Mid Cap Index witnessed a drawdown of -38.68% in 2020. Since the low of March 2020, the index has recovered 121% till August 2021.

Dhaval Kapadia, Director – Portfolio Specialist, Morningstar Investment Adviser India believes that Indian mid and small-cap stocks are trading at lofty P/Es. “The current valuations indicate a premium to our fair value assumption. On the other hand, the current margin and ROE are lower than the fair (long-term) assumption. Our valuation implied return framework factors a higher long-term margin and ROE estimate as compared to the current low margin and ROE that Indian equities offer – indicating a positive reversion impact on the return expectations. With the recent rally in the Indian markets, our valuation-driven framework suggests stretched market valuations. Our valuation implied return forecasts indicates that the return expectation from Indian equities is lower than what they were at the start of 2020, with all three market-cap segments offering low real returns.”

What should investors do?

The Mid Cap Funds category has delivered the fourth highest return over a one-year trailing period as on August 2, 2021. While the recent performance of Mid Cap Funds looks lucrative, investors should be mindful of the drawdown in such funds.

Experts are advising caution while investing in the mid and small cap space currently. “Macro-economic shocks over the last few years like demonetization, hastily implemented GST, IL&FS crisis & Covid-19 induced lockdowns have helped the large companies become larger and stronger, supported by scale and balance sheet strength. The smaller companies, however, have weakened and lost market share. Against this backdrop, when Covid-19 related uncertainty still lingers on, midcap valuations are close to all-time highs. We believe the markets are opting to ignore the risks associated with investing in smaller companies, but this could quickly reverse if global liquidity dries up or we encounter a Covid-19 third wave. We would advise the investor to tread with caution in the midcap & small-cap space,” says Sorbh Gupta, Fund Manager- Equity, Quantum AMC.

Investors would do well to take a long term approach while investing in Mid Cap Funds, which should be a part of the asset allocation. Importantly, one should not invest simply in funds that have generated outsized returns during a short time. For instance, Quant Mid Cap Fund has delivered 90.93% over a one year period as of August 2, 2021. However, over a ten-year period (as shown in the above table), the fund has not been able to outperform its benchmark. Similarly, Baroda Mid Cap has delivered 77.36% during the same period but failed to outperform over ten year period.