As markets continue to scale new highs, many companies from different sectors are going public to cash in on the bull market frenzy. From January 2021 till August 9, 2021, 33 IPOs have listed on the bourses.

We looked at how many mutual funds have participated in the IPOs that were listed since March 2021. Mutual Funds participated in most IPOs as anchor investors and skipped a few. Here are the findings from our analysis.

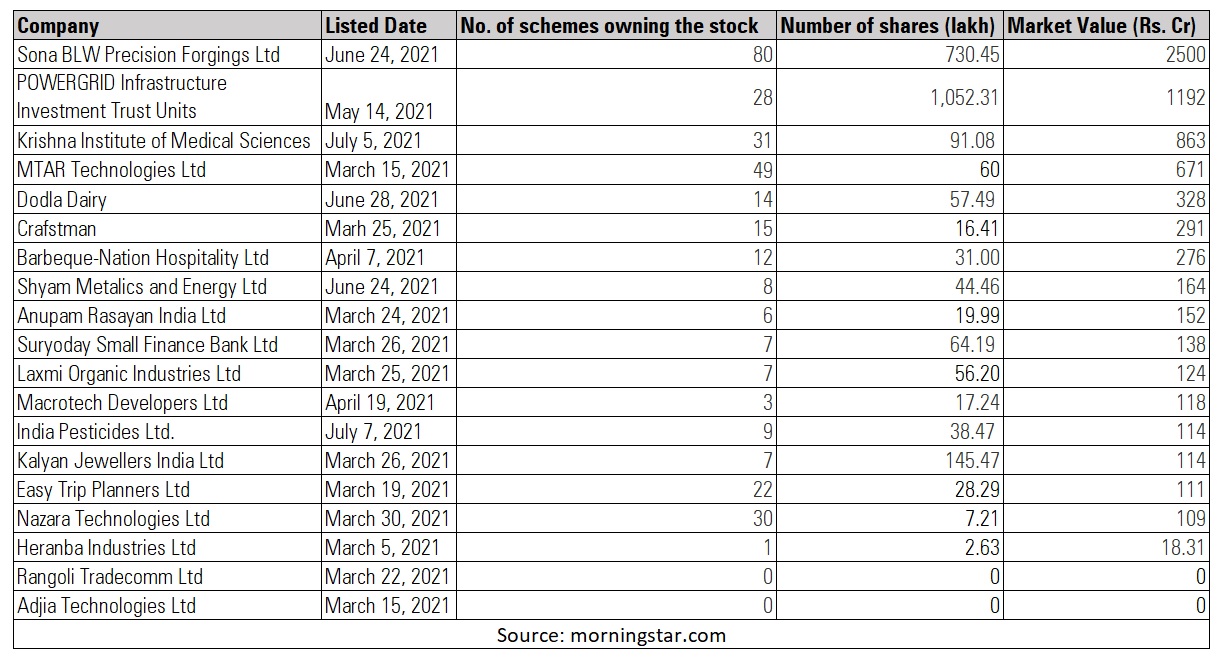

Sona BLW Precision Forgings (SONACOMS) is held by the highest number of funds (80) which is worth Rs 2,500 crore as of June 2021. The stock has gained 71% since it listed on June 24, 2021.

MTAR Technologies Ltd is the second most widely held IPO by MFs. It is owned by 49 schemes with market value of Rs 671 crore. The stock was issued at a price of Rs 575 and has gained 117% since listing.

Krishna Institute of Medical Sciences, which listed on the exchanges on July 5, 2021 is held by 31 funds which is worth Rs 863 crore as of June 2021.

Online food delivery firm Zomato which created quite a buzz in the market was subscribed by 19 mutual funds that collectively received 18.41 crore worth shares.

Mutual funds refrained from participating in two IPOs which were Rangoli Tradecomm Ltd and Adjia Technologies Ltd.

Heranba Industries Ltd, which was listed on March 5, 2021, is held by only one scheme which is IDFC Emerging Businesses Fund. This fund holds 2.63 lakh worth Rs 18.31 crore as of June 2021.