Lily Bowles is a Netflix subscriber and shareholder. She believes in the company’s ability to not only entertain but also challenge prejudice and create a greater sense of human connection.

As a self-described steward of her capital, Bowles wanted to know how Netflix, whose stock she first bought in 2016, was performing on material environmental, social, and governance (ESG) risks. These are sustainability issues that can be reasonably expected to have a financial impact on a company.

Bowles’ finance background, and her roughly 20 years as a Netflix viewer, made her uniquely positioned to get information on Netflix’s material ESG risk performance.

In previous jobs, she had worked with ESG data sets and was curious how truly financially material these risks were--and not just as a public-relations play. “I fundamentally believe that material ESG factors do affect the bottom line, and I have a curiosity of how they’re doing on material ESG issues,” she says.

Bowles’ story with Netflix, while a successful one, also highlights how difficult it is for individual investors to engage with companies they own.

Submitting Shareholder Resolution to Netflix

According to Sustainability Accounting Standards Board (SASB), Netflix’s most material ESG risks include the environmental footprint of hardware infrastructure, data privacy and advertising standards, data security, workforce diversity, and intellectual property. To get more information about how Netflix performed on these issues, Bowles submitted a shareholder resolution in December 2018.

In her proposal, she asked Netflix to disclose its “material ESG-related policies, practices, and performance using company-specific information and sustainable accounting metrics in its next annual report.” Bowles also explained “reporting could be done at reasonable cost and omit proprietary information or data the company was reluctant to share.”

The ball was now in Netflix’s court.

It didn’t take long for Bowles to realize how willing Netflix was to share its performance on material ESG issues. As a result, she withdrew her shareholder resolution--a typical move shareholders make when they have confidence the company will follow through on a proposal, says Morningstar’s head of policy research Aron Szapiro.

In February 2020, just over a year after Bowles filed her resolution, Netflix released its first Sustainability Accounting Standards Board Report, 2019 and Sustainability Accounting Standards Board Report, 2020 detailing how the company performed on material ESG risks. For example, the first report identified that Netflix matches 100% of nonrenewable energy use with renewable energy certificates. It uses a similar matching programme for nonrenewable energy consumption from its cloud-hosting partners.

This report was a success for Bowles. “[It] was truly exactly what I, and other members of the sustainable investment community, needed in order to feel more informed and confident about our decision to invest in Netflix,” she says. Bowles says the report might have been published even without her efforts, but her involvement certainly helped the process.

A Netflix spokesperson says the company had a positive experience working with Bowles and had already been working to disclose its performance on material ESG issues when her resolution was introduced. Since then, it has disclosed its ESG performance and what’s material to its business and industry using SASB’s framework in annual reports. It has also hired a head of sustainability and outlined other ESG information to its investors.

The average individual investor would find it difficult to replicate Bowles’ efforts.

Resolution filers now must understand the whole proxy process and have a keen sense of corporate governance, says Jackie Cook, Morningstar’s director of sustainability stewardship research. Such individuals also need to engage with the company’s management team, which is no easy task.

Most successful resolutions require significant time and effort, which is easier for large asset-management firms that can devote entire teams to engagement.

Cook says the success of these resolutions depends on the company. A corporation whose founder owns a majority of stock, like Facebook or Amazon.com, “makes them really impervious to shareholder pressure,” Cook says.

When Bowles submitted her resolution in December 2018, individual investors had to own at least $2,000 worth of stock and be a shareholder for at least a year before submitting resolutions. To resubmit a failed resolution, the proposal must have received 3% of the supporting vote once in the last five years, 6% of the vote if voted on twice in the last five years, and 10% of the vote if voted on three times or more in the last five years, according to an SEC press release.

However, just weeks before Bowles submitted her resolution, the SEC held a roundtable aimed at changing the way shareholders communicate and submit resolutions. This discussion would lead to rules that make it harder for individual investors to do what Bowles did with Netflix, Cook says.

The rules

, enacted in September 2020, upped the thresholds of support needed to resubmit a failed resolution from 3% to 5%, 6% to 10%, and 10% to 20% and shortened the resubmission window for failed resolutions from five years to three years.

“Investor participation in shareholder engagement shouldn’t be viewed as a burden to corporations but rather as an opportunity to listen, learn, reflect, and improve,” says Bowles.

Bowles said the power of shareholder resolutions can help investors enact change in the companies they own. “All companies, whether they like it or not, are on an ESG sustainability journey,” she said. “And some are further ahead than others. But we’re trying to, as shareholder advocates, get them further along to have a better environmental and social impact.”

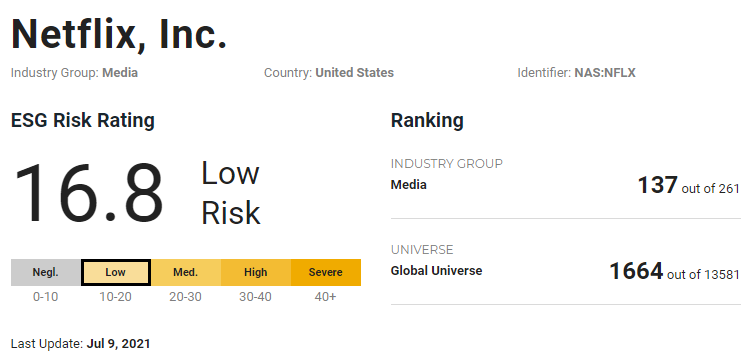

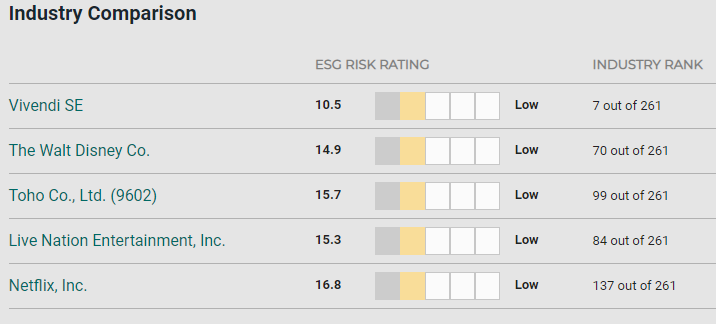

Sustainalytics, a Morningstar company, on Netflix.

Sustainalytics

ranks Netflix 44 out of 66 on its ESG risking rating among other companies in the movies and entertainment subindustry. This ranking is explained by its low management scores on issues like corporate governance, business ethics, and human capital. Jennifer Vieno, a Sustainalytics analyst who covers Netflix, says the lack of disclosures and programs targeting these issues are the main reasons behind the company’s scores.