Systematic Investment Plan (SIP) is an ideal way to invest in mutual funds to build long-term wealth. It instills discipline to invest regularly by investing at every market level.

One of the major advantages of SIP investing is rupee cost averaging which helps you buy more units when markets fall and lesser when they are high. This helps you reduce the average cost of your investment.

Morningstar.in offers an easy-to-use tool to calculate how much return you have earned on your SIP investment in any fund. Since there are multiple cash flows at different dates, Extended Internal Rate of Return (XIRR) is the right formula to calculate SIP returns.

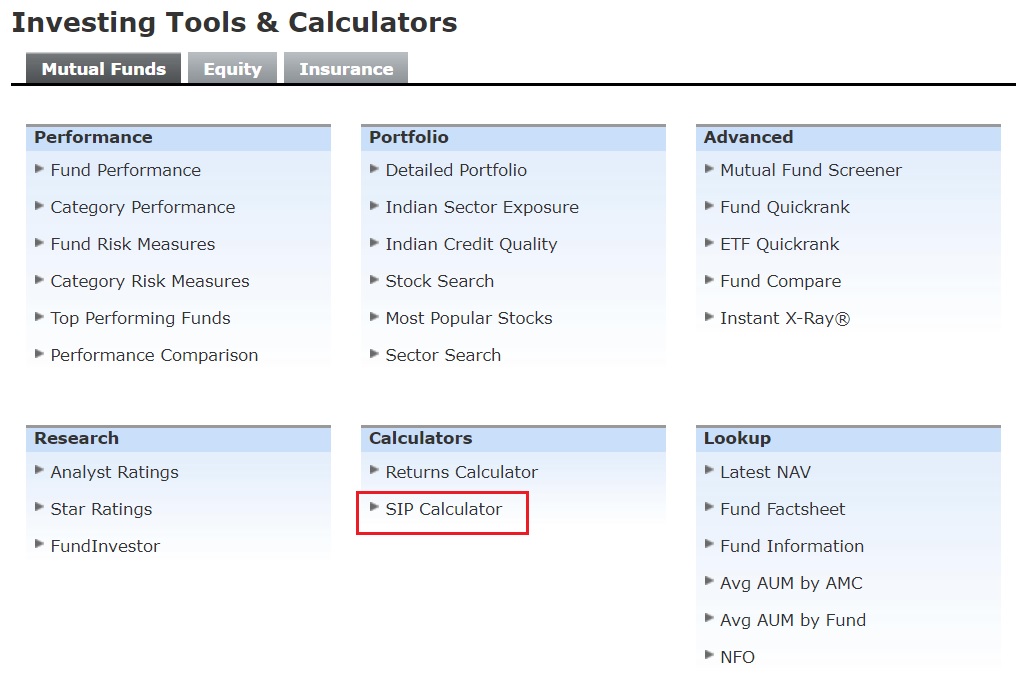

This tool is available under Tools > Mutual Funds > Calculator tab.

As you can see in the image below, you can set the frequency of SIP installment as fortnightly, monthly or quarterly. Put in the amount you invest in Instalment Amount. You can select up to three funds at one go. After you insert the name of the fund you wish to search, the results will show the Price or NAV at which you made each SIP installment every month, cumulative units you would accumulate, and the investment value.

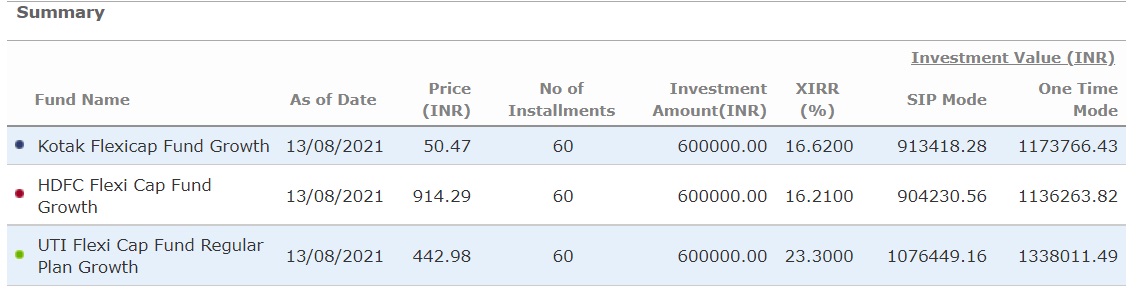

We searched for the three largest Flexi Cap funds with a monthly investment of Rs 10,000 for five years.

Click go and you get the following result.

The results show the XIRR return on your investment, the principal amount invested over five years and the final value of your investment done through SIP mode and lumpsum. This tool does not take into account withdrawals.