Dynamic bond funds are fixed-income funds that have the permissible investment mandate to invest across durations. They can choose debt instruments of their preference – be it government securities, corporate debt securities or money market instruments. The choice depends on the fund manager’s views around interest rates and spreads.

The term dynamic is apt because the fund manager has complete leeway to alter allocations between instruments of differing tenures to take advantage of changes in interest rates and/or corporate spreads.

Unlike other fund categories, there is no restriction in terms of duration and/or credit risk. The fund manager has a free hand to play out his views.

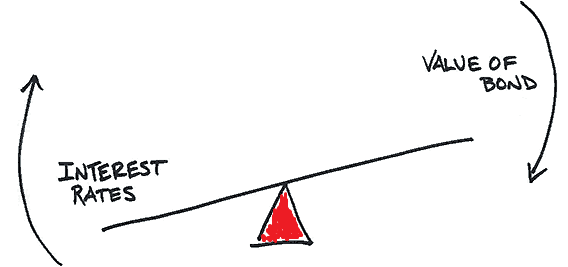

Step 1: Recognize how prices of fixed-income securities move inversely with interest rates.

Let’s use an example. You invest Rs 100 in a 10-year bond paying 5% per year.

- Face Value (FV): Rs 100. Amount loaned to the company to be returned on maturity.

- Maturity: 10 years. Tenure of the financial contract.

- Coupon Rate (CR): 5% per annum. This is always tied to the bond’s FV. 5% of Rs 100 = Rs 5 per annum.

During these 10 years, this bond will be traded in the market at a price based on the then prevailing interest rates. So buyers may pay more or less than the FV.

- Interest rates decline leading to price rising from Rs 100 to Rs 110

As the actual cash flow stream (coupons and maturity value) does not change during the life of the contract, a decline in interest rates results in the bond getting valued at higher prices than at issuance. This is because the discounting rate (which is the market interest rate) is now lower. (Value of a bond = present value of the cash flow stream over the life of the bond).

- Interest rates rise leading to price falling from Rs 100 to Rs 90.

Similarly, given the fixed cash flow stream, a rise in interest rates results in the bond getting valued at lower prices than at issuance.

Step 2: Understand how fund managers attempt to capitalize on this movement.

As explained above, fixed-income securities witness a decline in their value when interest rates rise and vice-versa. Now remember this: Longer maturity securities owing to their higher duration (sensitivity to interest rate fluctuations) witness a higher fall for the same quantum of interest rate movement relative to shorter maturity securities and vice-versa.

So, in anticipation of an uptrend in interest rates, dynamic bond funds can shift allocation out of longer duration securities into money market securities to lower the duration risk of the portfolio.

Similarly, if the fund manager anticipates interest rates to trend downwards, s/he can take positions in longer duration securities at various segments on the yield curve wherein they find valuations to be attractive. The fund manager also has the leeway to take exposure to relatively higher credit risk securities in order to boost the portfolio yield.

Step 3: Figure out if you need to invest in such funds.

These funds are ideal for investors who may not have the expertise and/or the time and resources to track markets actively and take interest rate and credit calls accordingly for the tactical portion of their portfolio. For such investors, these funds present an all-season product which relieves them of the need to take active calls.

This is also beneficial from a taxation perspective as investors do not need to churn their portfolio frequently, unlike investors taking active calls by moving to other debt categories in response to views on interest rates.

Given that these funds can take sharp interest rate calls, the invested corpus is exposed to the fund manager’s skills in assessing the macro conditions and security selection. So, there is that risk element that must be considered. As a cautionary move, it is advisable that investors allocate the tactical portion of their fixed-income portfolio to such funds. Let the core allocation stay in accrual fixed income funds with a high credit quality portfolio such as banking & PSU debt funds, corporate bond funds and short-duration funds.

Historically, the duration and credit management of dynamic bond funds has been broadly in line with that of medium-to-long term funds. Also, from a performance perspective their trailing performance across interest rate cycles has been close to that of medium-to-long duration funds. Rolling return performance in the last seven years too has been broadly similar on average.

In summary, the category has not capitalized on the flexibility to shuffle allocations dynamically on average.