Indian Railway Catering and Tourism Corporation Ltd (IRCTC) was in the news last week due to the government’s decision to take 50% of the convenience fee from IRCTC. The news came as a jolt for investors who were lured by its monopoly.

Although the government withdrew its decision to soothe investors nerves, the stock fell 29% on October 29, to hit an intra-day low of Rs 650 and settled at Rs 845, a fall of 7%.

IRCTC was listed on the bourses on October 14, 2019, and was issued at a price of Rs 320 at the upper price band. As of September 2021, 81 funds held 75.78 lakh shares of IRCTC. Funds seem to have reduced exposure in September 2021 in the stock after its stellar run. The total number of shares held by these funds dropped by 21.91 lakh in September 2021 as compared to August 2021.

After this episode, many experts warned investors of undue optimism surrounding PSU stocks.

What has changed for PSUs

While PSU Index has been a laggard for a long time, it has suddenly shot into the limelight with the government completing its strategic sale of Air India. The BSE PSU Price Return Index has delivered 1.70% over a five-year period. Over a one-year period, the Index has delivered 89.44% as of October 29, 2021.

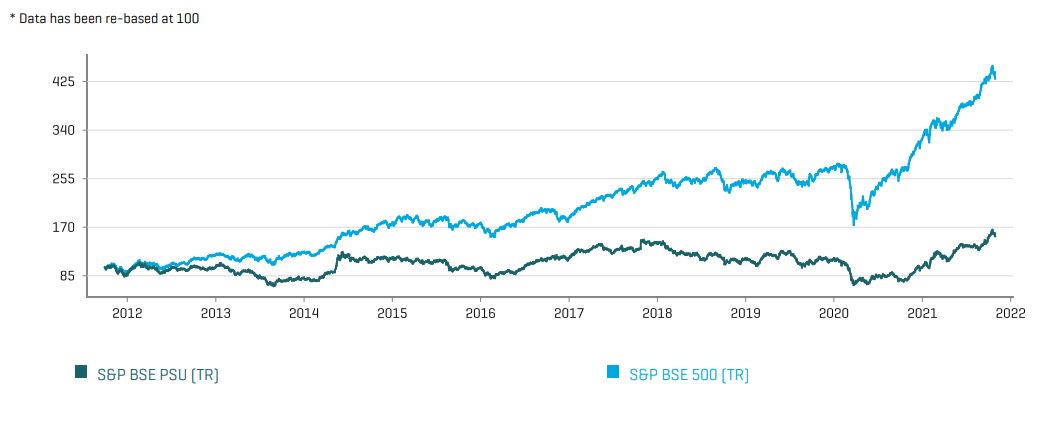

Historically, the BSE PSU TRI Index has underperformed the broader BSE 500 Index for the last ten years. While the index has doubled from March 2020, it is still below its peak of 9,557 achieved on November 3, 2017.

(Source: BSE)

Public sector firms are known to reward shareholders with dividends. Central Public Sector Enterprises Capital Restructuring Guidelines mandate all Central public sector enterprises to pay a minimum annual dividend of 30% of profit after tax, or 5 % of the net-worth, whichever is higher, subject to other conditions.

Constituents

The BSE PSU Index comprises 60 companies. The top ten constituents include State Bank of India, Power Grid Corp of India Ltd, NTPC Ltd, Oil & Natural Gas Corp Ltd, Bharat Petroleum Corp Ltd, Coal India Ltd, Indian Oil Corp Ltd, Gail India Ltd, Bharat Electronics Ltd and IRCTC.

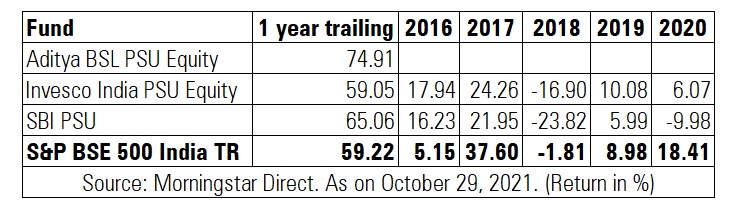

Performance of PSU Equity Funds

There are only three equity funds that invest exclusively in PSU stocks.

Benefit from disinvestment

We asked fund managers what their view on PSU companies and whether investors should look at this space. “A lot of these are well run companies. These companies had seen a significant de-rating over the last eight years. As the government is now moving ahead with its strategic divestment agenda, you will see significant value unlocking in many of these PSUs. It will have a rub-off effect on the entire PSU companies because when the government sells these companies, the value they will realise will be much higher than the valuation which the market has given to these companies as of now. This will help investors realise the hidden value in these companies. In the case of IRCTC, the government was sensitive to protect the interest of minority shareholders and intends to be a fair player,” says Pankaj Murarka, Founder, Renaissance Investment Managers.

When asked which companies he likes, Pankaj says that a few PSU are meaningful players in their respective industries. “We like SBI Bank and NTPC. A lot of these defense PSUs in the shipyard are trading at compelling valuations. Most of the PSUs offer deep value.”

Shridatta Bhandwaldar, Head – Equities, Canara Robeco Mutual Fund shares his picks from this space. "Within the PSU basket, we are looking at businesses where the terminal valuation of the business is not under a question mark. That leaves us with Defence, Engineering, select banking names and select utilities like gas, transmission, etc)."

Attractive valuations

Ashutosh Bhargava, Fund Manager and Head Equity Research, Nippon India Mutual Fund, says that PSUs are trading at attractive valuations.

"Current environment is well suited for stocks where earnings recovery is strong while valuations are inexpensive. This is where PSU stocks are scoring ahead of peers as these are relatively inexpensive and have strong earnings tailwinds. Within PSUs, PSU banks are also seeing better than expected asset quality performance and that’s another big advantage other than inexpensive valuations. Many PSU stocks are trading at a 50% discount to their long-term historical valuation multiple and that’s a rarity in the market where overall index valuations are not cheap. Meaningful progress in divestments will further help improve sentiments towards PSU stocks."

Ashutosh says that many of these stocks are from sectors like commodities, utilities, defense, oil & gas, etc where the current inflationary environment are not adversely impacting their earnings.

Risks

Nilesh Shetty, Fund Manager - Equity, Quantum Mutual Fund, observes that one needs to be mindful of the government's policy risks in these stocks. "Given the nature of the ownership, PSUs have always been rated lower on corporate governance and government policies can have a drastic impact on their profitability. Avoiding Government regulatory risk is impossible in such companies, but if one buys such stocks at deep discounts to fair value where such risks are discounted in the valuations then the returns generated may be in line with expectations."

What should you do

Unless one possesses nuanced research and investing skills for picking the right stocks in this space, Pankaj recommends taking exposure to PSU stocks through a mutual fund route to benefit from this trend.