Morningstar has released its Offshore Fund Spy Report. This report provides insights into performance, estimated flows, and asset trends for offshore funds focused on the Indian equity market. The flows are estimated from assets and total returns for the quarter ended September 2021.

An offshore India fund is one that is not domiciled in India but invests primarily in Indian equity markets. In this report, we have included the asset flows of funds and exchange-traded funds with an allocation to Indian stocks as of September 2021. All figures are in US dollars. All quarters refer to calendar-year quarters.

Here are some key findings from the report:

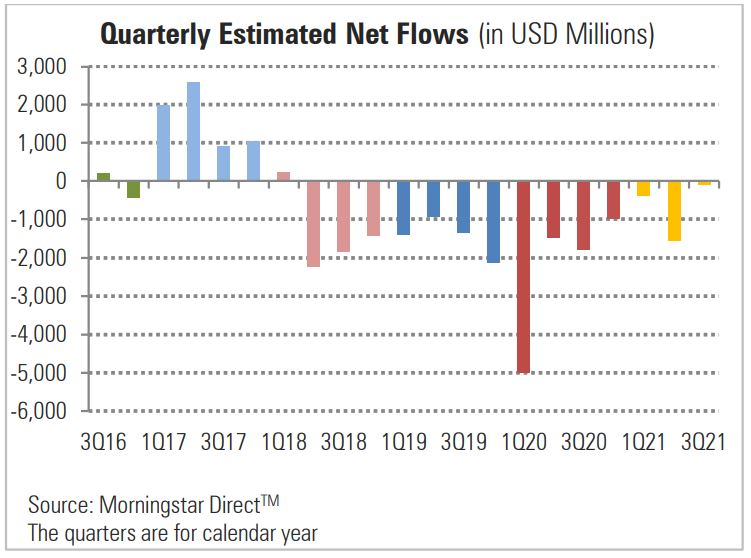

- The India-focused offshore fund and ETFs category continued to witness net outflows during the quarter ended September 2021, which was the 14th consecutive quarter of net outflows.

- The quantum of net outflows fell sharply this quarter to 95 million from 1.5 billion during the quarter ended June 2021.

- On a positive note, the India-focused offshore fund segment witnessed net inflows, albeit marginally, after 13 consecutive quarters of net outflows. Through the quarter, it received net inflows of 13.6 million, compared with net outflows of 1.7 billion in the previous quarter.

- The India-focused offshore ETF segment witnessed net outflows of 108.2 million through the quarter ended September 2021, after three consecutive quarters of net inflows. This is in line with expectations, given that investors, who have been sitting on profits on the back of Indian markets touching all-time highs, would have chosen to book them through the ETF route.

Quarterly estimated net flows of India-Focused Offshore Equity Funds and India-Focused Offshore ETFs

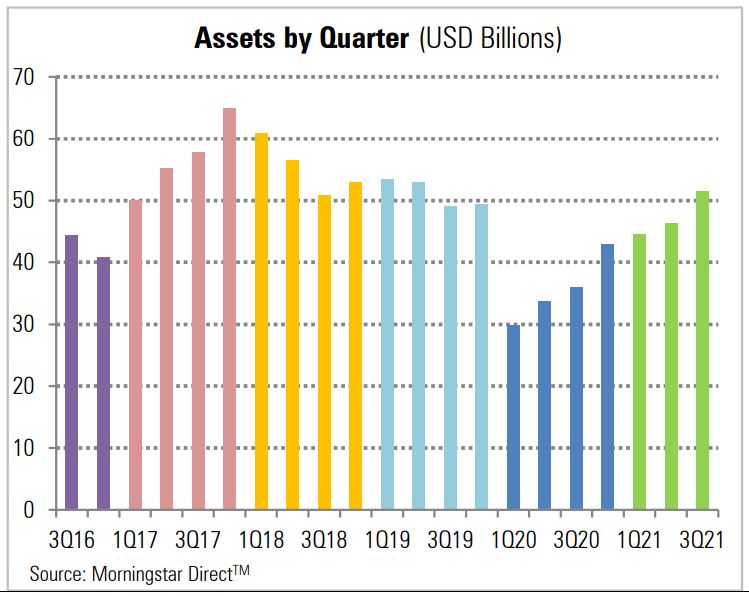

Assets of India-Focused Offshore Funds and ETFs

A relatively lower quantum of net outflows during the quarter and a sharp surge in the equity markets led to an increase in the assets of India-focused offshore funds and ETFs. Through the quarter ended September 2021, their asset base grew by 11% to 51.6 billion compared with 46.3 billion recorded in the June quarter.

There have been six consecutive quarters of increases in the asset size of India-focused offshore funds and ETFs category after the quarter ended March 2020, when the category's asset base decreased by a mammoth 40% to 29.8 billion from 49.4 billion recorded in December 2019.

Drop in net outflows from the India-Focused Offshore Funds and ETFs Category

The India-focused offshore funds and ETFs category has been witnessing consistent net outflows since February 2018. The intensity reached its peak in the March 2020 quarter, as almost 5 billion left its coffers. This was the highest quarterly net outflows that the category had ever witnessed. In fact, the net outflows from the category touched its peak in 2020 when it lost 9.3 billion of net assets. This was noticeably higher than the net outflows from the category in 2018 (5.3 billion) and 2019 (5.9 billion). The intensity of net outflows did show signs of moderation during the June, September, and December quarters of 2020 as well as during the quarter ended March 2021.

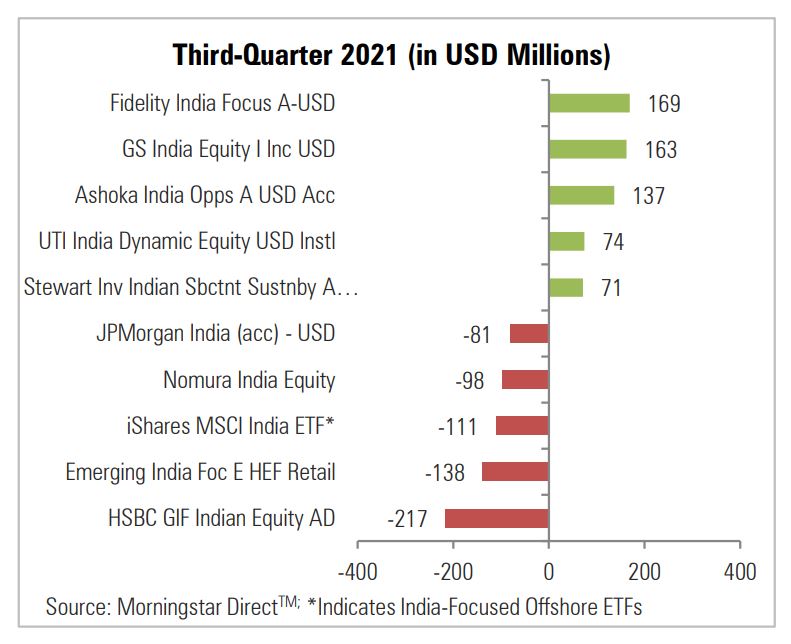

Five top and bottom India-Focused Offshore Funds and ETFs by estimated net flows in third quarter 2021

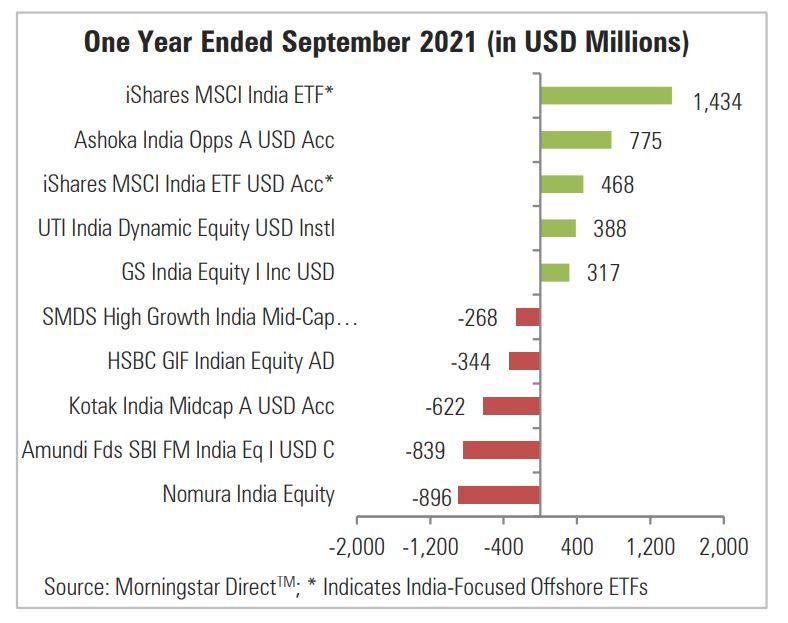

Five top and bottom India-Focused Offshore Funds and ETFs by estimated net flows over one year through September 2021