As the name suggests, multi-cap Unit Linked Insurance Plans (ULIPs) invest in stocks across market capitalisation – large, mid and small cap stocks.

The benefit of Multi Cap strategy is that a fund manager has the leeway to move across market caps which helps you diversify your investment. ULIPs are a mix of investment cum insurance products that come with a five-year lock-in period.

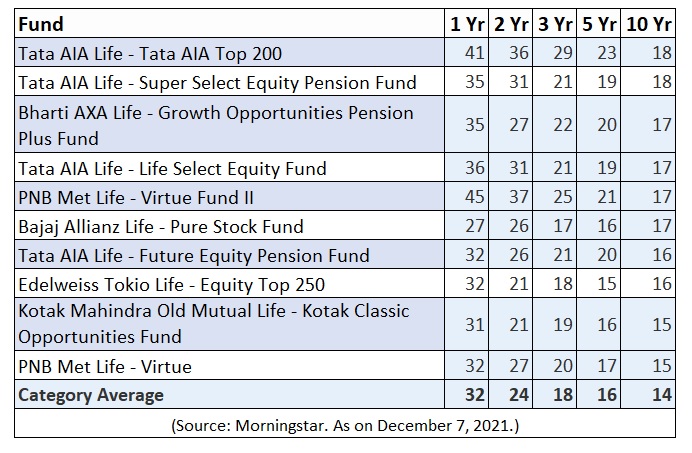

Here are the top-performing Multi Cap ULIPs over a 10-year period. We have shortlisted ten top-performing funds.

Over a ten-year period as of November 7, 2021, BSE 500 TRI has delivered 15.51% annualised return.

Tata AIA Top 200

- Star Rating: 5 stars

- Investment Style: Large Growth

- % of assets in stocks: 71%

- Number of stock holdings: 25

- % of assets in top 10 holdings: 37.93%

- Top 5 holdings: ICICI Bank, HDFC Bank, Reliance Industries Ltd, Infosys, Mahindra & Mahindra. As of October 2021.

Tata AIA Life Super Select Equity Pension Fund

- Star Rating: 5 stars

- Investment Style: Shariah

- % of assets in stocks:70.25 %

- Number of stock holdings: 25

- % of assets in top 10 holdings: 38.98%

- Top 5 holdings: Infosys, Hindustan Unilever, Havells India, Motherson Sumi Systems, KNR Constructions. As of October 2021.

Bharti Axa Life – Growth Opportunities Pension Plus Fund

- Star Rating: 4 stars

- Investment Style: NA

- % of assets in stocks: 96.79%

- Number of stock holdings: 101

- % of assets in top 10 holdings: 35.54%

- Top 5 holdings: Nippon India ETF Bank BeEs, Infosys, Housing Development Finance Corporation, HDFC Bank, Reliance Industries Ltd. As of October 2021.

Tata AIA Life Select Equity Fund

- Star Rating: 5 Stars

- Investment Style: Shariah

- % of assets in stocks: 70.66%

- Number of stock holdings: 28

- % of assets in top 10 holdings: 37.68%

- Top 5 holdings: Infosys, Titan, HUL, Havells India, Dixon Technologies (India) Ltd. As of October 2021.

PNB Met Life Virtue Fund II

- Star Rating: 5 Stars

- Investment Style: Shariah

- % of assets in stocks: 97.39%

- Number of stock holdings: 121

- % of assets in top 10 holdings: 23.41%

- Top 5 holdings: Reliance Industries Ltd, Nippon India ETF Nifty IT, Infosys, Bharti Airtel, Larsen & Toubro. As of November 2021.

Bajaj Allianz Life Pure Stock Fund

- Star Rating: 4 Stars

- Investment Style: Large Blend

- % of assets in stocks: 91.69%

- Number of stock holdings: 58

- % of assets in top 10 holdings: 38.48%

- Top 5 holdings: Reliance Industries Ltd, Infosys, ICICI Prudential IT ETF, Tata Steel, Hindalco Industries Ltd. As of October 2021.

Tata AIA Life Future Equity Pension Fund

- Star Rating: 4 Stars

- Investment Style: Large Growth

- % of assets in stocks: 71.77%

- Number of stock holdings: 16

- % of assets in top 10 holdings: 49.31%

- Top 5 holdings: Nippon India ETF Bank BeEs, ICICI Bank, Infosys, Reliance Industries Ltd, HDFC Bank. As of October 2021.

Edelweiss Tokio Life Equity Top 250

- Star Rating: 4 Stars

- Investment Style: Large Growth

- % of assets in stocks: 95.61%

- Number of stock holdings: 156

- % of assets in top 10 holdings: 24.21%

- Top 5 holdings: Nippon ETF Bank BeEs, Kotak Nifty ETF, Infosys, Reliance Industries Ltd, Housing Development Finance Corporation.

Kotak Classic Opportunities Fund

- Star Rating: 3 Stars

- Investment Style: Large Growth

- % of assets in stocks: 91.47%

- Number of stock holdings: 63

- % of assets in top 10 holdings: 40.43%

- Top 5 holdings: SBI ETF Nifty Bank, Infosys, ICICI Bank, Reliance Industries Ltd, Larsen & Toubro. As of October 2021.

PNB Met Life Virtue

- Star Rating: 4 Stars

- Investment Style: NA

- % of assets in stocks: 96.03%

- Number of stock holdings: 81

- % of assets in top 10 holdings: 29.88%

- Top 5 holdings: Infosys, Reliance Industries Ltd, Larsen & Toubro, Tata Consultancy Services, Bharti Airtel. As of November 2021.

ALSO READ: 8 terms you must know when investing in ULIPs

(These are not investment recommendation by Morningstar. Investors should consult their financial adviser before making any investment decisions.)