What are the pros and cons of a Systematic Investment Plan (SIP)? Does it work in all kinds of markets?

The market has been on an uptrend for the last 12-18 months. The concept of SIP is simple – you buy more units when the markets are down and fewer units when markets are high.

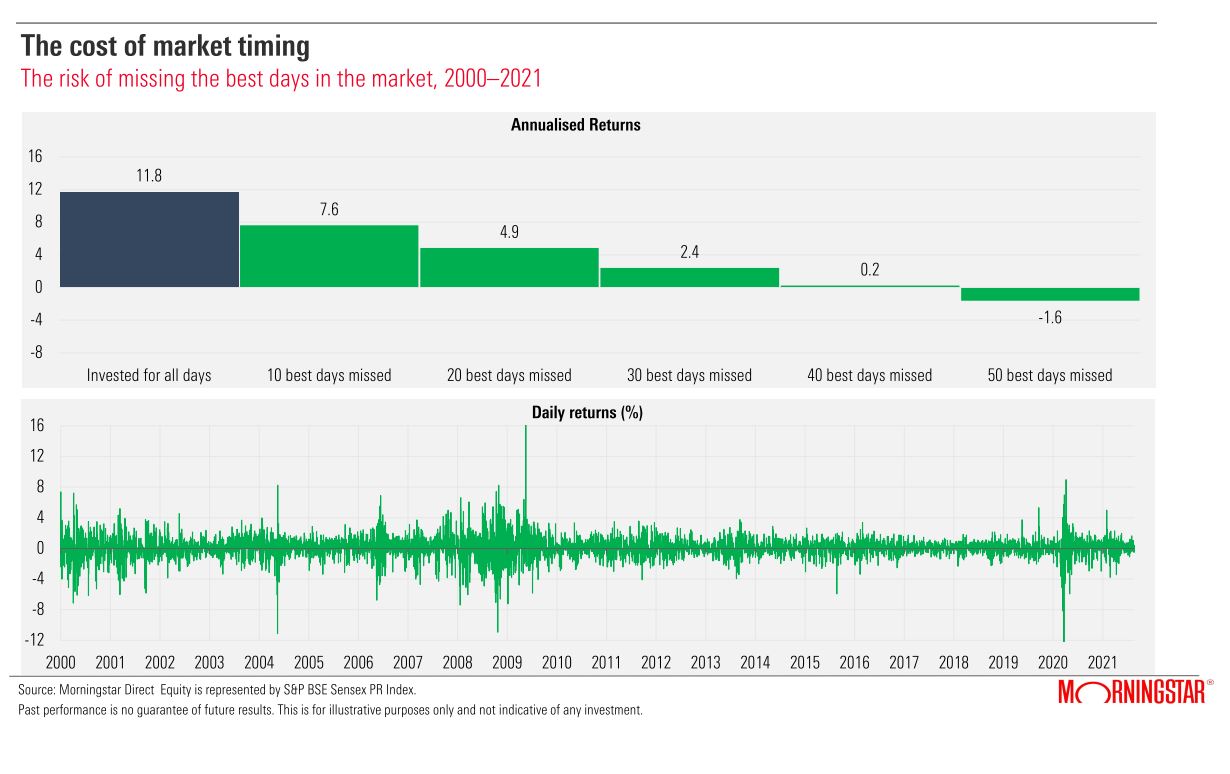

It helps inculcate discipline in investing to create long term wealth. As the famous saying goes ‘time in the market is more important than timing the market.’ Most investors may not have lumpsum to invest and via SIP one can invest smaller amounts even Rs 500-1,000 per month. It allows you build wealth gradually over a period of time.

Clearly, the advantages outweigh the disadvantages.

It is difficult to predict markets. No one would have predicted that the markets will recover so swiftly from the March 2020 crash. SIP investing takes away the risk of timing the market.

The below chart shows that if you would have missed investing for just ten days during 2000-2021, your CAGR return would be 7.6% vis-à-vis 11.8% if you would have remained invested for all days. Had you missed the best 40 days in the market, your return would be just 0.2% annually.

Let us look at a few disadvantages. If it’s a short-term SIP say running for only 6 to 12 months and if the markets are moving up, all the investments would happen over an upcycle only. Therefore, to benefit from SIPs ideally these investments should be long term in nature. But this is more related to the tenure of SIP.

Should you deploy lumpsum at this juncture?

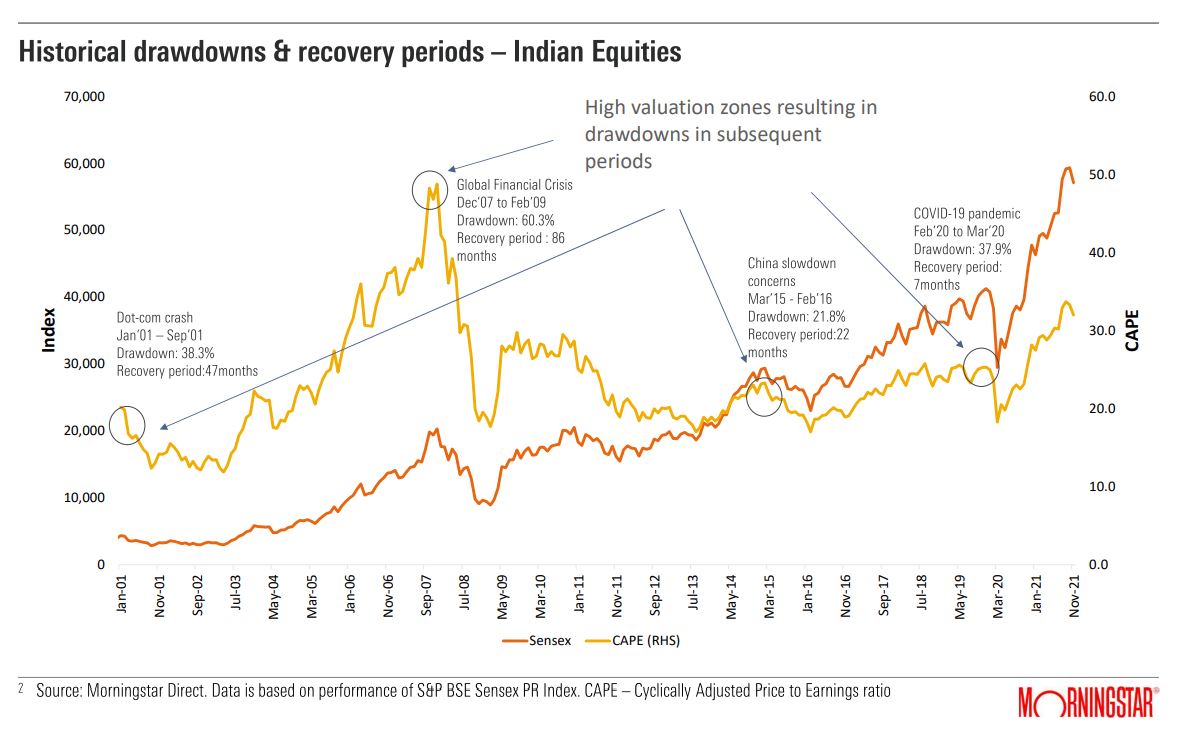

Lumpsum investing would work when there’s a significant correction in markets and one believes that markets look attractive, such as in March 2020. The markets had corrected by about 5%, which was not significant. The rally has been strong. From the March 2020 low, markets are up more than 100%. Thus, the 3-year return of funds are more than 15-18% CAGR. We think valuations are above fair value right now; they are not cheap. The optimism seems to be priced in.

On the other hand, there are concerns such as rising inflation, Fed tapering and hike in interest rates and roll back of stimulus. Further, risks related to new Covid variant is imminent. These risks are not priced in the market currently. So I would be cautious while investing lumpsum at this juncture. One can stagger the investment over 12-18 months over even longer through systematic transfer plan (STP).

In Morningstar Managed Portfolios, we are currently underweight Indian equities.