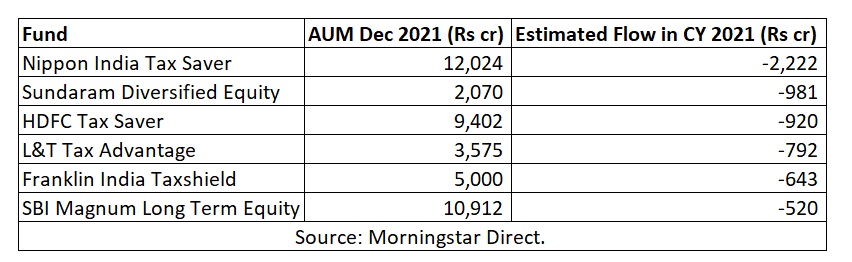

The assets under management in Equity Linked Savings Scheme stood at Rs 98,242 crore as of December 2021. The year 2021 has not been great for ELSS as the category saw net outflows of Rs 2,175 crore. Of the total 37 ELSS funds, only 12 funds received net inflow while the remaining 25 saw net outflows in CY 2021.

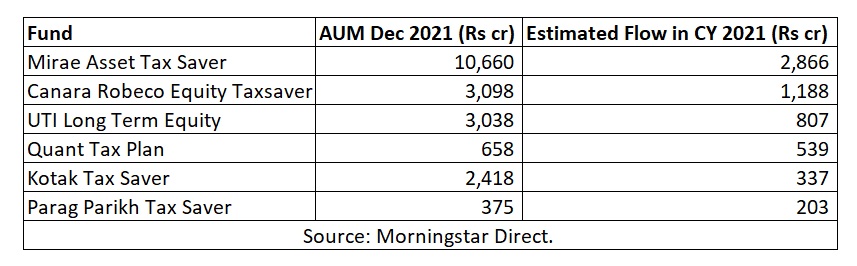

Mirae Asset Tax Saver Fund stood out from the pack. It received the highest net inflow in CY 2021 at Rs 2,866 crore.

Canara Robeco Equity Tax Saver received the second-highest net inflow at Rs 1,188 crore. UTI Long Term Equity stood at the third position by receiving net inflows of Rs 807 crore.

Funds that received the highest inflows

Funds that saw the highest outflows

Nehal Meshram, Senior Analyst – Manager Research, Morningstar Investment Adviser shares her view about Mirae Asset Tax Saver

The fund’s strategy is focused towards identifying stocks with a Growth at Reasonable Price (GARP) framework. The investment philosophy of the fund is built on three core principles: quality businesses with stable earnings, strong management, and attractive valuation. The process includes both quantitative and qualitative stock screening with bottom-up stock-picking. The sector selection is done through a top-down approach mainly based on growth prospects. Analysts then assess stocks at the industry and company levels and focus on key drivers such as returns on capital employed, returns on equity, and EBITDA margin. Within the framework, there is a lot of emphasis on qualitative analyses like management quality and execution capabilities. These are quantified by evaluating the trailing 10-year track record, which helps in removing subjectivity.

Neelesh Surana, Chief Investment Officer, Mirae Asset Mutual Fund, on what helped the fund

“When a fund completes three years, it gets recognition, stability, and confidence from distributors and investors. The three-year and five-year track record has been good. The fund has received inflows due to a combination of factors like performance and confidence among investors with our other funds. The fund’s philosophy and strategy is similar to our other funds. The lock-in brings some disciple among investors as three years is a good time frame in equity funds. Investors get a good tax-adjusted return.”

Talking about how he is managing the portfolio currently, Neelesh says, “We are avoiding companies where the valuations are high and it cuts across sectors. For instance, consumer discretionary is one space we are avoiding. Within BFSI, we are avoiding a few stocks but the overall sector is attractively valued. Our portfolio is diversified across sectors. We have good representation on long-term secular themes like financials, insurance, auto consumer staple, IT, among others. We don’t take sectoral calls. We take bottom-up stock-specific calls to outperform the sector.”

Launched in December 2015, Mirae Asset Tax Saver has outperformed its index BSE 500 TRI over 3-year and 5-year period.

ALSO READ:

Best Performing Tax Saving Funds