As the new era of work from home ushered in, healthcare and IT sector outshined in CY 2020, delivering 62% and 58% respectively, while PSU banks, media and Oil and Gas were the worst hit. After a spectacular run post-2020 crash, the Indian market has corrected 10% so far on account of multiple headwinds. Siddhartha Bhaiya, Managing Director and Fund Manager, Aequitas Investment Consultancy, on where is finding value currently.

You currently have zero exposure to Information Technology (IT), banking, and consumers. Can you explain your thought process behind this strategy?

It is not that we dislike these sectors. In fact, most of them are good businesses, perhaps which is why their stock prices are priced to perfection. We have at different points in time invested in companies in these sectors (where we found value) like ITC, Heritage foods, CCL Products, Neelkamal Plastics, and EID Parry’s in Consumer segment, Zensar Technologies in 2016/17 in the IT Space. We continue to have investments in Motilal Oswal Financial Services in the financial services space.

Yes, we have had a very small exposure to these sectors in our portfolio. In recent times, we have just about have had a nil exposure in these sectors.

We are firm believers in value investing which leaves us with a lot of margin of safety. It defies logic to buy a 60-70 Price to Earnings Per Share (P/E) stock and expect 25-30% returns from that sector on a continuous basis over the next 3-4 years. If one has to invest in a company with these valuations, it has to be justified with a 30% compound annual growth rate (CAGR) growth. All the sectors have been trading at 30/40 P/E multiples and growing in the range of 10-12% top-line which does not fit in our investment philosophy.

You tend to avoid fad/hot sectors. How do you identify if the trend is a fad or a long-term structural growth story? Can you share some examples of companies/themes you are avoiding currently?

We believe that the love that investors have for sectors is akin to that of Bollywood stars – just like your favourite Bollywood star keeps changing once every few years, the fad sectors keep changing.

The only difference is that, unlike Bollywood which keeps churning new faces every few years, markets must churn from the same 13 sectors. The fad sectors have such a nice Halo and positive media coverage that investors tend to build onto what they are reading and create “secular growth stories” – and we have all witnessed that whenever a stock or a sector becomes “a secular growth story” – it has let investors down - as the stock reaches its peak market cap only when it hits its peak EBITDA margin – sadly peak EBITDA margins are destined to go back to normal which causes a lot of pain to investors.

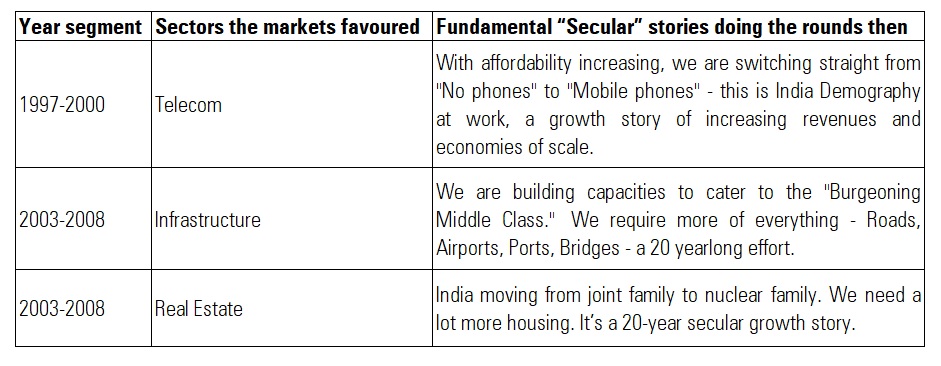

To give you a few examples:

Incidentally, all structural growth stories end up as fads. It’s like a self-feeding cycle that starts from:

Stage 1 Sectoral despondence: In this stage, companies are in deep debt. There is consolidation happening as the sector cannot absorb so many players. The companies have decimated balance sheets but with competition receding the ones that are left behind are stronger and start building the business but this is not recognised by the market participants and the Stock is labeled “A has-been company”.

Stage 2 Hope: The second stage in this cycle is one where the companies start paying off their debts and consequently are able to show not only EBITDA growth but also profit after tax (PAT) growth. This again is a stage of ignorance by market participants.

Stage 3 Revival: The third stage is one where the company starts seeing demand and finally starts adding capacities – but mind you this capacity is being added through internal accruals only, as the company still looks at banks as only fair-weather friends and not ones to bank upon when they are in need. The markets start noticing the companies now – we start getting increased Analyst participation in Company Quarterly concalls and the stock starts getting positive write-ups from the early adopters but still is not a part of larger institutions' portfolios.

Stage 4 Secular growth: The fourth stage is when the sector becomes “Hot property” – this is the time when they are really expanding capacities by 100/150% in anticipation of demand. By this time, everyone has to say positive things about the company – the balance sheets have been repaired, the EBITDA margins are growing at a very rapid pace, both top line and PAT reflect growth all across and the investors clamour for the stock. And then the “secular growth” stories start popping up.

Stage 5 Irrational exuberance: The last stage is the one which is accompanied by some blockbuster buyout or a merger, which is when normally the stock price tops out but this is also the time when the stock attracts the maximum eyeballs. This is also the stage when competition looks at the segment afresh and has thrown their hat in the ring forcing incumbents to either increase marketing spend to hold onto their market share or reduce prices and then the downward spiral begins all over again.

At which stage do you start investing in these companies?

We are early investors. We ideally start focussing on sectors when they are in Stage 1 and are invested in companies by Stage 2. From Stage 2 to 5 is anywhere between a 4–7-year journey in which we hope to participate in.

Sectors that we are avoiding are ones that are the current favourites of the market i.e., Banking, IT, and Consumption. These are great businesses but are valued to perfection. At times, even beyond perfection. If we are to make money for investors, we surely cannot put money in these sectors and hope that they will grow a further 30% CAGR from hereon for the next 5-6 years.

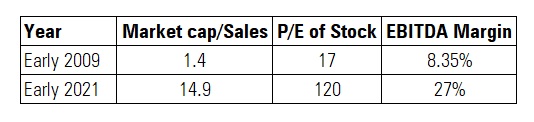

And since you have specifically asked for an example of a company that we are avoiding, there is a phenomenal Paint company, the best that we have. Since 2009, it has grown phenomenally and created a lot of wealth for its investors.

Unfortunately, most of the money the stock attracted was post 2020, which is when it had become a “secular growth story” in the mind of the investors. No doubt the stock has jumped but it is the stage when you attract a lot of retail investments only to make them see a long lull – as challenges for the company are going up in terms of raw material cost, they are getting some serious competition from newer entrants who come with deep pockets. Now whether competition fails or not is a different question which only time will tell, but the only thing that we see is that the market leader will have to protect its market share whether by coming out with new schemes or by doing more painter/dealer meets or by launching loyalty programmes – all of which will eat into their margins for sure.

Can you share three companies that you are currently holding where you have high conviction?

Before we get into the companies that we hold let me tell you a couple of things about the kind of companies that we hold. Our portfolio will always be made of companies that are leaders in their respective sectors – either by market share or by margin. The companies will have strong promoter holdings, cash on their balance sheet, a high degree of corporate governance and now coming out with amazing results every quarter.

Maithan Alloys: This is the most efficient Ferro alloy manufacturer in the country which has been coming out with amazing results. We have been holding the stock since 2014. For the March quarter of 2022, they have delivered Profit After Tax (PAT) of Rs 300 crore and have a market cap of Rs 3,500 crore. Over our holding period, we have seen the EBITDA margins grow from near 0 to approx. 30%.

GAEL: The largest processor of maize in the country. Since the time we have been holding the Stock, i.e. 2014, We have seen the migration of the company from trading being a large portion of their business to maize processing becoming more than 70% of their business. This kind of value addition brings about sustained EBITDA growth margins. For March 2022 quarter, they have delivered a PAT of Rs 105 crore and have a market cap of Rs 7,500 crore. Over our holding period, we have seen the EBITDA margins grow from 5% to approx. 15%.

JSL: JSL is the largest producer of stainless steel in the country. We have been holding the stock since 2019. As we grow, we are moving towards using stainless steel – whether it is the new bridges that are being constructed or “Vande Bharat Express” or the new metros – all are being made from stainless steel. For the March quarter 2022, the firm has delivered a PAT of Rs 670 crore and has a market cap of Rs 9,000 crore. Over our holding period, we have seen the earnings before interest taxes, depreciation, and amortisation (EBITDA) margins grow from 6% to approximately 15%.

Given that you focus on investing in the mid and small cap space, how do you protect your portfolio from huge drawdowns? Can you take us through how much drawdown your portfolio has witnessed in the recent market crashes?

We are all so used to segmentation of market caps that we have all painted Mid and small caps as places to take tactical exposure only and are susceptible to huge drawdowns.

Let me give you an example. If you have a Class of 300 students – the easiest way to classify them will be by their height as that is the most visible and therefore the easiest. But if you were to classify them by their Marks, now that’s a totally different story as one will have to do a lot of hard work.

Similarly, the easiest way to segment stocks is by their market cap. If you were to segment them by their profitability or top line, that would throw up a totally different set of names. All companies in our portfolio will fall in the Top 500 companies of India in terms of profitability.

With this kind of robust businesses that throw up cash, we look at drawdown as an opportunity to top up on our investments. The best part of the drawdown is that our set of companies bounce back strongly even on the stock performance albeit with a lag as the first love always is large cap stocks.

In all our nine years of history, we have actually had only two calendar years (2018 and 2019) where we have delivered a negative return. Even during COVID stricken year of 2020 our portfolio delivered (19.49%) better than Nifty returns (14.77%).

Which sectors/themes are being currently ignored by the market where do you think opportunities exist?

I think the largest miss by the markets is on the commodity, metals and infra (Capex) space. While we are all seeing capex being announced and executed all around us, the capex-oriented companies are yet to see the shine under the sun as it was during the times of 2005-08.