How long will your retirement last? This is one question that we really do not have an answer to. It is the biggest variable when it comes to retirement planning.

So what do we do about it? We can try as much as possible to take a realistic estimate, but we can be consistent savers. Sounds simple, but people really tend to underestimate the impact of reinvested interest.

James Gard, senior editor at Morningstar UK, on the issue of longevity.

One of the biggest issues with saving and investing for retirement is not knowing how long you’re going to live. Planning would be so much easier if you had a fixed date to work with (or even a ballpark figure).

Life expectancy figures, genetics, luck (good and bad), illness and wealth are all powerful variables to be considered. Being ill can have huge financial costs, especially if that carefully accumulated capital has to be plundered to fund health and social care.

When you're young you can't conceive of being old, or even living until you're 100. You could live for the average lifespan (70 years), below or above that. Last month, French film director Jean-Luc Godard died at the age of 91, through assisted suicide in Switzerland, after battling multiple illnesses. My grandparents, who received a message from Queen Elizabeth II on their platinum wedding anniversary, got to meet their great-grandchildren. The Queen (and her mother, who made it to 101) were outliers for her generation in terms of age but her father, George VI, died age 56. Death makes fools of statisticians and actuaries too: how can you plan for a difference of around 50 years in lifespan?

But what if we do live to a ripe old age? That is why we must harness the power of time.

Read This: 4 ways longevity is going to change everything

Sunniva Kolostyak, data journalist at Morningstar UK, visualises the impact of reinvested interest.

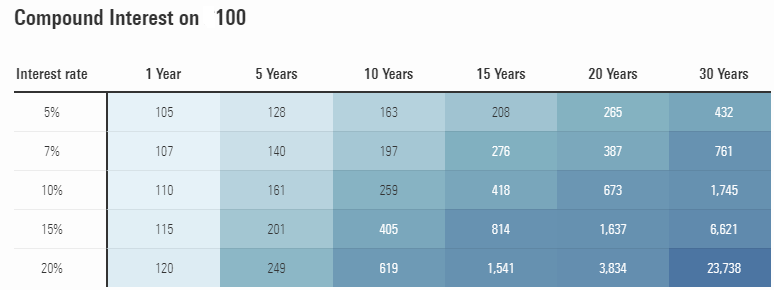

Compound interest is when small amounts of money grow into large sums over time because interest is reinvested.

Understanding the concept of it is easy enough; getting a real sense of the financial impact it can have on your savings is imperative. In fact, the majority of people underestimate its power, which can lead to poorer long-term financial decisions like a failure to save.

The below tables show how our savings would accumulate.

Click on images to enlarge.

The figures above exclude the impact of inflation, taxes, fees or brokerage. Nevertheless, the message is clear.

If you want to accumulate wealth, starting early and focusing on the best possible return can make a significant difference. If you add extra money to your investment portfolio on an annual basis, your savings would accumulate even more rapidly.

Related Reading