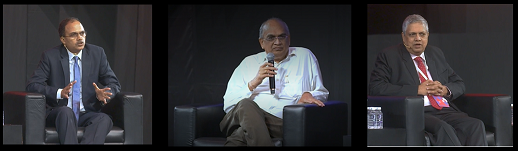

When seasoned investors engage in a conversation, there is always something to learn. These investors need no introduction, however details about them are mentioned at the end. What was interesting were the different perspectives on where one should look for value, as far as equity and debt go. Here is an excerpt in their own words.

Sankaran Naren pointed out that debt is a very appealing asset class today.

I see massive opportunity in debt. Debt has become an outstanding asset class for a long period to come. All along it was an ignored asset class because of the tampering by central banks.

From 2008 onwards, central bankers took over the role of being fund managers; for 13 years they controlled the equity markets and ensured that they don't fall. The role of being the biggest fund managers was over in November 2021. Today, both U.S. and Europe have agreed to raise rates; only Japan is left.

Equities will remain a volatile asset class till the day Jerome Powell says that he is done with tightening. That would be a turning point and equities will become a great asset class globally. Till then, we are going to have a period where volatility will remain in the equity market.

However, Prashant Jain believes in giving equity predominance, and calls it a generous asset class.

Debt is debt. I don't think debt can increase your purchasing power. Even if you buy equities expensive, if there is growth, it will outperform debt meaningfully.

The highest P/Es that the Indian market has ever traded at was in 1992 (40 P/Es). Even today, the market is maybe 40% cheaper than that. If you bought the Sensex even then, when it was at 4,000 levels, today it is at 60,000 levels. Add dividends and it is at 1,00,000. So, 4,000 has still become 1,00,000, that is 25 times in 30 years.

Compare that with debt. The wealth will be one-fourth or one-eighth of that. Equities are a generous asset class provided that you don't buy unsustainable businesses that go to zero.

Bharat Shah believes that equities are "not just generous, but munificent".

Fixed income will only give you what you are slated to want, but equity rewards you for the risk taken. In fixed income, you earn exactly what you bargained for. Equity is bountiful and rewarding. In some sense, fixed income is like working on a salary and equity investing is creating wealth opportunities.

This is assuming that you take intelligent risks. Which means that you are in a reasonable position to judge and bear the consequences if the risk rectifies one way or the other. Have a long-term perspective. Don’t gamble. Don’t leverage. If you combine all these measure, it simply begs the imagination as to how you can go wrong.

I'm saying despite the fact that I managed the largest bond fund and the largest liquid fund in the country for a number of years. So, it's not that I am partial to any asset class.

Sankaran Naren explains his stance in more detail.

If I take the audience here, the equity:debt exposure would probably be 80:20. That is the reason why I believe that there is to be a shift to debt.

If I look at a period from March to May 2020, there were so many investors who were 95% in equity and 5% in debt. They never got the opportunity to invest. So, the role of debt is not just to yield return. Equity can be the highest-yielding asset class over the next 10 years. But that doesn't mean that debt doesn't give you the chance to make more money in equity.

From 2017 to 2019, we tried our best to explain to people that debt was an important asset class. And people who had invested in debt got the opportunity to shift in 2020. That is something people realized in 2020.

In a rising interest rate environment, we told investors that a floating rate fund was a great product. But it was very difficult to convince the entire community that it's the only product to actually benefit from rising rates. The floating rate bond would actually give the highest G-Sec yield, something no one could have ever believed six months back, but that's what has happened.

That is the real problem at this point of time. Warren Buffett says that he has cash; from a wealth manager point of view, it is a debt fund.

Prashant Jain was Chief Investment Officer at HDFC Mutual Fund. He has 31 years of investment management experience. He is the only fund manager in India (and one of the few globally), to have continuously managed a scheme for over 28 years.

Bharat Shah has nearly 30 years of experience in the Indian capital markets. He is currently the Executive Director at ASK Investment Managers.

Sankaran Naren is Executive Director & Chief Investment Officer at ICICI Prudential AMC. He has three decades of experience across investment banking, fund management, equity research, and stock broking.