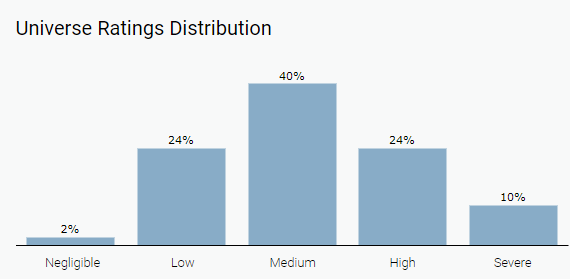

Let’s look at how Sustainalytics, a global leader in Environmental, Social and Governance (ESG) research and ratings, assigns ESG Risk Ratings. On a spectrum of 0 to 40+, there are five levels of risk.

A company’s ESG Risk Ratings score is assigned to one of five ESG risk categories. The higher the score the higher the risk of material financial impacts driven by ESG factors. EV = Enterprise Value.

- Negligible Risk

Overall Score of 0-9.99 points

EV is considered to have a negligible risk of material financial impacts driven by ESG factors

- Low Risk

Overall Score of 10-19.99 points

EV is considered to have a low risk of material financial impacts driven by ESG factors

- Medium Risk

Overall Score of 20-29.99 points

EV is considered to have a medium risk of material financial impacts driven by ESG factors

- High Risk

Overall Score of 30-39.99 points

EV is considered to have a high risk of material financial impacts driven by ESG factors

- Severe Risk

Overall Score of 40 and higher points

EV is considered to have a severe risk of material financial impacts driven by ESG factors

Supported by a robust materiality framework, Sustainalytics' ESG Risk Ratings provide a quantitative measure of unmanaged ESG risk. The above ESG Risk Ratings measure a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks.

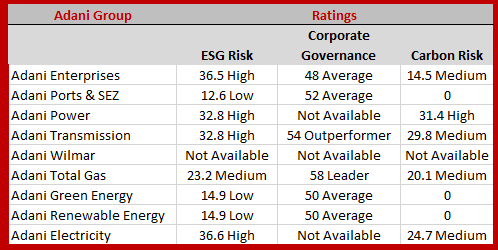

How the Adani Group companies fare