Neil Parikh, chairman and chief executive officer of PPFAS Mutual Fund penned this article years ago. The wisdom is worth reading again.

Warren Buffett’s two main rules of investing are: 1) Never lose money. 2) Never forget Rule 1.

This is all the more important in the quest to create long- term sustainable wealth, especially when the market is at an all-time high and everything seems to be trending up. It's imperative we look at downside risk/ downside protection.

For example, let’s say you have two portfolio options with these returns over the next four years:

Investment A: 40%, 50%, -60%, 65%

Investment B: 20%, 15%, 17%, 20%

Which option would you prefer?

Recently, when I posed this question, Investment A was preferred since it appeared more exciting. But, if you take the average, Investment A will have a 23.75% average and Investment B, 18%.

While simple averaging does not work in the markets, the concept of compounding does. Let’s do that with the assumption that we invest Rs 100 in both.

As we see, Investment B returns far more than Investment A after four years. The negative return in Year 3 destroys the overall long-term returns in Investment A.

These large drops in asset prices are something investors need to be aware of as they truly affect long-term returns and goals of the individual. Avoiding the big money mistakes are paramount for successful investing.

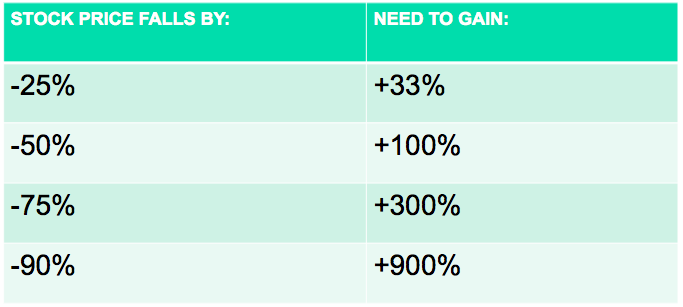

Let’s look at another way to understand negative returns and their impact on our investments by assuming a stock price of Rs 100.

As we see, if an investment falls by 25% (100 to 75), to get back to the original purchase price, the investment will have to go by 33% (75 to 100); lose 50% and the investment will need to go up by double or 100% just to recover the purchase price!

The more you lose, the tougher it is to even regain your cost price. We have seen such instances during the tech boom and financial crisis.

So what should investors do to avoid the big negative returns?

- Keep in mind preservation of capital and earning a ‘reasonable’ rate of return on that capital for a long period. Unreasonable growth is not sustainable over a longer term.

- Avoid fancied stocks and sectors which have already run up and are trading at expensive valuations. You only pay a fancy price for these and when it is no longer fancied by the market, you are left with a fancy loss.

- Look for bargains and good businesses which are out of favour, specially when momentum is strong and even bad quality companies see their prices soar.

- FOMO. The Fear of Missing Out is is also strong. If you keep hearing your friends and neighbours making money in the markets then one gets envious and wants to also participate. This leads to buying stocks on tips or without doing adequate research. This seldom works out well for the investor. Also, one needs to remember that people like talking about their victories. No one likes talking about their losses or failures.

- IPOs: Avoid high priced Initial Public Offerings. Such offerings come up in bull markets when the company can fetch the maximum price for its original shareholders/ promoters.

- When all seems to be going fine, the human tendency is to get overconfident in their ability. Investors start believing that nothing can go wrong. They will under-react to new information if it goes against what they believe. This is dangerous as this leads to irrational behaviour as investors do not take logical actions on their investments.

Investing should be about optimising returns instead of maximising them.

To maximise returns one needs to take maximum risk. This can be extremely harmful when the tide turns. Optimising returns is when for the lowest amount of risk we get the best or most effective returns. This ensures we avoid permanent loss of capital and earn sustainable returns over the long term.

A version of this article was published on the website earlier.