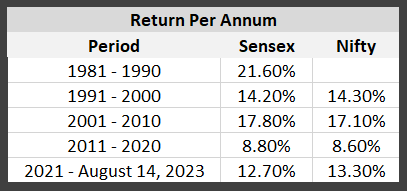

A recent data point by First Global brought to light the fact that investing in stock markets is not a short-term play.

You need to have a perspective of decades.

Stock markets go through long and deep periods of decline. But not all crashes are alike in their cause, severity or duration. So predictions of recovery are virtually impossible.

Remember the Lost Decade of the U.S.? It refers to the 2000s when the S&P 500 finished the decade lower than it started (10-year period from December 31, 1999 through December 31, 2009).

There was a 54% drop from August 2000 to February 2009. It began the year the dot-com bubble burst and the market did not get back to its August 2000 level until May 2013—almost 12 and a half years after the initial crash.

On the other hand, the Pandemic Crash saw the market collapse and then roar on in a matter of months.

Stock market history is littered with bear markets, and subsequent bull runs that took it to new heights.

Depressed markets and extreme events can be frightening in the short term. But over the very long run, stock markets have been very generous in rewarding those investors who can get through long periods of decline. If history is any guide, prudent long-term investors who can withstand the risks of equity investing should stay the course and not panic. Eventually, they will be richly compensated. It is not a smooth ride. But the trajectory has been upwards.

Just take a look at world events.

The Great Depression, World War II, Cuban Missile crisis, the Asian financial crisis, dotcom meltdown, the India-Pakistan and India-China stand-offs and border skirmishes at various times, the 9/11 terrorist attacks on the Twin Towers in New York, war in Iraq, the Russian-Ukraine aggression, the Global Financial Crisis, the European debt debacle, trade sanctions in the battle between U.S. and China, the pandemic.

I referred to the Lost Decade above. Incidentally, people tend to forget the first Lost Decade of the 1970s that was marked by geopolitical disruptions (Yom Kippur War, Iran Revolution, Vietnam War, Energy Crisis, recession).

The regularity of market crashes and declines is a reminder that patience is key to investing in equity markets.