Retirement spending is not written in stone. It must be viewed on a spectrum across the retirement lifecycle. Retirees tend to reduce spending in the middle and later years of retirement. However, in some instances spending increases later in life due to higher healthcare costs.

In an article in Enterprise Investor, retirement researcher and expert David Blanchett shares some very interesting insights.

He writes that retirement income planning tools largely assume “static” spending: That is, portfolio withdrawals are expected to change over time based on inflation or some other constant factor. This assumption is overly simplistic and inconsistent with the decisions retirees might make when faced with potential portfolio ruin.

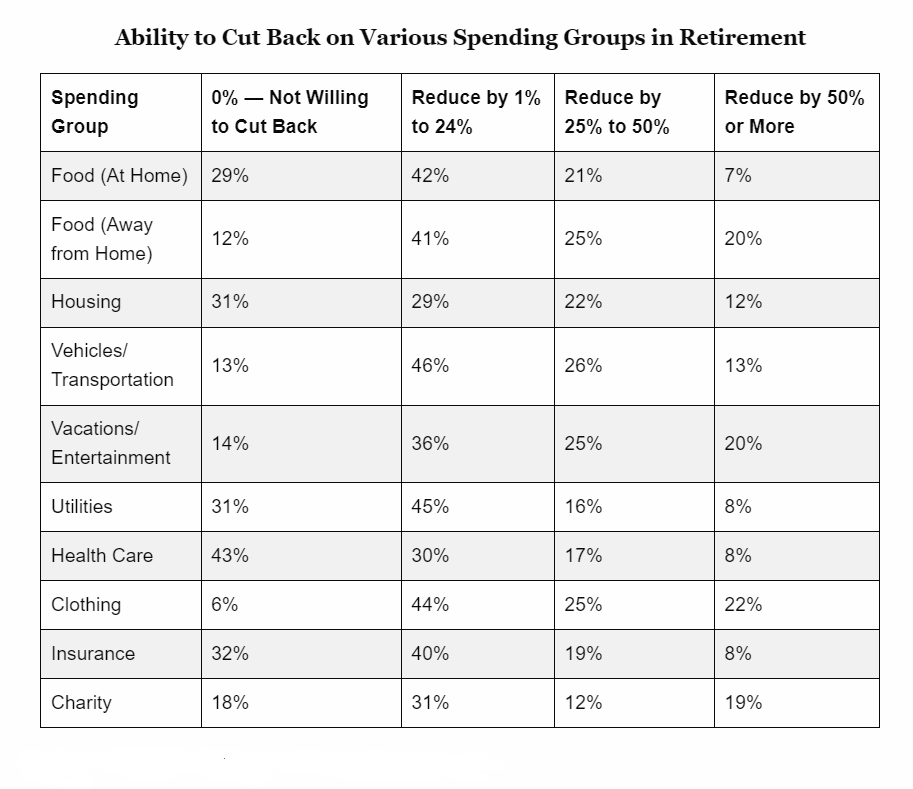

But individuals dynamically adjust their spending throughout retirement based on how their situation develops. Accordingly, they increase their spending or cut it down. If their portfolio performance falls below expectations, for example, they may need to tighten their belts, and vice versa. Here are some indications from his October 2021 research.

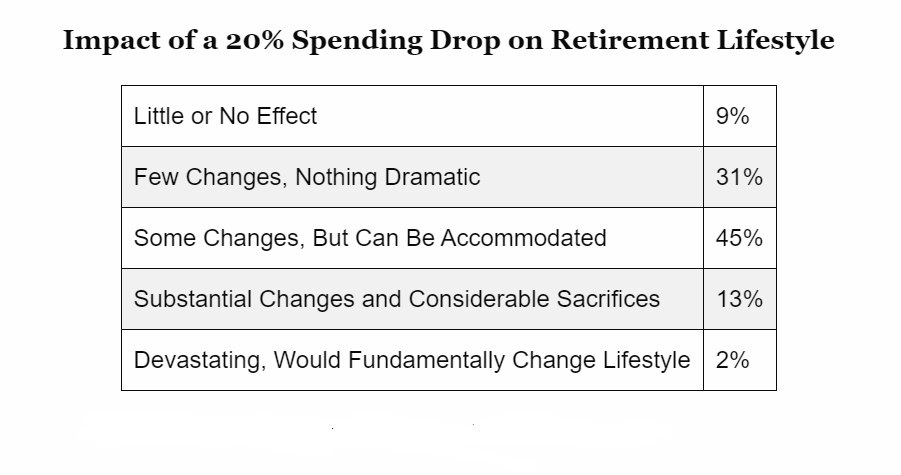

For example, only 15% said a 20% spending drop would create “substantial changes” or be “devastating” to their retirement lifestyle, while 40% said it would have “little or no effect” or necessitate “few changes.” Retirees appear to be far more sanguine on a potential reduction in spending than traditional models would suggest.

The clear ability to cut spending as demonstrated in the first chart, and the relatively small implied potential impact on retiree satisfaction, or utility, in the second, at least for a relatively small change in spending, has important implications when projecting retirement income goals.

While understanding each retiree’s spending goal at the more granular expenditure level is important, so too is having a sense of what amount of spending is essential (needs) and flexible (wants).

Spending flexibility is very critical when considering the investment portfolio’s role in funding retirement spending. Research demonstrates that retirement spending is far more flexible than implied by most financial planning tools. Retirees have both the ability and the willingness to adjust spending over time. That’s why incorporating spending flexibility can have significant implications on a variety of retirement-related decisions, such as required savings level and asset allocations.

The data source and information can be accessed in much more detail in Redefining the Retirement Income Goal