Roshi Jain, Senior Fund Manager, HDFC Mutual Fund

Let me start by asking you who should avoid your fund?

Investors who are momentum oriented will encounter a dissonance with the way I manage the portfolio. I have no axe to grind with momentum investing. There are numerous ways to create alpha; many styles and strategies, just that mine is not suited for momentum driven investors.

I would not call myself a growth or value investor because I find these silos too restrictive. Moreover, these labels are assigned very loosely. Often, companies that are cyclically challenged are termed as value companies. The moment growth comes back, they are referred to as growth companies.

Because I can be contrarian at times and tend to run high deviations from the benchmark, if my thesis takes longer to play out, the fund will underperform for that period of time.

Patience is key for those investing in schemes which I manage.

How do you balance your conviction and risk management.

What you see in the scheme portfolio (concentrated number of stocks) is purely the outcome of being fundamentally driven, return focused and where we are currently positioned in the cycle.

At this current point in the cycle, I find better risk-reward in large caps. Now when it comes to large caps, one tends to be concentrated for many reasons - liquidity is not an issue, the universe is relatively smaller, and one can build size.

Once I begin to spot opportunities in the mid-cap and small-cap space, then by virtue of them having lower liquidity, I will have to hold a larger number of stocks.

I do not subscribe to the view that a large weight in the benchmark is a good enough reason for the stock to be in the portfolio.

I do believe that effective risk management is by focusing on fundamentals of companies. Just reducing or limiting the extent of overweight and underweight vis-à-vis the benchmark is not risk management or risk mitigation in my opinion.

Broadly, our team’s fundamental oriented research gives me a sense of how much weightage must be given to a particular stock. I will factor in the return potential based on probability of growth and return assumptions. If for example, I find a seasoned company that has medium-term prospects, good management, and attractive valuations, I will be more comfortable taking a larger weight there. I am benchmark aware rather than being benchmark driven.

While I do take active risk, my entire stock selection process is firmly entrenched in fundamental research, which forms the primary determinant of portfolio construction.

What are the red flags that will cause you to completely avoid a company? Would it be high debt on the balance sheet?

I mostly steer clear of broad-brush generalizations.

One can still create alpha by buying leveraged companies which are turning around. In Telecom, debt was high at a point in time. But you could see the nature of the sector was changing. Banking too is heavily leveraged. A contrarian bet in a cyclical sector may be leveraged. One cannot use a single metric like a divining rod because each sector has its own dynamics.

I would not go to extremes and take special situation bets. But I would look at companies that are cyclically challenged, where the quality is good but the position on the cycle is not. Which means that the company will weather the cycle and emerge stronger. A capable management can deal with its debt-to-equity ratio.

Where I would not compromise is where the quality of management leaves much to be desired, and where minority shareholders are not fairly treated.

When you shift between market caps, how do you decide where to sell and what to offload?

It is largely a question of trade-offs. For a stock I hold if I feel there is no longer any significant upside or there are stocks with better risk-reward profile, then I would offload the former to use it as funding currency for the latter.

It is a flexi-cap fund. I have no percentages in mind when it comes to market-cap allocation. The market-cap exposure is an outcome of the fundamental research-based approach and availability of liquidity in the stock.

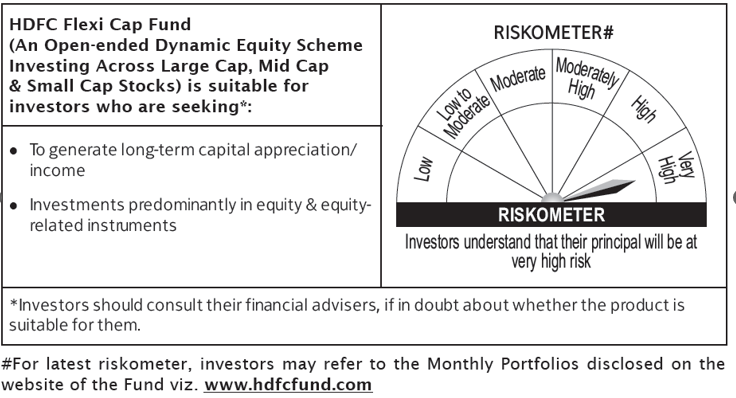

HDFC FLEXI CAP

DISCLAIMER

The views expressed by Ms Roshi Jain, are as of 23 October 2023. The views are based on internal data, publicly available information and other sources believed to be reliable. The statements contained herein are based on our current views and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Stocks/Sectors referred above are illustrative and not recommended by HDFC Mutual Fund (“the Fund”)/ HDFC AMC. The Schemes of the Fund may or may not have any present or future positions in these sectors. The Fund/ HDFCAMC is not guaranteeing any returns on investments made in the Scheme(s). Past performance may or may not be sustained in future. The current investment strategies are subject to change depending on market conditions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.